Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>SAPPI</strong><br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September 2010<br />

20. INTEREST-BEARING BORROWINGS (Continued)<br />

accounted as on balance sheet, with a corresponding liability (external loan) being recognized and<br />

corresponding interest is recognized as finance cost.<br />

The trade receivables are legally transferred, however most of the market risk (foreign exchange risk<br />

and interest rate risk) and the credit risk is retained by Sappi. As a consequence, based on the risks and<br />

rewards evaluation, these securitized receivables do not qualify for de-recognition under IAS 39.<br />

Further detail of the value of trade receivables pledged as security for these loans is included in<br />

note 16.<br />

Sappi Fine Paper North America<br />

Sappi sells the majority of its US$ receivables to Galleon Capital LLC on a non-recourse basis.<br />

Credit enhancement includes a 3% deferred purchase price plus a letter of credit in the amount of<br />

US$18 million that relates to the uninsured portion of those obligors with concentrations above 3%<br />

(Sappi, as servicer of the receivables, is responsible for the collection of all amounts that are due from<br />

the customer). The rate of discounting charged on the receivables is LIBOR (London Inter Bank Offered<br />

Rate) plus a margin for receivables to customers located in Organization for Economic Co-operation and<br />

Development (‘‘OECD’’) countries.<br />

Sappi Fine Paper Europe and Sappi Trading<br />

Under a combined securitization arrangement for Sappi Fine Paper Europe and Sappi Trading,<br />

Sappi sells receivables to Galleon Capital LLC on a non-recourse basis. Credit enhancement is<br />

calculated by deducting a deferred purchase price of 14%. Sappi is responsible for the collection of all<br />

amounts that are due from the customer. The rate of discounting that is charged on the receivables is<br />

LIBOR (London Inter Bank Offered Rate) plus a margin for receivables to customers located in OECD<br />

countries plus a further margin for receivables to customers located in non-OECD countries.<br />

Unutilized facilities<br />

The group monitors its availability of funds on a weekly basis. The group treasury committee<br />

determines the amount of unutilized facilities to determine the headroom which it currently operates in.<br />

The net cash balances included in current assets and current liabilities are included in the determination<br />

of the headroom available.<br />

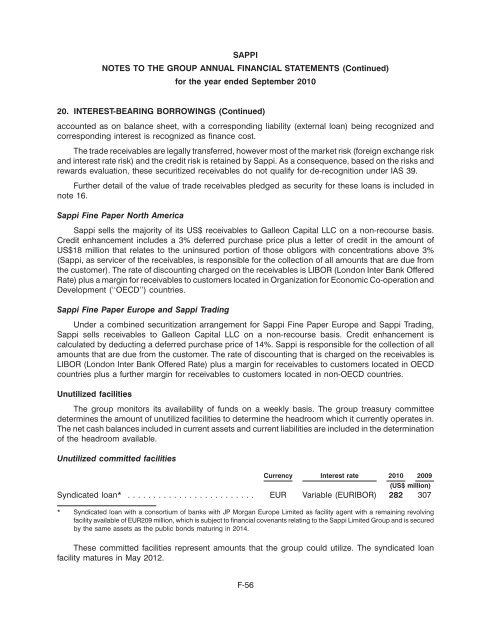

Unutilized committed facilities<br />

Currency Interest rate 2010 2009<br />

(US$ million)<br />

Syndicated loan* ......................... EUR Variable (EURIBOR) 282 307<br />

* Syndicated loan with a consortium of banks with JP Morgan Europe Limited as facility agent with a remaining revolving<br />

facility available of EUR209 million, which is subject to financial covenants relating to the Sappi Limited Group and is secured<br />

by the same assets as the public bonds maturing in 2014.<br />

These committed facilities represent amounts that the group could utilize. The syndicated loan<br />

facility matures in May 2012.<br />

F-56