MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE<br />

FINANCIAL STATEMENTS<br />

FOR THE YE<strong>AR</strong> ENDED JUNE 30, <strong>2018</strong><br />

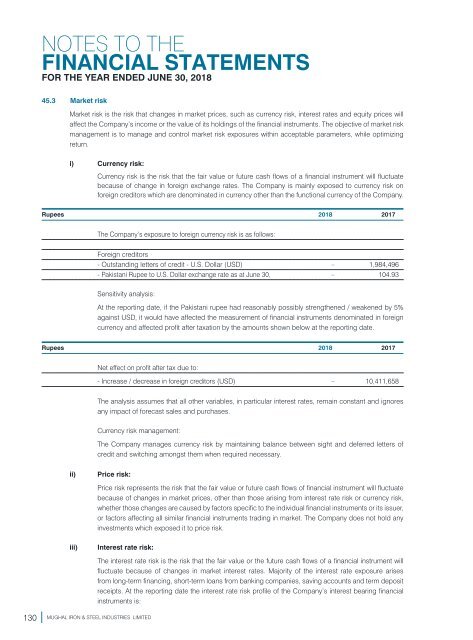

45.3 Market risk<br />

Market risk is the risk that changes in market prices, such as currency risk, interest rates and equity prices will<br />

affect the Company’s income or the value of its holdings of the financial instruments. The objective of market risk<br />

management is to manage and control market risk exposures within acceptable parameters, while optimizing<br />

return.<br />

i) Currency risk:<br />

Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate<br />

because of change in foreign exchange rates. The Company is mainly exposed to currency risk on<br />

foreign creditors which are denominated in currency other than the functional currency of the Company.<br />

Rupees <strong>2018</strong> 2017<br />

The Company’s exposure to foreign currency risk is as follows:<br />

Foreign creditors<br />

- Outstanding letters of credit - U.S. Dollar (USD) – 1,984,496<br />

- Pakistani Rupee to U.S. Dollar exchange rate as at June 30, – 104.93<br />

Sensitivity analysis:<br />

At the reporting date, if the Pakistani rupee had reasonably possibly strengthened / weakened by 5%<br />

against USD, it would have affected the measurement of financial instruments denominated in foreign<br />

currency and affected profit after taxation by the amounts shown below at the reporting date.<br />

Rupees <strong>2018</strong> 2017<br />

Net effect on profit after tax due to:<br />

- Increase / decrease in foreign creditors (USD) – 10,411,658<br />

The analysis assumes that all other variables, in particular interest rates, remain constant and ignores<br />

any impact of forecast sales and purchases.<br />

Currency risk management:<br />

The Company manages currency risk by maintaining balance between sight and deferred letters of<br />

credit and switching amongst them when required necessary.<br />

ii)<br />

iii)<br />

Price risk:<br />

Price risk represents the risk that the fair value or future cash flows of financial instrument will fluctuate<br />

because of changes in market prices, other than those arising from interest rate risk or currency risk,<br />

whether those changes are caused by factors specific to the individual financial instruments or its issuer,<br />

or factors affecting all similar financial instruments trading in market. The Company does not hold any<br />

investments which exposed it to price risk.<br />

Interest rate risk:<br />

The interest rate risk is the risk that the fair value or the future cash flows of a financial instrument will<br />

fluctuate because of changes in market interest rates. Majority of the interest rate exposure arises<br />

from long-term financing, short-term loans from banking companies, saving accounts and term deposit<br />

receipts. At the reporting date the interest rate risk profile of the Company’s interest bearing financial<br />

instruments is:<br />

130 MUGHAL IRON & STEEL INDUSTRIES LIMITED