Shareholders' Letter

Shareholders' Letter

Shareholders' Letter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In 2009, Swisscom terminated interest rate swaps designated for hedge accounting to hedge interest<br />

rate risks in connection with planned issuance of debenture bonds totalling CHF 500 million.<br />

The effective portion of CHF 24 million was left in the caption other reserves and will be recognised<br />

as interest expense over the remaining duration of the debenture bond issued in 2009.<br />

Furthermore, as of 31 December 2010, a basis interest rate swap with a duration until 2012 with<br />

a negative market value of CHF 1 million (prior year: CHF 2 million) as well as interest rate swaps<br />

aggregating CHF 200 million with a duration until 2040 with a negative market value of CHF 10<br />

million were recorded under derivative financial instruments which were not designated for hedge<br />

accounting.<br />

As of 31 December 2010, derivative financial instruments include forward currency contracts of<br />

EUR 175 million and USD 130 million which serve to hedge future purchases of goods and services<br />

in the respective currencies. These hedges with negative fair values aggregating CHF 15 million<br />

were designated for hedge accounting. CHF 16 million was recorded in the hedging reserve within<br />

consolidated equity for these designated hedging instruments.<br />

In addition, included in derivative financial instruments are foreign currency forward contracts,<br />

currency swaps and currency options for EUR and USD which serve to hedge future transactions<br />

in connection with Swisscom’s operating activities and which were not designated for hedge<br />

accounting purposes.<br />

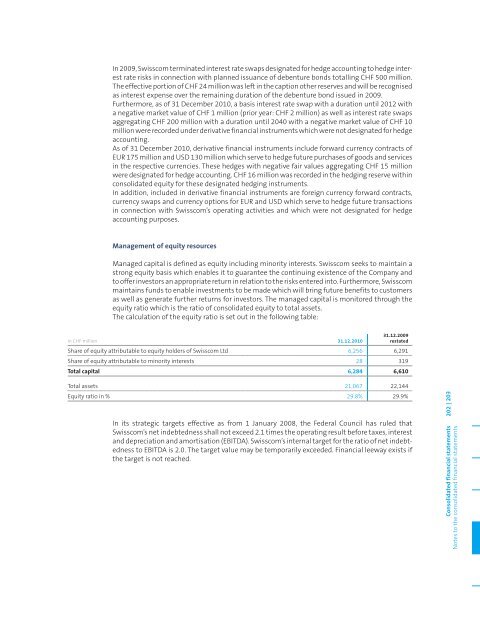

Management of equity resources<br />

Managed capital is defined as equity including minority interests. Swisscom seeks to maintain a<br />

strong equity basis which enables it to guarantee the continuing existence of the Company and<br />

to offer investors an appropriate return in relation to the risks entered into. Furthermore, Swisscom<br />

maintains funds to enable investments to be made which will bring future benefits to customers<br />

as well as generate further returns for investors. The managed capital is monitored through the<br />

equity ratio which is the ratio of consolidated equity to total assets.<br />

The calculation of the equity ratio is set out in the following table:<br />

31.12.2009<br />

In CHF million 31.12.2010 restated<br />

Share of equity attributable to equity holders of Swisscom Ltd 6,256 6,291<br />

Share of equity attributable to minority interests 28 319<br />

Total capital 6,284 6,610<br />

Total assets 21,067 22,144<br />

Equity ratio in % 29.8% 29.9%<br />

In its strategic targets effective as from 1 January 2008, the Federal Council has ruled that<br />

Swisscom’s net indebtedness shall not exceed 2.1 times the operating result before taxes, interest<br />

and depreciation and amortisation (EBITDA). Swisscom’s internal target for the ratio of net indebtedness<br />

to EBITDA is 2.0. The target value may be temporarily exceeded. Financial leeway exists if<br />

the target is not reached.<br />

Consolidated financial statements 202 | 203<br />

Notes to the consolidated financial statements