You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(3) In the third quarter of fiscal 2010 the Group revised its methodology for all immature timber and mature timber resulting in<br />

US$ 28 million positive increase in profit. See note 2 of the Group Annual Financial Statements included elsewhere in this<br />

Annual Report. In fiscal 2010 the Group entered into a BEE transaction resulting in a US$ 23 million charge to profit. See<br />

note 28 of the Group Annual Financial Statements included elsewhere in this Annual Report for further details.<br />

(4) During the fiscal years 2010 to 2008, the Group recorded a (US$ 10 million), US$ 79 million, US$ 119 million asset<br />

(impairment reversals) impairments. See note 4 and note 9 of the Group Annual Financial Statements included elsewhere in<br />

this Annual Report for further details.<br />

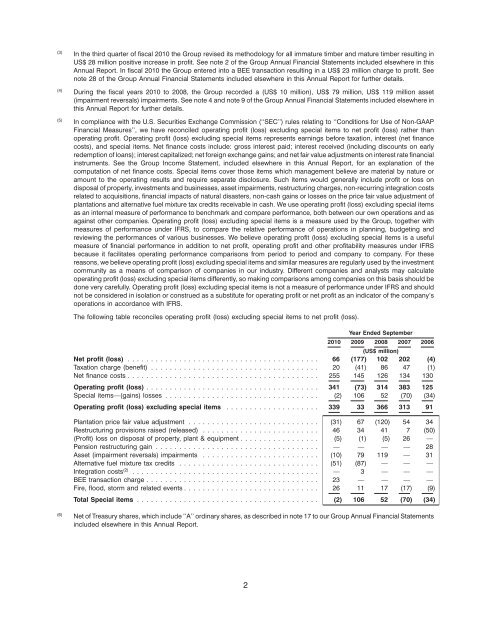

(5) In compliance with the U.S. Securities Exchange Commission (‘‘SEC’’) rules relating to ‘‘Conditions for Use of Non-GAAP<br />

Financial Measures’’, we have reconciled operating profit (loss) excluding special items to net profit (loss) rather than<br />

operating profit. Operating profit (loss) excluding special items represents earnings before taxation, interest (net finance<br />

costs), and special items. Net finance costs include: gross interest paid; interest received (including discounts on early<br />

redemption of loans); interest capitalized; net foreign exchange gains; and net fair value adjustments on interest rate financial<br />

instruments. See the Group Income Statement, included elsewhere in this Annual Report, for an explanation of the<br />

computation of net finance costs. Special items cover those items which management believe are material by nature or<br />

amount to the operating results and require separate disclosure. Such items would generally include profit or loss on<br />

disposal of property, investments and businesses, asset impairments, restructuring charges, non-recurring integration costs<br />

related to acquisitions, financial impacts of natural disasters, non-cash gains or losses on the price fair value adjustment of<br />

plantations and alternative fuel mixture tax credits receivable in cash. We use operating profit (loss) excluding special items<br />

as an internal measure of performance to benchmark and compare performance, both between our own operations and as<br />

against other companies. Operating profit (loss) excluding special items is a measure used by the Group, together with<br />

measures of performance under IFRS, to compare the relative performance of operations in planning, budgeting and<br />

reviewing the performances of various businesses. We believe operating profit (loss) excluding special items is a useful<br />

measure of financial performance in addition to net profit, operating profit and other profitability measures under IFRS<br />

because it facilitates operating performance comparisons from period to period and company to company. For these<br />

reasons, we believe operating profit (loss) excluding special items and similar measures are regularly used by the investment<br />

community as a means of comparison of companies in our industry. Different companies and analysts may calculate<br />

operating profit (loss) excluding special items differently, so making comparisons among companies on this basis should be<br />

done very carefully. Operating profit (loss) excluding special items is not a measure of performance under IFRS and should<br />

not be considered in isolation or construed as a substitute for operating profit or net profit as an indicator of the company’s<br />

operations in accordance with IFRS.<br />

The following table reconciles operating profit (loss) excluding special items to net profit (loss).<br />

Year Ended September<br />

2010 2009 2008 2007 2006<br />

(US$ million)<br />

Net profit (loss) ......................................... 66 (177) 102 202 (4)<br />

Taxation charge (benefit) .................................... 20 (41) 86 47 (1)<br />

Net finance costs ......................................... 255 145 126 134 130<br />

Operating profit (loss) ..................................... 341 (73) 314 383 125<br />

Special items—(gains) losses ................................. (2) 106 52 (70) (34)<br />

Operating profit (loss) excluding special items .................... 339 33 366 313 91<br />

Plantation price fair value adjustment ............................ (31) 67 (120) 54 34<br />

Restructuring provisions raised (released) ......................... 46 34 41 7 (50)<br />

(Profit) loss on disposal of property, plant & equipment ................. (5) (1) (5) 26 —<br />

Pension restructuring gain ................................... — — — — 28<br />

Asset (impairment reversals) impairments ......................... (10) 79 119 — 31<br />

Alternative fuel mixture tax credits .............................. (51) (87) — — —<br />

Integration costs (2) ........................................ — 3 — — —<br />

BEE transaction charge ..................................... 23 — — — —<br />

Fire, flood, storm and related events ............................. 26 11 17 (17) (9)<br />

Total Special items ....................................... (2) 106 52 (70) (34)<br />

(6) Net of Treasury shares, which include ‘‘A’’ ordinary shares, as described in note 17 to our Group Annual Financial Statements<br />

included elsewhere in this Annual Report.<br />

2