Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

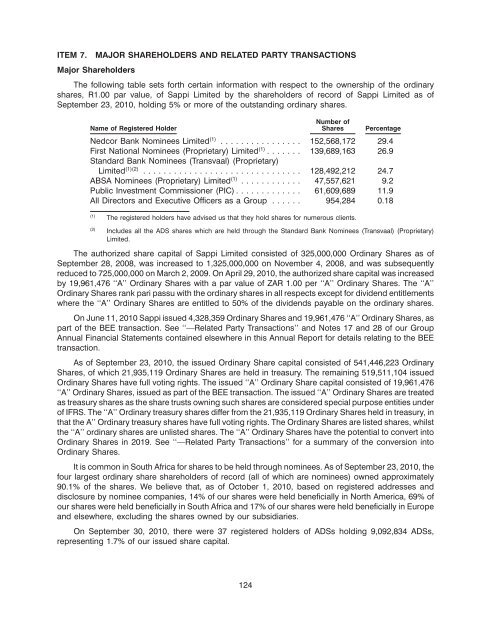

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS<br />

Major Shareholders<br />

The following table sets forth certain information with respect to the ownership of the ordinary<br />

shares, R1.00 par value, of Sappi Limited by the shareholders of record of Sappi Limited as of<br />

September 23, 2010, holding 5% or more of the outstanding ordinary shares.<br />

Name of Registered Holder<br />

Number of<br />

Shares Percentage<br />

Nedcor Bank Nominees Limited (1) ................ 152,568,172 29.4<br />

First National Nominees (Proprietary) Limited (1) .......<br />

Standard Bank Nominees (Transvaal) (Proprietary)<br />

139,689,163 26.9<br />

Limited (1)(2) ............................... 128,492,212 24.7<br />

ABSA Nominees (Proprietary) Limited (1) ............ 47,557,621 9.2<br />

Public Investment Commissioner (PIC) ............. 61,609,689 11.9<br />

All Directors and Executive Officers as a Group ...... 954,284 0.18<br />

(1) The registered holders have advised us that they hold shares for numerous clients.<br />

(2) Includes all the ADS shares which are held through the Standard Bank Nominees (Transvaal) (Proprietary)<br />

Limited.<br />

The authorized share capital of Sappi Limited consisted of 325,000,000 Ordinary Shares as of<br />

September 28, 2008, was increased to 1,325,000,000 on November 4, 2008, and was subsequently<br />

reduced to 725,000,000 on March 2, 2009. On April 29, 2010, the authorized share capital was increased<br />

by 19,961,476 ‘‘A’’ Ordinary Shares with a par value of ZAR 1.00 per ‘‘A’’ Ordinary Shares. The ‘‘A’’<br />

Ordinary Shares rank pari passu with the ordinary shares in all respects except for dividend entitlements<br />

where the ‘‘A’’ Ordinary Shares are entitled to 50% of the dividends payable on the ordinary shares.<br />

On June 11, 2010 Sappi issued 4,328,359 Ordinary Shares and 19,961,476 ‘‘A’’ Ordinary Shares, as<br />

part of the BEE transaction. See ‘‘—Related Party Transactions’’ and Notes 17 and 28 of our Group<br />

Annual Financial Statements contained elsewhere in this Annual Report for details relating to the BEE<br />

transaction.<br />

As of September 23, 2010, the issued Ordinary Share capital consisted of 541,446,223 Ordinary<br />

Shares, of which 21,935,119 Ordinary Shares are held in treasury. The remaining 519,511,104 issued<br />

Ordinary Shares have full voting rights. The issued ‘‘A’’ Ordinary Share capital consisted of 19,961,476<br />

‘‘A’’ Ordinary Shares, issued as part of the BEE transaction. The issued ‘‘A’’ Ordinary Shares are treated<br />

as treasury shares as the share trusts owning such shares are considered special purpose entities under<br />

of IFRS. The ‘‘A’’ Ordinary treasury shares differ from the 21,935,119 Ordinary Shares held in treasury, in<br />

that the A’’ Ordinary treasury shares have full voting rights. The Ordinary Shares are listed shares, whilst<br />

the ‘‘A’’ ordinary shares are unlisted shares. The ‘‘A’’ Ordinary Shares have the potential to convert into<br />

Ordinary Shares in 2019. See ‘‘—Related Party Transactions’’ for a summary of the conversion into<br />

Ordinary Shares.<br />

It is common in South Africa for shares to be held through nominees. As of September 23, 2010, the<br />

four largest ordinary share shareholders of record (all of which are nominees) owned approximately<br />

90.1% of the shares. We believe that, as of October 1, 2010, based on registered addresses and<br />

disclosure by nominee companies, 14% of our shares were held beneficially in North America, 69% of<br />

our shares were held beneficially in South Africa and 17% of our shares were held beneficially in Europe<br />

and elsewhere, excluding the shares owned by our subsidiaries.<br />

On September 30, 2010, there were 37 registered holders of ADSs holding 9,092,834 ADSs,<br />

representing 1.7% of our issued share capital.<br />

124