Shareholders' Letter

Shareholders' Letter

Shareholders' Letter

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

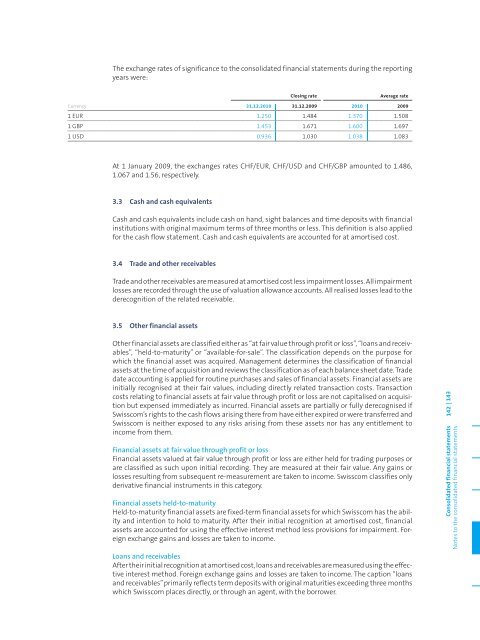

The exchange rates of significance to the consolidated financial statements during the reporting<br />

years were:<br />

Closing rate Average rate<br />

Currency 31.12.2010 31.12.2009 2010 2009<br />

1 EUR 1.250 1.484 1.370 1.508<br />

1 GBP 1.453 1.671 1.600 1.697<br />

1 USD 0.936 1.030 1.038 1.083<br />

At 1 January 2009, the exchanges rates CHF/EUR, CHF/USD and CHF/GBP amounted to 1.486,<br />

1.067 and 1.56, respectively.<br />

3.3 Cash and cash equivalents<br />

Cash and cash equivalents include cash on hand, sight balances and time deposits with financial<br />

institutions with original maximum terms of three months or less. This definition is also applied<br />

for the cash flow statement. Cash and cash equivalents are accounted for at amortised cost.<br />

3.4 Trade and other receivables<br />

Trade and other receivables are measured at amortised cost less impairment losses. All impairment<br />

losses are recorded through the use of valuation allowance accounts. All realised losses lead to the<br />

derecognition of the related receivable.<br />

3.5 Other financial assets<br />

Other financial assets are classified either as “at fair value through profit or loss”, “loans and receivables”,<br />

“held-to-maturity” or “available-for-sale”. The classification depends on the purpose for<br />

which the financial asset was acquired. Management determines the classification of financial<br />

assets at the time of acquisition and reviews the classification as of each balance sheet date. Trade<br />

date accounting is applied for routine purchases and sales of financial assets. Financial assets are<br />

initially recognised at their fair values, including directly related transaction costs. Transaction<br />

costs relating to financial assets at fair value through profit or loss are not capitalised on acquisition<br />

but expensed immediately as incurred. Financial assets are partially or fully derecognised if<br />

Swisscom’s rights to the cash flows arising there from have either expired or were transferred and<br />

Swisscom is neither exposed to any risks arising from these assets nor has any entitlement to<br />

income from them.<br />

Financial assets at fair value through profit or loss<br />

Financial assets valued at fair value through profit or loss are either held for trading purposes or<br />

are classified as such upon initial recording. They are measured at their fair value. Any gains or<br />

losses resulting from subsequent re-measurement are taken to income. Swisscom classifies only<br />

derivative financial instruments in this category.<br />

Financial assets held-to-maturity<br />

Held-to-maturity financial assets are fixed-term financial assets for which Swisscom has the ability<br />

and intention to hold to maturity. After their initial recognition at amortised cost, financial<br />

assets are accounted for using the effective interest method less provisions for impairment. Foreign<br />

exchange gains and losses are taken to income.<br />

Loans and receivables<br />

After their initial recognition at amortised cost, loans and receivables are measured using the effective<br />

interest method. Foreign exchange gains and losses are taken to income. The caption “loans<br />

and receivables” primarily reflects term deposits with original maturities exceeding three months<br />

which Swisscom places directly, or through an agent, with the borrower.<br />

Consolidated financial statements 142 | 143<br />

Notes to the consolidated financial statements