Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>SAPPI</strong><br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September 2010<br />

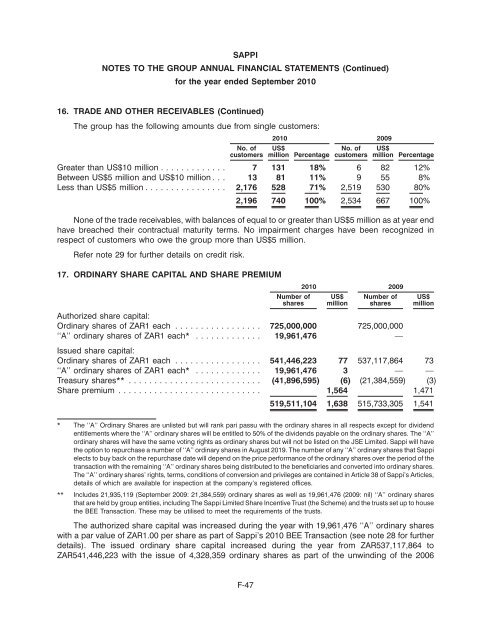

16. TRADE AND OTHER RECEIVABLES (Continued)<br />

The group has the following amounts due from single customers:<br />

2010 2009<br />

No. of US$ No. of US$<br />

customers million Percentage customers million Percentage<br />

Greater than US$10 million ............. 7 131 18% 6 82 12%<br />

Between US$5 million and US$10 million . . . 13 81 11% 9 55 8%<br />

Less than US$5 million ................ 2,176 528 71% 2,519 530 80%<br />

2,196 740 100% 2,534 667 100%<br />

None of the trade receivables, with balances of equal to or greater than US$5 million as at year end<br />

have breached their contractual maturity terms. No impairment charges have been recognized in<br />

respect of customers who owe the group more than US$5 million.<br />

Refer note 29 for further details on credit risk.<br />

17. ORDINARY SHARE CAPITAL AND SHARE PREMIUM<br />

2010 2009<br />

Number of US$ Number of US$<br />

shares million shares million<br />

Authorized share capital:<br />

Ordinary shares of ZAR1 each ................. 725,000,000 725,000,000<br />

‘‘A’’ ordinary shares of ZAR1 each*<br />

Issued share capital:<br />

............. 19,961,476 —<br />

Ordinary shares of ZAR1 each ................. 541,446,223 77 537,117,864 73<br />

‘‘A’’ ordinary shares of ZAR1 each* ............. 19,961,476 3 — —<br />

Treasury shares** .......................... (41,896,595) (6) (21,384,559) (3)<br />

Share premium ............................ 1,564 1,471<br />

519,511,104 1,638 515,733,305 1,541<br />

* The ‘‘A’’ Ordinary Shares are unlisted but will rank pari passu with the ordinary shares in all respects except for dividend<br />

entitlements where the ‘‘A’’ ordinary shares will be entitled to 50% of the dividends payable on the ordinary shares. The ‘‘A’’<br />

ordinary shares will have the same voting rights as ordinary shares but will not be listed on the JSE Limited. Sappi will have<br />

the option to repurchase a number of ‘‘A’’ ordinary shares in August 2019. The number of any ‘‘A’’ ordinary shares that Sappi<br />

elects to buy back on the repurchase date will depend on the price performance of the ordinary shares over the period of the<br />

transaction with the remaining ‘‘A’’ ordinary shares being distributed to the beneficiaries and converted into ordinary shares.<br />

The ‘‘A’’ ordinary shares’ rights, terms, conditions of conversion and privileges are contained in Article 38 of Sappi’s Articles,<br />

details of which are available for inspection at the company’s registered offices.<br />

** Includes 21,935,119 (September 2009: 21,384,559) ordinary shares as well as 19,961,476 (2009: nil) ‘‘A’’ ordinary shares<br />

that are held by group entities, including The Sappi Limited Share Incentive Trust (the Scheme) and the trusts set up to house<br />

the BEE Transaction. These may be utilised to meet the requirements of the trusts.<br />

The authorized share capital was increased during the year with 19,961,476 ‘‘A’’ ordinary shares<br />

with a par value of ZAR1.00 per share as part of Sappi’s 2010 BEE Transaction (see note 28 for further<br />

details). The issued ordinary share capital increased during the year from ZAR537,117,864 to<br />

ZAR541,446,223 with the issue of 4,328,359 ordinary shares as part of the unwinding of the 2006<br />

F-47