You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>SAPPI</strong><br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September 2010<br />

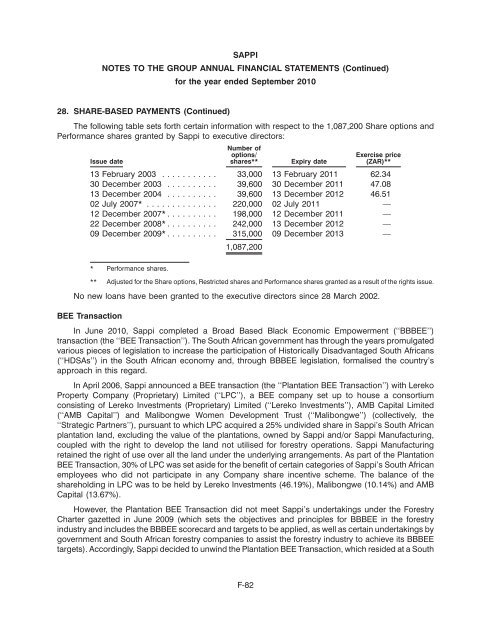

28. SHARE-BASED PAYMENTS (Continued)<br />

The following table sets forth certain information with respect to the 1,087,200 Share options and<br />

Performance shares granted by Sappi to executive directors:<br />

Number of<br />

options/ Exercise price<br />

Issue date shares** Expiry date (ZAR)**<br />

13 February 2003 ........... 33,000 13 February 2011 62.34<br />

30 December 2003 .......... 39,600 30 December 2011 47.08<br />

13 December 2004 .......... 39,600 13 December 2012 46.51<br />

02 July 2007* .............. 220,000 02 July 2011 —<br />

12 December 2007* .......... 198,000 12 December 2011 —<br />

22 December 2008* .......... 242,000 13 December 2012 —<br />

09 December 2009* .......... 315,000<br />

1,087,200<br />

09 December 2013 —<br />

* Performance shares.<br />

** Adjusted for the Share options, Restricted shares and Performance shares granted as a result of the rights issue.<br />

No new loans have been granted to the executive directors since 28 March 2002.<br />

BEE Transaction<br />

In June 2010, Sappi completed a Broad Based Black Economic Empowerment (‘‘BBBEE’’)<br />

transaction (the ‘‘BEE Transaction’’). The South African government has through the years promulgated<br />

various pieces of legislation to increase the participation of Historically Disadvantaged South Africans<br />

(‘‘HDSAs’’) in the South African economy and, through BBBEE legislation, formalised the country’s<br />

approach in this regard.<br />

In April 2006, Sappi announced a BEE transaction (the ‘‘Plantation BEE Transaction’’) with Lereko<br />

Property Company (Proprietary) Limited (‘‘LPC’’), a BEE company set up to house a consortium<br />

consisting of Lereko Investments (Proprietary) Limited (‘‘Lereko Investments’’), AMB Capital Limited<br />

(‘‘AMB Capital’’) and Malibongwe Women Development Trust (‘‘Malibongwe’’) (collectively, the<br />

‘‘Strategic Partners’’), pursuant to which LPC acquired a 25% undivided share in Sappi’s South African<br />

plantation land, excluding the value of the plantations, owned by Sappi and/or Sappi Manufacturing,<br />

coupled with the right to develop the land not utilised for forestry operations. Sappi Manufacturing<br />

retained the right of use over all the land under the underlying arrangements. As part of the Plantation<br />

BEE Transaction, 30% of LPC was set aside for the benefit of certain categories of Sappi’s South African<br />

employees who did not participate in any Company share incentive scheme. The balance of the<br />

shareholding in LPC was to be held by Lereko Investments (46.19%), Malibongwe (10.14%) and AMB<br />

Capital (13.67%).<br />

However, the Plantation BEE Transaction did not meet Sappi’s undertakings under the Forestry<br />

Charter gazetted in June 2009 (which sets the objectives and principles for BBBEE in the forestry<br />

industry and includes the BBBEE scorecard and targets to be applied, as well as certain undertakings by<br />

government and South African forestry companies to assist the forestry industry to achieve its BBBEE<br />

targets). Accordingly, Sappi decided to unwind the Plantation BEE Transaction, which resided at a South<br />

F-82