MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE<br />

FINANCIAL STATEMENTS<br />

FOR THE YE<strong>AR</strong> ENDED JUNE 30, <strong>2018</strong><br />

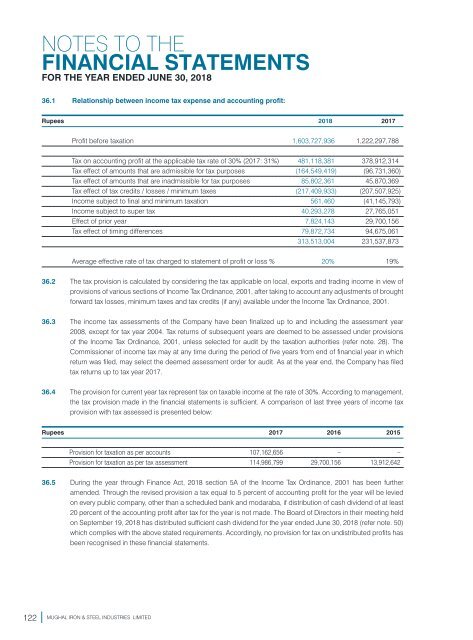

36.1 Relationship between income tax expense and accounting profit:<br />

Rupees <strong>2018</strong> 2017<br />

Profit before taxation 1,603,727,936 1,222,297,788<br />

Tax on accounting profit at the applicable tax rate of 30% (2017: 31%) 481,118,381 378,912,314<br />

Tax effect of amounts that are admissible for tax purposes (164,549,419) (96,731,360)<br />

Tax effect of amounts that are inadmissible for tax purposes 85,802,361 45,870,369<br />

Tax effect of tax credits / losses / minimum taxes (217,409,933) (207,507,925)<br />

Income subject to final and minimum taxation 561,460 (41,145,793)<br />

Income subject to super tax 40,293,278 27,765,051<br />

Effect of prior year 7,824,143 29,700,156<br />

Tax effect of timing differences 79,872,734 94,675,061<br />

313,513,004 231,537,873<br />

Average effective rate of tax charged to statement of profit or loss % 20% 19%<br />

36.2 The tax provision is calculated by considering the tax applicable on local, exports and trading income in view of<br />

provisions of various sections of Income Tax Ordinance, 2001, after taking to account any adjustments of brought<br />

forward tax losses, minimum taxes and tax credits (if any) available under the Income Tax Ordinance, 2001.<br />

36.3 The income tax assessments of the Company have been finalized up to and including the assessment year<br />

2008, except for tax year 2004. Tax returns of subsequent years are deemed to be assessed under provisions<br />

of the Income Tax Ordinance, 2001, unless selected for audit by the taxation authorities (refer note. 28). The<br />

Commissioner of income tax may at any time during the period of five years from end of financial year in which<br />

return was filed, may select the deemed assessment order for audit. As at the year end, the Company has filed<br />

tax returns up to tax year 2017.<br />

36.4 The provision for current year tax represent tax on taxable income at the rate of 30%. According to management,<br />

the tax provision made in the financial statements is sufficient. A comparison of last three years of income tax<br />

provision with tax assessed is presented below:<br />

Rupees 2017 2016 2015<br />

Provision for taxation as per accounts 107,162,656 – –<br />

Provision for taxation as per tax assessment 114,986,799 29,700,156 13,912,642<br />

36.5 During the year through Finance Act, <strong>2018</strong> section 5A of the Income Tax Ordinance, 2001 has been further<br />

amended. Through the revised provision a tax equal to 5 percent of accounting profit for the year will be levied<br />

on every public company, other than a scheduled bank and modaraba, if distribution of cash dividend of at least<br />

20 percent of the accounting profit after tax for the year is not made. The Board of Directors in their meeting held<br />

on September 19, <strong>2018</strong> has distributed sufficient cash dividend for the year ended June 30, <strong>2018</strong> (refer note. 50)<br />

which complies with the above stated requirements. Accordingly, no provision for tax on undistributed profits has<br />

been recognised in these financial statements.<br />

122 MUGHAL IRON & STEEL INDUSTRIES LIMITED