You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

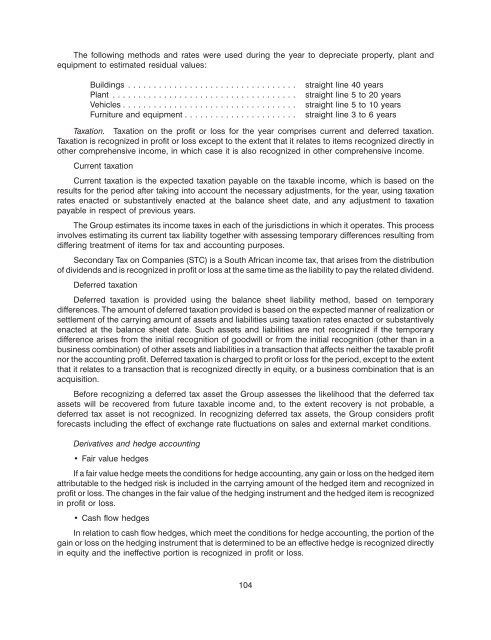

The following methods and rates were used during the year to depreciate property, plant and<br />

equipment to estimated residual values:<br />

Buildings ................................. straight line 40 years<br />

Plant .................................... straight line 5 to 20 years<br />

Vehicles .................................. straight line 5 to 10 years<br />

Furniture and equipment ...................... straight line 3 to 6 years<br />

Taxation. Taxation on the profit or loss for the year comprises current and deferred taxation.<br />

Taxation is recognized in profit or loss except to the extent that it relates to items recognized directly in<br />

other comprehensive income, in which case it is also recognized in other comprehensive income.<br />

Current taxation<br />

Current taxation is the expected taxation payable on the taxable income, which is based on the<br />

results for the period after taking into account the necessary adjustments, for the year, using taxation<br />

rates enacted or substantively enacted at the balance sheet date, and any adjustment to taxation<br />

payable in respect of previous years.<br />

The Group estimates its income taxes in each of the jurisdictions in which it operates. This process<br />

involves estimating its current tax liability together with assessing temporary differences resulting from<br />

differing treatment of items for tax and accounting purposes.<br />

Secondary Tax on Companies (STC) is a South African income tax, that arises from the distribution<br />

of dividends and is recognized in profit or loss at the same time as the liability to pay the related dividend.<br />

Deferred taxation<br />

Deferred taxation is provided using the balance sheet liability method, based on temporary<br />

differences. The amount of deferred taxation provided is based on the expected manner of realization or<br />

settlement of the carrying amount of assets and liabilities using taxation rates enacted or substantively<br />

enacted at the balance sheet date. Such assets and liabilities are not recognized if the temporary<br />

difference arises from the initial recognition of goodwill or from the initial recognition (other than in a<br />

business combination) of other assets and liabilities in a transaction that affects neither the taxable profit<br />

nor the accounting profit. Deferred taxation is charged to profit or loss for the period, except to the extent<br />

that it relates to a transaction that is recognized directly in equity, or a business combination that is an<br />

acquisition.<br />

Before recognizing a deferred tax asset the Group assesses the likelihood that the deferred tax<br />

assets will be recovered from future taxable income and, to the extent recovery is not probable, a<br />

deferred tax asset is not recognized. In recognizing deferred tax assets, the Group considers profit<br />

forecasts including the effect of exchange rate fluctuations on sales and external market conditions.<br />

Derivatives and hedge accounting<br />

Fair value hedges<br />

If a fair value hedge meets the conditions for hedge accounting, any gain or loss on the hedged item<br />

attributable to the hedged risk is included in the carrying amount of the hedged item and recognized in<br />

profit or loss. The changes in the fair value of the hedging instrument and the hedged item is recognized<br />

in profit or loss.<br />

Cash flow hedges<br />

In relation to cash flow hedges, which meet the conditions for hedge accounting, the portion of the<br />

gain or loss on the hedging instrument that is determined to be an effective hedge is recognized directly<br />

in equity and the ineffective portion is recognized in profit or loss.<br />

104