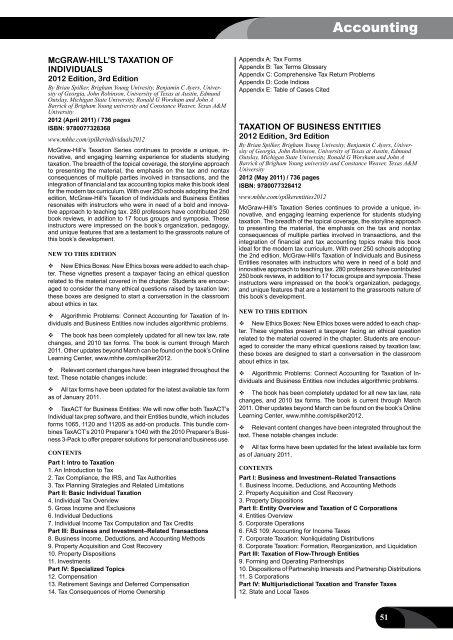

Accounting<strong>McGraw</strong>-<strong>Hill</strong>’s TAXATION ofIndividuals2012 Edition, 3rd EditionBy Brian Spilker, Brigham Young Univesity, Benjamin C Ayers, Universityof Georgia, John Robinson, University of Texas at Austin, EdmundOutslay, Michigan State University, Ronald G Worsham and John ABarrick of Brigham Young university and Constance Weaver, Texas A&MUniversity2012 (April 2011) / 736 pagesISBN: 9780077328368www.mhhe.com/spilkerindividuals2012<strong>McGraw</strong>-<strong>Hill</strong>’s Taxation Series continues to provide a unique, innovative,and engaging learning experience for students studyingtaxation. The breadth of the topical coverage, the storyline approachto presenting the material, the emphasis on the tax and nontaxconsequences of multiple parties involved in transactions, and theintegration of financial and tax accounting topics make this book idealfor the modern tax curriculum. With over 250 schools adopting the 2ndedition, <strong>McGraw</strong>-<strong>Hill</strong>’s Taxation of Individuals and Business Entitiesresonates with instructors who were in need of a bold and innovativeapproach to teaching tax. 280 professors have contributed 250book reviews, in addition to 17 focus groups and symposia. Theseinstructors were impressed on the book’s organization, pedagogy,and unique features that are a testament to the grassroots nature ofthis book’s development.New to this editionNew Ethics Boxes: New Ethics boxes were added to each chapter.These vignettes present a taxpayer facing an ethical questionrelated to the material covered in the chapter. Students are encouragedto consider the many ethical questions raised by taxation law;these boxes are designed to start a conversation in the classroomabout ethics in tax.Algorithmic Problems: Connect Accounting for Taxation of Individualsand Business Entities now includes algorithmic problems.The book has been completely updated for all new tax law, ratechanges, and 2010 tax forms. The book is current through March2011. Other updates beyond March can be found on the book’s OnlineLearning Center, www.mhhe.com/spilker2012.Relevant content changes have been integrated throughout thetext. These notable changes include:All tax forms have been updated for the latest available tax formas of January 2011.TaxACT for Business Entities: We will now offer both TaxACT’sIndividual tax prep software, and their Entities bundle, which includesforms 1065, 1120 and 1120S as add-on products. This bundle combinesTaxACT’s 2010 Preparer’s 1040 with the 2010 Preparer’s Business3-Pack to offer preparer solutions for personal and business use.ContentsPart I: Intro to Taxation1. An Introduction to Tax2. Tax Compliance, the IRS, and Tax Authorities3. Tax Planning Strategies and Related LimitationsPart II: Basic Individual Taxation4. Individual Tax Overview5. Gross Income and Exclusions6. Individual Deductions7. Individual Income Tax Computation and Tax CreditsPart III: Business and Investment–Related Transactions8. Business Income, Deductions, and Accounting Methods9. Property Acquisition and Cost Recovery10. Property Dispositions11. InvestmentsPart IV: Specialized Topics12. Compensation13. Retirement Savings and Deferred Compensation14. Tax Consequences of Home OwnershipAppendix A: Tax FormsAppendix B: Tax Terms GlossaryAppendix C: Comprehensive Tax Return ProblemsAppendix D: Code IndicesAppendix E: Table of Cases CitedTAXATION OF BUSINESS ENtities2012 Edition, 3rd EditionBy Brian Spilker, Brigham Young Univesity, Benjamin C Ayers, Universityof Georgia, John Robinson, University of Texas at Austin, EdmundOutslay, Michigan State University, Ronald G Worsham and John ABarrick of Brigham Young university and Constance Weaver, Texas A&MUniversity2012 (May 2011) / 736 pagesISBN: 9780077328412www.mhhe.com/spilkerentities2012<strong>McGraw</strong>-<strong>Hill</strong>’s Taxation Series continues to