You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

than we use. By region, the South African operations are net sellers of pulp, Sappi Fine Paper North<br />

America produces slightly more pulp than it uses and the European operations are approximately 51%<br />

integrated. The expansion of our Saiccor mill in South Africa increased pulp production by<br />

approximately 200,000 tonnes. Approximately 70% of the wood requirements of Sappi Southern Africa<br />

are from sources either owned or managed by us. Both the North American and European operations<br />

are dependent on outside suppliers of wood for their pulp production requirements.<br />

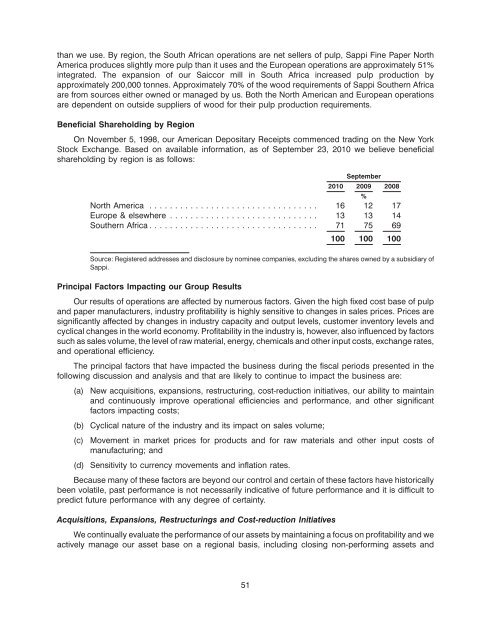

Beneficial Shareholding by Region<br />

On November 5, 1998, our American Depositary Receipts commenced trading on the New York<br />

Stock Exchange. Based on available information, as of September 23, 2010 we believe beneficial<br />

shareholding by region is as follows:<br />

2010<br />

September<br />

2009<br />

%<br />

2008<br />

North America ................................. 16 12 17<br />

Europe & elsewhere ............................. 13 13 14<br />

Southern Africa ................................. 71 75 69<br />

100 100 100<br />

Source: Registered addresses and disclosure by nominee companies, excluding the shares owned by a subsidiary of<br />

Sappi.<br />

Principal Factors Impacting our Group Results<br />

Our results of operations are affected by numerous factors. Given the high fixed cost base of pulp<br />

and paper manufacturers, industry profitability is highly sensitive to changes in sales prices. Prices are<br />

significantly affected by changes in industry capacity and output levels, customer inventory levels and<br />

cyclical changes in the world economy. Profitability in the industry is, however, also influenced by factors<br />

such as sales volume, the level of raw material, energy, chemicals and other input costs, exchange rates,<br />

and operational efficiency.<br />

The principal factors that have impacted the business during the fiscal periods presented in the<br />

following discussion and analysis and that are likely to continue to impact the business are:<br />

(a) New acquisitions, expansions, restructuring, cost-reduction initiatives, our ability to maintain<br />

and continuously improve operational efficiencies and performance, and other significant<br />

factors impacting costs;<br />

(b) Cyclical nature of the industry and its impact on sales volume;<br />

(c) Movement in market prices for products and for raw materials and other input costs of<br />

manufacturing; and<br />

(d) Sensitivity to currency movements and inflation rates.<br />

Because many of these factors are beyond our control and certain of these factors have historically<br />

been volatile, past performance is not necessarily indicative of future performance and it is difficult to<br />

predict future performance with any degree of certainty.<br />

Acquisitions, Expansions, Restructurings and Cost-reduction Initiatives<br />

We continually evaluate the performance of our assets by maintaining a focus on profitability and we<br />

actively manage our asset base on a regional basis, including closing non-performing assets and<br />

51