You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>SAPPI</strong><br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September 2010<br />

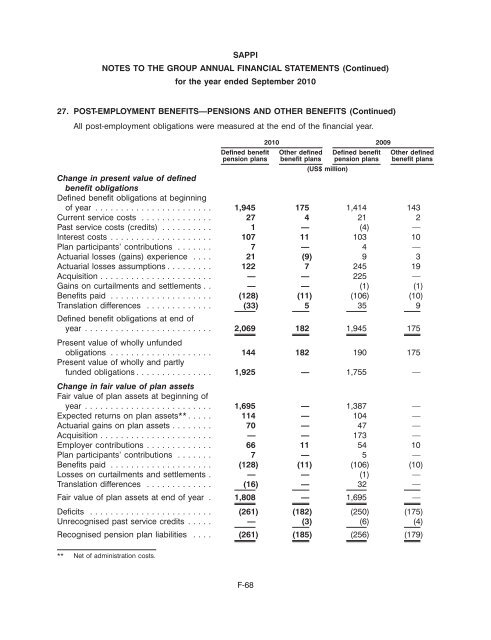

27. POST-EMPLOYMENT BENEFITS—PENSIONS AND OTHER BENEFITS (Continued)<br />

All post-employment obligations were measured at the end of the financial year.<br />

2010 2009<br />

Defined benefit Other defined Defined benefit Other defined<br />

pension plans benefit plans pension plans benefit plans<br />

(US$ million)<br />

Change in present value of defined<br />

benefit obligations<br />

Defined benefit obligations at beginning<br />

of year ....................... 1,945 175 1,414 143<br />

Current service costs .............. 27 4 21 2<br />

Past service costs (credits) .......... 1 — (4) —<br />

Interest costs .................... 107 11 103 10<br />

Plan participants’ contributions ....... 7 — 4 —<br />

Actuarial losses (gains) experience .... 21 (9) 9 3<br />

Actuarial losses assumptions ......... 122 7 245 19<br />

Acquisition ...................... — — 225 —<br />

Gains on curtailments and settlements . . — — (1) (1)<br />

Benefits paid .................... (128) (11) (106) (10)<br />

Translation differences .............<br />

Defined benefit obligations at end of<br />

(33) 5 35 9<br />

year .........................<br />

Present value of wholly unfunded<br />

2,069 182 1,945 175<br />

obligations ....................<br />

Present value of wholly and partly<br />

144 182 190 175<br />

funded obligations ...............<br />

Change in fair value of plan assets<br />

Fair value of plan assets at beginning of<br />

1,925 — 1,755 —<br />

year ......................... 1,695 — 1,387 —<br />

Expected returns on plan assets** ..... 114 — 104 —<br />

Actuarial gains on plan assets ........ 70 — 47 —<br />

Acquisition ...................... — — 173 —<br />

Employer contributions ............. 66 11 54 10<br />

Plan participants’ contributions ....... 7 — 5 —<br />

Benefits paid .................... (128) (11) (106) (10)<br />

Losses on curtailments and settlements . — — (1) —<br />

Translation differences ............. (16) — 32 —<br />

Fair value of plan assets at end of year . 1,808 — 1,695 —<br />

Deficits ........................ (261) (182) (250) (175)<br />

Unrecognised past service credits ..... — (3) (6) (4)<br />

Recognised pension plan liabilities .... (261) (185) (256) (179)<br />

** Net of administration costs.<br />

F-68