provide a unique, innovative,and engaging learning experience for students studyingtaxation. The breadth of the topical coverage, the storyline approachto presenting the material, the emphasis on the tax and nontaxconsequences of multiple parties involved in transactions, and theintegration of financial and tax accounting topics make this bookideal for the modern tax curriculum. With over 250 schools adoptingthe 2nd edition, <strong>McGraw</strong>-<strong>Hill</strong>’s Taxation of Individuals and BusinessEntities resonates with instructors who were in need of a bold andinnovative approach to teaching tax. 280 professors have contributed250 book reviews, in addition to 17 focus groups and symposia. Theseinstructors were impressed on the book’s organization, pedagogy,and unique features that are a testament to the grassroots nature ofthis book’s development.New to this editionNew Ethics Boxes: New Ethics boxes were added to each chapter.These vignettes present a taxpayer facing an ethical questionrelated to the material covered in the chapter. Students are encouragedto consider the many ethical questions raised by taxation law;these boxes are designed to start a conversation in the classroomabout ethics in tax.Algorithmic Problems: Connect Accounting for Taxation of Individualsand Business Entities now includes algorithmic problems.The book has been completely updated for all new tax law, ratechanges, and 2010 tax forms. The book is current through March2011. Other updates beyond March can be found on the book’s OnlineLearning Center, www.mhhe.com/spilker2012.Relevant content changes have been integrated throughout thetext. These notable changes include:All tax forms have been updated for the latest available tax formas of January 2011.ContentsPart I: Business and Investment–Related Transactions1. Business Income, Deductions, and Accounting Methods2. Property Acquisition and Cost Recovery3. Property DispositionsPart II: Entity Overview and Taxation of C Corporations4. Entities Overview5. Corporate Operations6. FAS 109: Accounting for Income Taxes7. Corporate Taxation: Nonliquidating Distributions8. Corporate Taxation: Formation, Reorganization, and LiquidationPart III: Taxation of Flow-Through Entities9. Forming and Operating Partnerships10. Dispositions of Partnership Interests and Partnership Distributions11. S CorporationsPart IV: Multijurisdictional Taxation and Transfer Taxes12. State and Local Taxes51

Accounting13. The U.S. Taxation of Multinational Transactions14. Transfer Taxes and Wealth PlanningAppendix A: Tax FormsAppendix B: Tax Terms GlossaryAppendix C: Comprehensive Tax Return ProblemsAppendix D: Code Indices<strong>McGraw</strong>-<strong>Hill</strong>’s TAXATION OFINDIVIDUALS and BUSINESS ENtities2012 Edition, 3rd EditionBy Brian Spilker, Brigham Young Univesity, Benjamin C Ayers, Universityof Georgia, John Robinson, University of Texas at Austin, EdmundOutslay, Michigan State University, Ronald G Worsham and John ABarrick of Brigham Young university and Constance Weaver, Texas A&MUniversity2012 (April 2011) / 1264 pagesISBN: 9780078111068www.mhhe.com/spilkercomp2012<strong>McGraw</strong>-<strong>Hill</strong>’s Taxation Series continues to provide a unique, innovative,and engaging learning experience for students studyingtaxation. The breadth of the topical coverage, the storyline approachto presenting the material, the emphasis on the tax and nontaxconsequences of multiple parties involved in transactions, and theintegration of financial and tax accounting topics make this book idealfor the modern tax curriculum. With over 250 schools adopting the 2ndedition, <strong>McGraw</strong>-<strong>Hill</strong>’s Taxation of Individuals and Business Entitiesresonates with instructors who were in need of a bold and innovativeapproach to teaching tax. 280 professors have contributed 250book reviews, in addition to 17 focus groups and symposia. Theseinstructors were impressed