MS AR 2018 (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Rupees <strong>2018</strong> 2017<br />

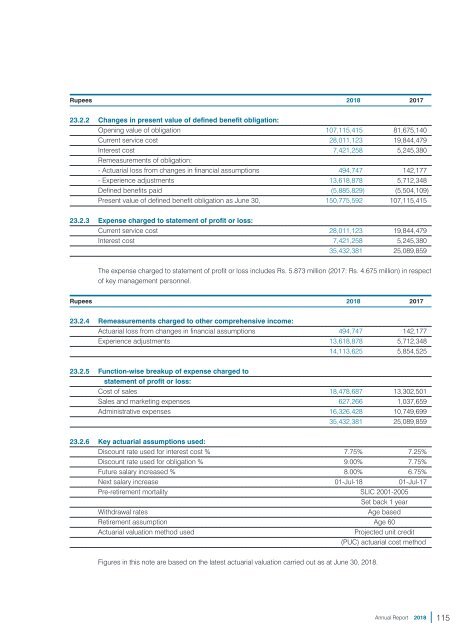

23.2.2 Changes in present value of defined benefit obligation:<br />

Opening value of obligation 107,115,415 81,675,140<br />

Current service cost 28,011,123 19,844,479<br />

Interest cost 7,421,258 5,245,380<br />

Remeasurements of obligation:<br />

- Actuarial loss from changes in financial assumptions 494,747 142,177<br />

- Experience adjustments 13,618,878 5,712,348<br />

Defined benefits paid (5,885,829) (5,504,109)<br />

Present value of defined benefit obligation as June 30, 150,775,592 107,115,415<br />

23.2.3 Expense charged to statement of profit or loss:<br />

Current service cost 28,011,123 19,844,479<br />

Interest cost 7,421,258 5,245,380<br />

35,432,381 25,089,859<br />

The expense charged to statement of profit or loss includes Rs. 5.873 million (2017: Rs. 4.675 million) in respect<br />

of key management personnel.<br />

Rupees <strong>2018</strong> 2017<br />

23.2.4 Remeasurements charged to other comprehensive income:<br />

Actuarial loss from changes in financial assumptions 494,747 142,177<br />

Experience adjustments 13,618,878 5,712,348<br />

14,113,625 5,854,525<br />

23.2.5 Function-wise breakup of expense charged to<br />

statement of profit or loss:<br />

Cost of sales 18,478,687 13,302,501<br />

Sales and marketing expenses 627,266 1,037,659<br />

Administrative expenses 16,326,428 10,749,699<br />

35,432,381 25,089,859<br />

23.2.6 Key actuarial assumptions used:<br />

Discount rate used for interest cost % 7.75% 7.25%<br />

Discount rate used for obligation % 9.00% 7.75%<br />

Future salary increased % 8.00% 6.75%<br />

Next salary increase 01-Jul-18 01-Jul-17<br />

Pre-retirement mortality SLIC 2001-2005<br />

Set back 1 year<br />

Withdrawal rates<br />

Age based<br />

Retirement assumption Age 60<br />

Actuarial valuation method used<br />

Projected unit credit<br />

(PUC) actuarial cost method<br />

Figures in this note are based on the latest actuarial valuation carried out as at June 30, <strong>2018</strong>.<br />

Annual Report <strong>2018</strong><br />

115