Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

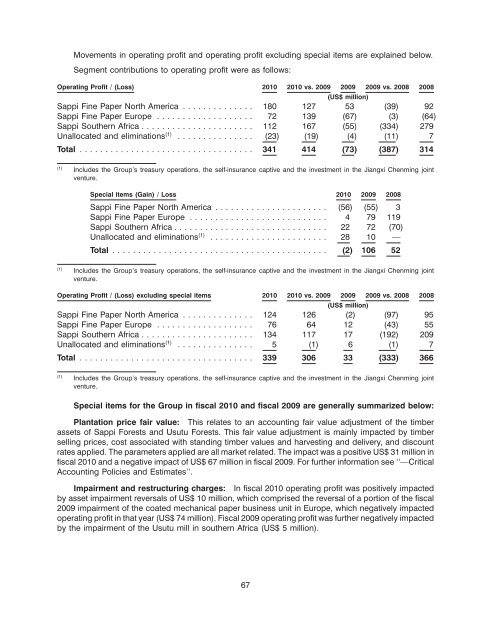

Movements in operating profit and operating profit excluding special items are explained below.<br />

Segment contributions to operating profit were as follows:<br />

Operating Profit / (Loss) 2010 2010 vs. 2009 2009 2009 vs. 2008 2008<br />

Sappi Fine Paper North America .............. 180 127<br />

(US$ million)<br />

53 (39) 92<br />

Sappi Fine Paper Europe ................... 72 139 (67) (3) (64)<br />

Sappi Southern Africa ...................... 112 167 (55) (334) 279<br />

Unallocated and eliminations (1) ............... (23) (19) (4) (11) 7<br />

Total .................................. 341 414 (73) (387) 314<br />

(1) Includes the Group’s treasury operations, the self-insurance captive and the investment in the Jiangxi Chenming joint<br />

venture.<br />

Special items (Gain) / Loss 2010 2009 2008<br />

Sappi Fine Paper North America ...................... (56) (55) 3<br />

Sappi Fine Paper Europe ........................... 4 79 119<br />

Sappi Southern Africa .............................. 22 72 (70)<br />

Unallocated and eliminations (1) ....................... 28 10 —<br />

Total .......................................... (2) 106 52<br />

(1) Includes the Group’s treasury operations, the self-insurance captive and the investment in the Jiangxi Chenming joint<br />

venture.<br />

Operating Profit / (Loss) excluding special items 2010 2010 vs. 2009 2009 2009 vs. 2008 2008<br />

Sappi Fine Paper North America .............. 124 126<br />

(US$ million)<br />

(2) (97) 95<br />

Sappi Fine Paper Europe ................... 76 64 12 (43) 55<br />

Sappi Southern Africa ...................... 134 117 17 (192) 209<br />

Unallocated and eliminations (1) ............... 5 (1) 6 (1) 7<br />

Total .................................. 339 306 33 (333) 366<br />

(1) Includes the Group’s treasury operations, the self-insurance captive and the investment in the Jiangxi Chenming joint<br />

venture.<br />

Special items for the Group in fiscal 2010 and fiscal 2009 are generally summarized below:<br />

Plantation price fair value: This relates to an accounting fair value adjustment of the timber<br />

assets of Sappi Forests and Usutu Forests. This fair value adjustment is mainly impacted by timber<br />

selling prices, cost associated with standing timber values and harvesting and delivery, and discount<br />

rates applied. The parameters applied are all market related. The impact was a positive US$ 31 million in<br />

fiscal 2010 and a negative impact of US$ 67 million in fiscal 2009. For further information see ‘‘—Critical<br />

Accounting Policies and Estimates’’.<br />

Impairment and restructuring charges: In fiscal 2010 operating profit was positively impacted<br />

by asset impairment reversals of US$ 10 million, which comprised the reversal of a portion of the fiscal<br />

2009 impairment of the coated mechanical paper business unit in Europe, which negatively impacted<br />

operating profit in that year (US$ 74 million). Fiscal 2009 operating profit was further negatively impacted<br />

by the impairment of the Usutu mill in southern Africa (US$ 5 million).<br />

67