on the book’s organization, pedagogy,and unique features that are a testament to the grassroots nature ofthis book’s development.New to this editionNew Ethics Boxes: New Ethics boxes were added to each chapter.These vignettes present a taxpayer facing an ethical questionrelated to the material covered in the chapter. Students are encouragedto consider the many ethical questions raised by taxation law;these boxes are designed to start a conversation in the classroomabout ethics in tax.Algorithmic Problems: Connect Accounting for Taxation of Individualsand Business Entities now includes algorithmic problems.The book has been completely updated for all new tax law, ratechanges, and 2010tax forms. The book is current through March2011. Other updates beyond March can be found on the book’s OnlineLearning Center, www.mhhe.com/spilker2012.Relevant content changes have been integrated throughout thetext. These notable changes include:All tax forms have been updated for the latest available tax formas of January 2011.Better Examples: The examples used throughout the chapterrelate directly to the storyline presented at the beginning of eachchapter, so students become familiar with one fact set and learn howto apply those facts to different scenarios. In addition to providingin-context examples, we provide “What-If” scenarios within manyexamples to illustrate how variations in the facts might or might notchange the answers.ContentsPart I: Intro to Taxation1. An Introduction to Tax2. Tax Compliance, the IRS, and Tax Authorities3. Tax Planning Strategies and Related LimitationsPart II: Basic Individual Taxation4. Individual Tax Overview5. Gross Income and Exclusions6. Individual Deductions7. Individual Income Tax Computation and Tax CreditsPart III: Business and Investment–Related Transactions8. Business Income, Deductions, and Accounting Methods9. Property Acquisition and Cost Recovery10. Property Dispositions11. InvestmentsPart IV: Specialized Topics12. Compensation13. Retirement Savings and Deferred Compensation14. Tax Consequences of Home OwnershipPart V: Entity Overview and Taxation of C Corporations15. Entities Overview16. Corporate Operations17. FASB ASC Topic 740: Income Taxes18. Corporate Taxation: Nonliquidating Distributions19. Corporate Taxation: Formation, Reorganization, and LiquidationPart VI: Taxation of Flow-Through Entities20. Forming and Operating Partnerships21. Dispositions of Partnership Interests and Partnership Distributions22. S CorporationsPart VII: Multijurisdictional Taxation and Transfer Taxes23. State and Local Taxes24. The U.S. Taxation of Multinational Transactions25. Transfer Taxes and Wealth PlanningAppendix A: Tax FormsAppendix B: Tax Terms GlossaryAppendix C: Comprehensive Tax Return ProblemsAppendix D: Code IndicesAppendix E: Table of Cases CitedNEW*9780071078764*TAXATION IN SINGAPOREBy Simon Poh2011 (August 2010) / 424 pagesISBN: 9780071078764An Asian PublicationThis book is intended for candidates taking professional examinationsin Singapore taxation, as well as full-time undergraduate studentstaking Singapore income tax courses in local universities and othertertiary institutions. Lecturers may adopt it as the main text of a onesemestercourse on basic taxation in Singapore. It is also suitablefor those who have little or no knowledge in Singapore taxation, asit attempts to explain the tax laws in simple language. The depth ofcoverage is sufficient to enable readers to build a strong foundationin Singapore taxation, including preparation of both corporate andindividual tax computations.FeaturesDetailed coverage of main tax topics, including capital allowances,tax deductions and taxation of foreign income, non-residentsand companiesClear learning objectives set out at the beginning of each chapterIn-depth review questions at the end of each chapter to test thereaders’ grasp of Singapore taxation52

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha