You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>SAPPI</strong><br />

NOTES TO THE GROUP ANNUAL FINANCIAL STATEMENTS (Continued)<br />

for the year ended September 2010<br />

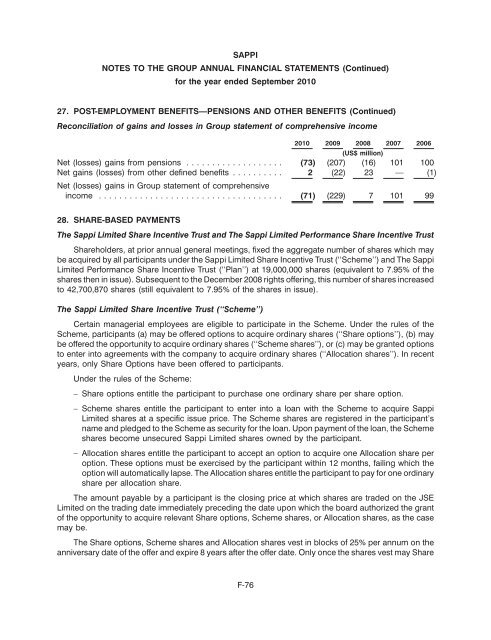

27. POST-EMPLOYMENT BENEFITS—PENSIONS AND OTHER BENEFITS (Continued)<br />

Reconciliation of gains and losses in Group statement of comprehensive income<br />

2010 2009 2008<br />

(US$ million)<br />

2007 2006<br />

Net (losses) gains from pensions ................... (73) (207) (16) 101 100<br />

Net gains (losses) from other defined benefits ..........<br />

Net (losses) gains in Group statement of comprehensive<br />

2 (22) 23 — (1)<br />

income .................................... (71) (229) 7 101 99<br />

28. SHARE-BASED PAYMENTS<br />

The Sappi Limited Share Incentive Trust and The Sappi Limited Performance Share Incentive Trust<br />

Shareholders, at prior annual general meetings, fixed the aggregate number of shares which may<br />

be acquired by all participants under the Sappi Limited Share Incentive Trust (‘‘Scheme’’) and The Sappi<br />

Limited Performance Share Incentive Trust (‘‘Plan’’) at 19,000,000 shares (equivalent to 7.95% of the<br />

shares then in issue). Subsequent to the December 2008 rights offering, this number of shares increased<br />

to 42,700,870 shares (still equivalent to 7.95% of the shares in issue).<br />

The Sappi Limited Share Incentive Trust (‘‘Scheme’’)<br />

Certain managerial employees are eligible to participate in the Scheme. Under the rules of the<br />

Scheme, participants (a) may be offered options to acquire ordinary shares (‘‘Share options’’), (b) may<br />

be offered the opportunity to acquire ordinary shares (‘‘Scheme shares’’), or (c) may be granted options<br />

to enter into agreements with the company to acquire ordinary shares (‘‘Allocation shares’’). In recent<br />

years, only Share Options have been offered to participants.<br />

Under the rules of the Scheme:<br />

– Share options entitle the participant to purchase one ordinary share per share option.<br />

– Scheme shares entitle the participant to enter into a loan with the Scheme to acquire Sappi<br />

Limited shares at a specific issue price. The Scheme shares are registered in the participant’s<br />

name and pledged to the Scheme as security for the loan. Upon payment of the loan, the Scheme<br />

shares become unsecured Sappi Limited shares owned by the participant.<br />

– Allocation shares entitle the participant to accept an option to acquire one Allocation share per<br />

option. These options must be exercised by the participant within 12 months, failing which the<br />

option will automatically lapse. The Allocation shares entitle the participant to pay for one ordinary<br />

share per allocation share.<br />

The amount payable by a participant is the closing price at which shares are traded on the JSE<br />

Limited on the trading date immediately preceding the date upon which the board authorized the grant<br />

of the opportunity to acquire relevant Share options, Scheme shares, or Allocation shares, as the case<br />

may be.<br />

The Share options, Scheme shares and Allocation shares vest in blocks of 25% per annum on the<br />

anniversary date of the offer and expire 8 years after the offer date. Only once the shares vest may Share<br />

F-76