MS AR 2018 (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

term loans from banking companies and short-term loans from Directors and their relatives. A reconciliation<br />

between the opening and closing balances of these items is provided in note. 43. Consistent with the transition<br />

provisions of the amendments, the Company has not disclosed comparative information for the prior period.<br />

Apart from the additional disclosure in note. 43, the application of these amendments has had no impact on the<br />

Company’s financial statements.<br />

Amendments to IAS 12 - Income Taxes - Recognition of Deferred Tax Assets for Unrealised Losses<br />

The Company has applied these amendments for the first time in the current year. The amendments clarify<br />

how an entity should evaluate whether there will be sufficient future taxable profits against which it can utilise a<br />

deductible temporary difference. The application of these amendments has had no impact on the Company’s<br />

financial statements as the Company already assesses the sufficiency of future taxable profits in a way that is<br />

consistent with these amendments.<br />

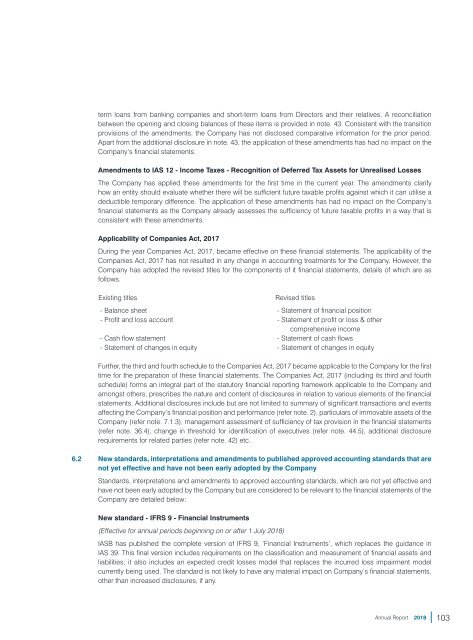

Applicability of Companies Act, 2017<br />

During the year Companies Act, 2017, became effective on these financial statements. The applicability of the<br />

Companies Act, 2017 has not resulted in any change in accounting treatments for the Company. However, the<br />

Company has adopted the revised titles for the components of it financial statements, details of which are as<br />

follows.<br />

Existing titles<br />

Revised titles<br />

- Balance sheet - Statement of financial position<br />

- Profit and loss account - Statement of profit or loss & other<br />

comprehensive income<br />

- Cash flow statement - Statement of cash flows<br />

- Statement of changes in equity - Statement of changes in equity<br />

Further, the third and fourth schedule to the Companies Act, 2017 became applicable to the Company for the first<br />

time for the preparation of these financial statements. The Companies Act, 2017 (including its third and fourth<br />

schedule) forms an integral part of the statutory financial reporting framework applicable to the Company and<br />

amongst others, prescribes the nature and content of disclosures in relation to various elements of the financial<br />

statements. Additional disclosures include but are not limited to summary of significant transactions and events<br />

affecting the Company’s financial position and performance (refer note. 2), particulars of immovable assets of the<br />

Company (refer note. 7.1.3), management assessment of sufficiency of tax provision in the financial statements<br />

(refer note. 36.4), change in threshold for identification of executives (refer note. 44.5), additional disclosure<br />

requirements for related parties (refer note. 42) etc.<br />

6.2 New standards, interpretations and amendments to published approved accounting standards that are<br />

not yet effective and have not been early adopted by the Company<br />

Standards, interpretations and amendments to approved accounting standards, which are not yet effective and<br />

have not been early adopted by the Company but are considered to be relevant to the financial statements of the<br />

Company are detailed below:<br />

New standard - IFRS 9 - Financial Instruments<br />

(Effective for annual periods beginning on or after 1 July <strong>2018</strong>)<br />

IASB has published the complete version of IFRS 9, ‘Financial Instruments’, which replaces the guidance in<br />

IAS 39. This final version includes requirements on the classification and measurement of financial assets and<br />

liabilities; it also includes an expected credit losses model that replaces the incurred loss impairment model<br />

currently being used. The standard is not likely to have any material impact on Company’s financial statements,<br />

other than increased disclosures, if any.<br />

Annual Report <strong>2018</strong><br />

103