- Page 1 and 2:

As filed with the Securities and Ex

- Page 3 and 4:

Item 7. Major Shareholders and Rela

- Page 5 and 6:

References to ‘‘NBSK’’ are

- Page 7 and 8:

PART I ITEM 1. IDENTITY OF DIRECTOR

- Page 9 and 10:

Risk Factors In addition to other i

- Page 11 and 12:

For further information, see ‘‘

- Page 13 and 14:

terms of the debt being refinanced.

- Page 15 and 16:

The inability to recover increasing

- Page 17 and 18:

A large percentage of our employees

- Page 19 and 20:

merge or consolidate with other com

- Page 21 and 22:

we operate. The transaction was app

- Page 23 and 24:

currencies as we can benefit from i

- Page 25 and 26:

Major Product Categories Pulp: Desc

- Page 27 and 28:

for coated mechanical paper decline

- Page 29 and 30:

The chart below represents our oper

- Page 31 and 32:

The following table sets out the ap

- Page 33 and 34:

The following table sets forth sale

- Page 35 and 36:

Kangas. As a direct result of the g

- Page 37 and 38:

Customers Sappi Fine Paper sells it

- Page 39 and 40:

The following chart sets forth cert

- Page 41 and 42:

Construction on the expansion proje

- Page 43 and 44:

lease extendable to 2089. The locat

- Page 45 and 46:

North America Wood In connection wi

- Page 47 and 48:

Pulp Sappi Fine Paper Europe produc

- Page 49 and 50:

ENVIRONMENTAL AND SAFETY MATTERS En

- Page 51 and 52:

and management of forests are all r

- Page 53 and 54:

ORGANIZATIONAL STRUCTURE Sappi Limi

- Page 55 and 56:

Approximate Secured / Location Use

- Page 57 and 58:

than we use. By region, the South A

- Page 59 and 60:

‘‘—Markets’’ for a furthe

- Page 61 and 62:

'000 metric tonnes 8,000 7,000 6,00

- Page 63 and 64:

The price of NBSK and Bleached Hard

- Page 65 and 66:

ZAR/US$ 16.00 14.00 12.00 10.00 8.0

- Page 67 and 68:

The fiscal period average three-mon

- Page 69 and 70:

employees from the beginning of 200

- Page 71 and 72:

The Sappi Southern Africa reportabl

- Page 73 and 74:

Movements in operating profit and o

- Page 75 and 76:

Operating profit in fiscal 2009 was

- Page 77 and 78:

Sappi Southern Africa Key figures:

- Page 79 and 80:

Comparing fiscal 2010 with fiscal 2

- Page 81 and 82:

This comparison includes the closur

- Page 83 and 84:

African operations into the US doll

- Page 85 and 86:

Sappi Fine Paper North America Comp

- Page 87 and 88:

Taxation 2010 2009 (US$ million) 20

- Page 89 and 90:

elation to inventory levels and rec

- Page 91 and 92:

Capital expenditure by region is as

- Page 93 and 94:

Over the past three years the relat

- Page 95 and 96:

Group’s securitization programs,

- Page 97 and 98:

Credit Facility terminate on May 31

- Page 99 and 100:

quarters ending from January 2012 t

- Page 101 and 102:

As no default event has occurred, n

- Page 103 and 104:

In addition, Sappi Fine Paper North

- Page 105 and 106:

areas where our South African busin

- Page 107 and 108:

Recoveries in equity markets couple

- Page 109 and 110:

Impairment of assets other than goo

- Page 111 and 112:

The gains or losses, which are reco

- Page 113 and 114:

The Group’s policy is to recogniz

- Page 115 and 116:

ITEM 6. DIRECTORS, SENIOR MANAGEMEN

- Page 117 and 118:

Deenadayalen (Len) Konar Sappi boar

- Page 119 and 120:

Mohammed Valli (Valli) Moosa Other

- Page 121 and 122:

Rudolf Thummer Sappi board committe

- Page 123 and 124:

Executive Officers The Executive Di

- Page 125 and 126:

companies have to comply with domes

- Page 127 and 128:

average more than 45% of the employ

- Page 129 and 130:

For a detailed description of the S

- Page 131 and 132:

Pursuant to the Companies Amendment

- Page 133 and 134:

Post transaction shareholding struc

- Page 135 and 136:

Dividends We consider dividends on

- Page 137 and 138:

ITEM 9. THE OFFER AND LISTING Offer

- Page 139 and 140:

ITEM 10. ADDITIONAL INFORMATION Mem

- Page 141 and 142:

holder of the beneficial interest i

- Page 143 and 144:

Voting Rights Subject to any rights

- Page 145 and 146:

provision of the New Act by any oth

- Page 147 and 148:

South African Companies Act, 2008 A

- Page 149 and 150:

state securities laws. The securiti

- Page 151 and 152: documents are the agent for the new

- Page 153 and 154: Dividends There are no restrictions

- Page 155 and 156: STC STC is imposed on South African

- Page 157 and 158: with any connected persons) held mo

- Page 159 and 160: of our ordinary shares or ADSs, as

- Page 161 and 162: of gain recognized on a sale or oth

- Page 163 and 164: integrated operations could be adve

- Page 165 and 166: PART II ITEM 13. DEFAULTS, DIVIDEND

- Page 167 and 168: (d) Changes in Internal Control ove

- Page 169 and 170: PART III ITEM 17. FINANCIAL STATEME

- Page 171 and 172: 4.13 Credit Agreement, dated August

- Page 173 and 174: SIGNATURES The registrant hereby ce

- Page 175 and 176: REPORT OF THE INDEPENDENT REGISTERE

- Page 177 and 178: SAPPI GROUP STATEMENT OF COMPREHENS

- Page 179 and 180: SAPPI GROUP CASH FLOW STATEMENT for

- Page 181 and 182: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 183 and 184: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 185 and 186: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 187 and 188: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 189 and 190: SAPPI NOTES TO THE GROUP ANNUAL FIN

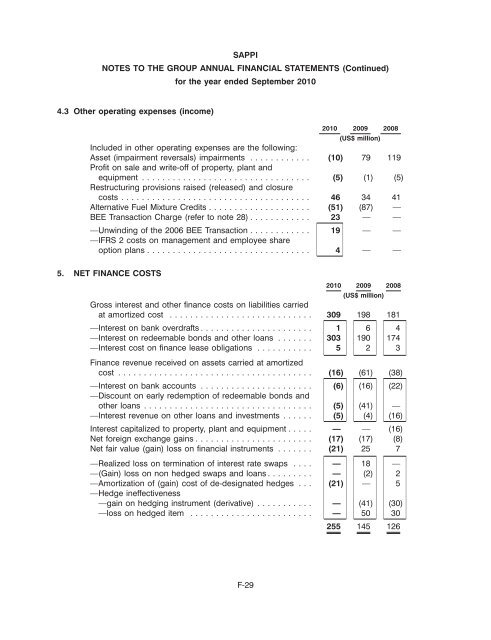

- Page 191 and 192: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 193 and 194: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 195 and 196: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 197 and 198: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 199 and 200: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 201: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 205 and 206: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 207 and 208: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 209 and 210: 10. PLANTATIONS SAPPI NOTES TO THE

- Page 211 and 212: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 213 and 214: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 215 and 216: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 217 and 218: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 219 and 220: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 221 and 222: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 223 and 224: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 225 and 226: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 227 and 228: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 229 and 230: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 231 and 232: 22. PROVISIONS SAPPI NOTES TO THE G

- Page 233 and 234: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 235 and 236: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 237 and 238: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 239 and 240: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 241 and 242: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 243 and 244: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 245 and 246: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 247 and 248: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 249 and 250: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 251 and 252: SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 253 and 254:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 255 and 256:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 257 and 258:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 259 and 260:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 261 and 262:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 263 and 264:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 265 and 266:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 267 and 268:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 269 and 270:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 271 and 272:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 273 and 274:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 275 and 276:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 277 and 278:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 279 and 280:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 281 and 282:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 283 and 284:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 285 and 286:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 287 and 288:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 289 and 290:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 291 and 292:

SAPPI NOTES TO THE GROUP ANNUAL FIN

- Page 293 and 294:

SAPPI CONDENSED SAPPI LIMITED COMPA

- Page 295 and 296:

SAPPI CONDENSED SAPPI LIMITED COMPA

- Page 297 and 298:

SAPPI CONDENSED SAPPI LIMITED COMPA

- Page 299:

SAPPI NOTES TO THE CONDENSED SAPPI