Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

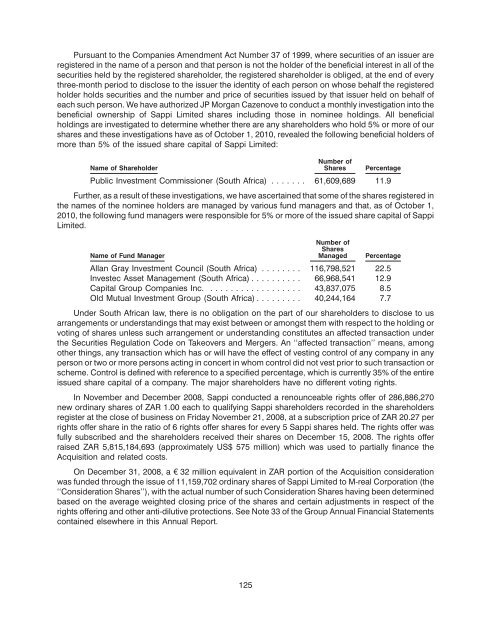

Pursuant to the Companies Amendment Act Number 37 of 1999, where securities of an issuer are<br />

registered in the name of a person and that person is not the holder of the beneficial interest in all of the<br />

securities held by the registered shareholder, the registered shareholder is obliged, at the end of every<br />

three-month period to disclose to the issuer the identity of each person on whose behalf the registered<br />

holder holds securities and the number and price of securities issued by that issuer held on behalf of<br />

each such person. We have authorized JP Morgan Cazenove to conduct a monthly investigation into the<br />

beneficial ownership of Sappi Limited shares including those in nominee holdings. All beneficial<br />

holdings are investigated to determine whether there are any shareholders who hold 5% or more of our<br />

shares and these investigations have as of October 1, 2010, revealed the following beneficial holders of<br />

more than 5% of the issued share capital of Sappi Limited:<br />

Name of Shareholder<br />

Number of<br />

Shares Percentage<br />

Public Investment Commissioner (South Africa) ....... 61,609,689 11.9<br />

Further, as a result of these investigations, we have ascertained that some of the shares registered in<br />

the names of the nominee holders are managed by various fund managers and that, as of October 1,<br />

2010, the following fund managers were responsible for 5% or more of the issued share capital of Sappi<br />

Limited.<br />

Number of<br />

Shares<br />

Name of Fund Manager Managed Percentage<br />

Allan Gray Investment Council (South Africa) ........ 116,798,521 22.5<br />

Investec Asset Management (South Africa) .......... 66,968,541 12.9<br />

Capital Group Companies Inc. .................. 43,837,075 8.5<br />

Old Mutual Investment Group (South Africa) ......... 40,244,164 7.7<br />

Under South African law, there is no obligation on the part of our shareholders to disclose to us<br />

arrangements or understandings that may exist between or amongst them with respect to the holding or<br />

voting of shares unless such arrangement or understanding constitutes an affected transaction under<br />

the Securities Regulation Code on Takeovers and Mergers. An ‘‘affected transaction’’ means, among<br />

other things, any transaction which has or will have the effect of vesting control of any company in any<br />

person or two or more persons acting in concert in whom control did not vest prior to such transaction or<br />

scheme. Control is defined with reference to a specified percentage, which is currently 35% of the entire<br />

issued share capital of a company. The major shareholders have no different voting rights.<br />

In November and December 2008, Sappi conducted a renounceable rights offer of 286,886,270<br />

new ordinary shares of ZAR 1.00 each to qualifying Sappi shareholders recorded in the shareholders<br />

register at the close of business on Friday November 21, 2008, at a subscription price of ZAR 20.27 per<br />

rights offer share in the ratio of 6 rights offer shares for every 5 Sappi shares held. The rights offer was<br />

fully subscribed and the shareholders received their shares on December 15, 2008. The rights offer<br />

raised ZAR 5,815,184,693 (approximately US$ 575 million) which was used to partially finance the<br />

Acquisition and related costs.<br />

On December 31, 2008, a e 32 million equivalent in ZAR portion of the Acquisition consideration<br />

was funded through the issue of 11,159,702 ordinary shares of Sappi Limited to M-real Corporation (the<br />

‘‘Consideration Shares’’), with the actual number of such Consideration Shares having been determined<br />

based on the average weighted closing price of the shares and certain adjustments in respect of the<br />

rights offering and other anti-dilutive protections. See Note 33 of the Group Annual Financial Statements<br />

contained elsewhere in this Annual Report.<br />

125