MS AR 2018 (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

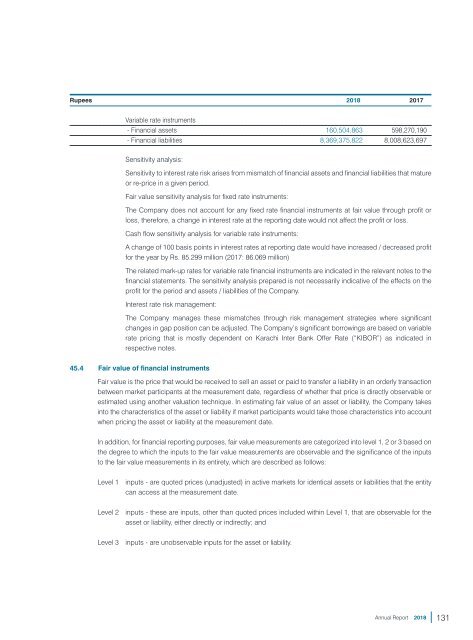

Rupees <strong>2018</strong> 2017<br />

Variable rate instruments<br />

- Financial assets 160,504,863 598,270,190<br />

- Financial liabilities 8,369,375,822 8,008,623,697<br />

Sensitivity analysis:<br />

Sensitivity to interest rate risk arises from mismatch of financial assets and financial liabilities that mature<br />

or re-price in a given period.<br />

Fair value sensitivity analysis for fixed rate instruments:<br />

The Company does not account for any fixed rate financial instruments at fair value through profit or<br />

loss, therefore, a change in interest rate at the reporting date would not affect the profit or loss.<br />

Cash flow sensitivity analysis for variable rate instruments:<br />

A change of 100 basis points in interest rates at reporting date would have increased / decreased profit<br />

for the year by Rs. 85.299 million (2017: 86.069 million)<br />

The related mark-up rates for variable rate financial instruments are indicated in the relevant notes to the<br />

financial statements. The sensitivity analysis prepared is not necessarily indicative of the effects on the<br />

profit for the period and assets / liabilities of the Company.<br />

Interest rate risk management:<br />

The Company manages these mismatches through risk management strategies where significant<br />

changes in gap position can be adjusted. The Company’s significant borrowings are based on variable<br />

rate pricing that is mostly dependent on Karachi Inter Bank Offer Rate (“KIBOR”) as indicated in<br />

respective notes.<br />

45.4 Fair value of financial instruments<br />

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction<br />

between market participants at the measurement date, regardless of whether that price is directly observable or<br />

estimated using another valuation technique. In estimating fair value of an asset or liability, the Company takes<br />

into the characteristics of the asset or liability if market participants would take those characteristics into account<br />

when pricing the asset or liability at the measurement date.<br />

In addition, for financial reporting purposes, fair value measurements are categorized into level 1, 2 or 3 based on<br />

the degree to which the inputs to the fair value measurements are observable and the significance of the inputs<br />

to the fair value measurements in its entirety, which are described as follows:<br />

Level 1 inputs - are quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity<br />

can access at the measurement date.<br />

Level 2 inputs - these are inputs, other than quoted prices included within Level 1, that are observable for the<br />

asset or liability, either directly or indirectly; and<br />

Level 3 inputs - are unobservable inputs for the asset or liability.<br />

Annual Report <strong>2018</strong><br />

131