Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ITEM 9. THE OFFER AND LISTING<br />

Offer and Listing Details<br />

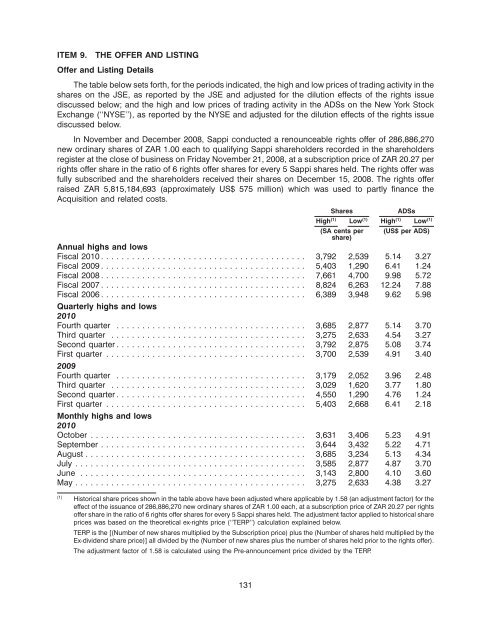

The table below sets forth, for the periods indicated, the high and low prices of trading activity in the<br />

shares on the JSE, as reported by the JSE and adjusted for the dilution effects of the rights issue<br />

discussed below; and the high and low prices of trading activity in the ADSs on the New York Stock<br />

Exchange (‘‘NYSE’’), as reported by the NYSE and adjusted for the dilution effects of the rights issue<br />

discussed below.<br />

In November and December 2008, Sappi conducted a renounceable rights offer of 286,886,270<br />

new ordinary shares of ZAR 1.00 each to qualifying Sappi shareholders recorded in the shareholders<br />

register at the close of business on Friday November 21, 2008, at a subscription price of ZAR 20.27 per<br />

rights offer share in the ratio of 6 rights offer shares for every 5 Sappi shares held. The rights offer was<br />

fully subscribed and the shareholders received their shares on December 15, 2008. The rights offer<br />

raised ZAR 5,815,184,693 (approximately US$ 575 million) which was used to partly finance the<br />

Acquisition and related costs.<br />

Shares ADSs<br />

High (1) Low (1) High (1) Low (1)<br />

(SA cents per<br />

share)<br />

(US$ per ADS)<br />

Annual highs and lows<br />

Fiscal 2010 ........................................ 3,792 2,539 5.14 3.27<br />

Fiscal 2009 ........................................ 5,403 1,290 6.41 1.24<br />

Fiscal 2008 ........................................ 7,661 4,700 9.98 5.72<br />

Fiscal 2007 ........................................ 8,824 6,263 12.24 7.88<br />

Fiscal 2006 ........................................<br />

Quarterly highs and lows<br />

2010<br />

6,389 3,948 9.62 5.98<br />

Fourth quarter ..................................... 3,685 2,877 5.14 3.70<br />

Third quarter ...................................... 3,275 2,633 4.54 3.27<br />

Second quarter ..................................... 3,792 2,875 5.08 3.74<br />

First quarter .......................................<br />

2009<br />

3,700 2,539 4.91 3.40<br />

Fourth quarter ..................................... 3,179 2,052 3.96 2.48<br />

Third quarter ...................................... 3,029 1,620 3.77 1.80<br />

Second quarter ..................................... 4,550 1,290 4.76 1.24<br />

First quarter .......................................<br />

Monthly highs and lows<br />

2010<br />

5,403 2,668 6.41 2.18<br />

October .......................................... 3,631 3,406 5.23 4.91<br />

September ........................................ 3,644 3,432 5.22 4.71<br />

August ........................................... 3,685 3,234 5.13 4.34<br />

July ............................................. 3,585 2,877 4.87 3.70<br />

June ............................................ 3,143 2,800 4.10 3.60<br />

May............................................. 3,275 2,633 4.38 3.27<br />

(1) Historical share prices shown in the table above have been adjusted where applicable by 1.58 (an adjustment factor) for the<br />

effect of the issuance of 286,886,270 new ordinary shares of ZAR 1.00 each, at a subscription price of ZAR 20.27 per rights<br />

offer share in the ratio of 6 rights offer shares for every 5 Sappi shares held. The adjustment factor applied to historical share<br />

prices was based on the theoretical ex-rights price (‘‘TERP’’) calculation explained below.<br />

TERP is the [(Number of new shares multiplied by the Subscription price) plus the (Number of shares held multiplied by the<br />

Ex-dividend share price)] all divided by the (Number of new shares plus the number of shares held prior to the rights offer).<br />

The adjustment factor of 1.58 is calculated using the Pre-announcement price divided by the TERP.<br />

131