Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

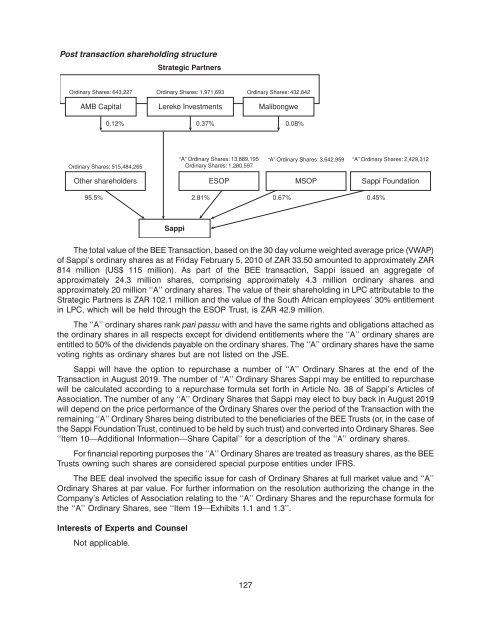

Post transaction shareholding structure<br />

Ordinary Shares: 643,227<br />

AMB Capital<br />

0.12%<br />

Ordinary Shares: 515,484,265<br />

Strategic Partners<br />

“A” Ordinary Shares: 13,889,195<br />

Ordinary Shares: 1,280,597<br />

Other shareholders ESOP<br />

Ordinary Shares: 1,971,693 Ordinary Shares: 432,842<br />

Lereko Investments Malibongwe<br />

Sappi<br />

0.37% 0.08%<br />

“A” Ordinary Shares: 3,642,959 “A” Ordinary Shares: 2,429,312<br />

MSOP Sappi Foundation<br />

95.5% 2.81% 0.67% 0.45%<br />

9DEC201014050729<br />

The total value of the BEE Transaction, based on the 30 day volume weighted average price (VWAP)<br />

of Sappi’s ordinary shares as at Friday February 5, 2010 of ZAR 33.50 amounted to approximately ZAR<br />

814 million (US$ 115 million). As part of the BEE transaction, Sappi issued an aggregate of<br />

approximately 24.3 million shares, comprising approximately 4.3 million ordinary shares and<br />

approximately 20 million ‘‘A’’ ordinary shares. The value of their shareholding in LPC attributable to the<br />

Strategic Partners is ZAR 102.1 million and the value of the South African employees’ 30% entitlement<br />

in LPC, which will be held through the ESOP Trust, is ZAR 42.9 million.<br />

The ‘‘A’’ ordinary shares rank pari passu with and have the same rights and obligations attached as<br />

the ordinary shares in all respects except for dividend entitlements where the ‘‘A’’ ordinary shares are<br />

entitled to 50% of the dividends payable on the ordinary shares. The ‘‘A’’ ordinary shares have the same<br />

voting rights as ordinary shares but are not listed on the JSE.<br />

Sappi will have the option to repurchase a number of ‘‘A’’ Ordinary Shares at the end of the<br />

Transaction in August 2019. The number of ‘‘A’’ Ordinary Shares Sappi may be entitled to repurchase<br />

will be calculated according to a repurchase formula set forth in Article No. 38 of Sappi’s Articles of<br />

Association. The number of any ‘‘A’’ Ordinary Shares that Sappi may elect to buy back in August 2019<br />

will depend on the price performance of the Ordinary Shares over the period of the Transaction with the<br />

remaining ‘‘A’’ Ordinary Shares being distributed to the beneficiaries of the BEE Trusts (or, in the case of<br />

the Sappi Foundation Trust, continued to be held by such trust) and converted into Ordinary Shares. See<br />

‘‘Item 10—Additional Information—Share Capital’’ for a description of the ‘‘A’’ ordinary shares.<br />

For financial reporting purposes the ‘‘A’’ Ordinary Shares are treated as treasury shares, as the BEE<br />

Trusts owning such shares are considered special purpose entities under IFRS.<br />

The BEE deal involved the specific issue for cash of Ordinary Shares at full market value and ‘‘A’’<br />

Ordinary Shares at par value. For further information on the resolution authorizing the change in the<br />

Company’s Articles of Association relating to the ‘‘A’’ Ordinary Shares and the repurchase formula for<br />

the ‘‘A’’ Ordinary Shares, see ‘‘Item 19—Exhibits 1.1 and 1.3’’.<br />

Interests of Experts and Counsel<br />

Not applicable.<br />

127