MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANALYSIS OF PROSPECTS OF THE<br />

ENTITY INCLUDING T<strong>AR</strong>GETS FOR<br />

FINANCIAL AND NON-FINANCIAL<br />

MEASURES<br />

Prospects Of The Entity<br />

Efficient use of available resources, modernization of<br />

production facilities through technology advancement<br />

and innovation, expansion of capacities, development<br />

of innovative products, exploration of alternative energy<br />

resources, overcome energy constraints, reduction in costs<br />

of production and diversification, provide sufficient support<br />

to the management’s projection of enhanced profitability and<br />

return to the members.<br />

Targets For Financial Measures<br />

Various factors and variables were considered and<br />

estimated in projecting targets for financial year June 30,<br />

<strong>2018</strong>. The results of some of these factors can be monitored<br />

while for others they can only be improved to some extent.<br />

Absolute commitment, continuous evaluation and steady<br />

implementation have resulted in achievement of set goals<br />

and objectives. This is evident from the fact that despite of<br />

insufficient electricity load from the grid station, enhanced<br />

production levels were achieved and operating targets were<br />

met by way of efficient utilization of existing capacities and<br />

commissioning of new gas engines, which enabled the<br />

Company to increase its turnover despite adverse market<br />

conditions.<br />

Targets For Non-Financial Measures<br />

The Company has identified the following areas as key nonfinancial<br />

performance measures:<br />

• Maintenance of product quality<br />

• Relationship with customers<br />

• Brand establishment and preference<br />

• Raw material quality<br />

• Employee satisfaction<br />

• Responsibilities towards the society<br />

Responsibility for implementation has been delegated to the<br />

management, with continuous monitoring and control by the<br />

Board.<br />

Explanation As To Why The Results From<br />

Performance Measures Have Changed Over The<br />

Period Or How The Indicators Have Changed<br />

Results of performance measures were in line with the<br />

targets and there were no material changes.<br />

CRITICAL PERFORMANCE<br />

INDICATORS<br />

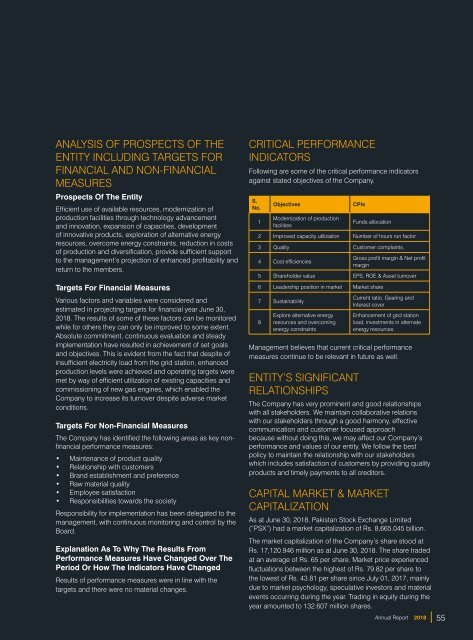

Following are some of the critical performance indicators<br />

against stated objectives of the Company.<br />

S.<br />

No.<br />

1<br />

Objectives<br />

Modernization of production<br />

facilities<br />

CPIs<br />

Funds allocation<br />

2 Improved capacity utilization Number of hours run factor<br />

3 Quality Customer complaints,<br />

4 Cost efficiencies<br />

Gross profit margin & Net profit<br />

margin<br />

5 Shareholder value EPS, ROE & Asset turnover<br />

6 Leadership position in market Market share<br />

7 Sustainability<br />

8<br />

Explore alternative energy<br />

resources and overcoming<br />

energy constraints<br />

Current ratio, Gearing and<br />

Interest cover<br />

Enhancement of grid station<br />

load, investments in alternate<br />

energy resources.<br />

Management believes that current critical performance<br />

measures continue to be relevant in future as well.<br />

ENTITY’S SIGNIFICANT<br />

RELATIONSHIPS<br />

The Company has very prominent and good relationships<br />

with all stakeholders. We maintain collaborative relations<br />

with our stakeholders through a good harmony, effective<br />

communication and customer focused approach<br />

because without doing this, we may affect our Company’s<br />

performance and values of our entity. We follow the best<br />

policy to maintain the relationship with our stakeholders<br />

which includes satisfaction of customers by providing quality<br />

products and timely payments to all creditors.<br />

CAPITAL M<strong>AR</strong>KET & M<strong>AR</strong>KET<br />

CAPITALIZATION<br />

As at June 30, <strong>2018</strong>, Pakistan Stock Exchange Limited<br />

(“PSX”) had a market capitalization of Rs. 8,665.045 billion.<br />

The market capitalization of the Company’s share stood at<br />

Rs. 17,120.946 million as at June 30, <strong>2018</strong>. The share traded<br />

at an average of Rs. 65 per share. Market price experienced<br />

fluctuations between the highest of Rs. 79.82 per share to<br />

the lowest of Rs. 43.81 per share since July 01, 2017, mainly<br />

due to market psychology, speculative investors and material<br />

events occurring during the year. Trading in equity during the<br />

year amounted to 132.607 million shares.<br />

Annual Report <strong>2018</strong><br />

55