You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and cash equivalents were US$ 770 million. The committed facility is the e 209 million Revolving Credit<br />

Facility which was entirely undrawn at the end of fiscal 2010 and fiscal 2009.<br />

In 2010, our financing activities concentrated on reducing gross debt by utilizing our cash resources<br />

to repay certain long term debt. In 2009, our financing activities concentrated on arranging longer term<br />

debt to refinance a portion of our existing short-term debt and repurchase the vendor loan notes issued<br />

to M-real in connection with the Acquisition. This was achieved by the issuance of US$ 300 million and<br />

e 350 million Senior Secured Notes due 2014, the refinancing of a bank syndicated loan of e 400 million<br />

and the extension of its maturity from 2010 to 2014, and the refinancing of our existing e 600 million<br />

revolving credit facility maturing in 2010 which was replaced by a e 209 million Revolving Credit Facility<br />

maturing in 2012. See ‘‘Item 10—Additional Information—Material Contracts’’.<br />

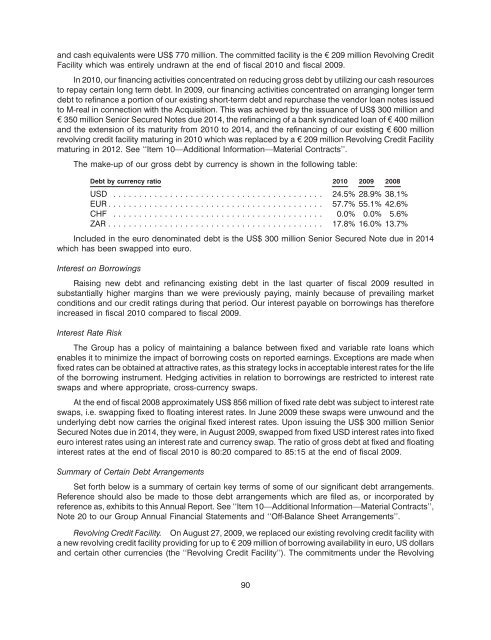

The make-up of our gross debt by currency is shown in the following table:<br />

Debt by currency ratio 2010 2009 2008<br />

USD ......................................... 24.5% 28.9% 38.1%<br />

EUR.......................................... 57.7% 55.1% 42.6%<br />

CHF ......................................... 0.0% 0.0% 5.6%<br />

ZAR.......................................... 17.8% 16.0% 13.7%<br />

Included in the euro denominated debt is the US$ 300 million Senior Secured Note due in 2014<br />

which has been swapped into euro.<br />

Interest on Borrowings<br />

Raising new debt and refinancing existing debt in the last quarter of fiscal 2009 resulted in<br />

substantially higher margins than we were previously paying, mainly because of prevailing market<br />

conditions and our credit ratings during that period. Our interest payable on borrowings has therefore<br />

increased in fiscal 2010 compared to fiscal 2009.<br />

Interest Rate Risk<br />

The Group has a policy of maintaining a balance between fixed and variable rate loans which<br />

enables it to minimize the impact of borrowing costs on reported earnings. Exceptions are made when<br />

fixed rates can be obtained at attractive rates, as this strategy locks in acceptable interest rates for the life<br />

of the borrowing instrument. Hedging activities in relation to borrowings are restricted to interest rate<br />

swaps and where appropriate, cross-currency swaps.<br />

At the end of fiscal 2008 approximately US$ 856 million of fixed rate debt was subject to interest rate<br />

swaps, i.e. swapping fixed to floating interest rates. In June 2009 these swaps were unwound and the<br />

underlying debt now carries the original fixed interest rates. Upon issuing the US$ 300 million Senior<br />

Secured Notes due in 2014, they were, in August 2009, swapped from fixed USD interest rates into fixed<br />

euro interest rates using an interest rate and currency swap. The ratio of gross debt at fixed and floating<br />

interest rates at the end of fiscal 2010 is 80:20 compared to 85:15 at the end of fiscal 2009.<br />

Summary of Certain Debt Arrangements<br />

Set forth below is a summary of certain key terms of some of our significant debt arrangements.<br />

Reference should also be made to those debt arrangements which are filed as, or incorporated by<br />

reference as, exhibits to this Annual Report. See ‘‘Item 10—Additional Information—Material Contracts’’,<br />

Note 20 to our Group Annual Financial Statements and ‘‘Off-Balance Sheet Arrangements’’.<br />

Revolving Credit Facility. On August 27, 2009, we replaced our existing revolving credit facility with<br />

a new revolving credit facility providing for up to e 209 million of borrowing availability in euro, US dollars<br />

and certain other currencies (the ‘‘Revolving Credit Facility’’). The commitments under the Revolving<br />

90