MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

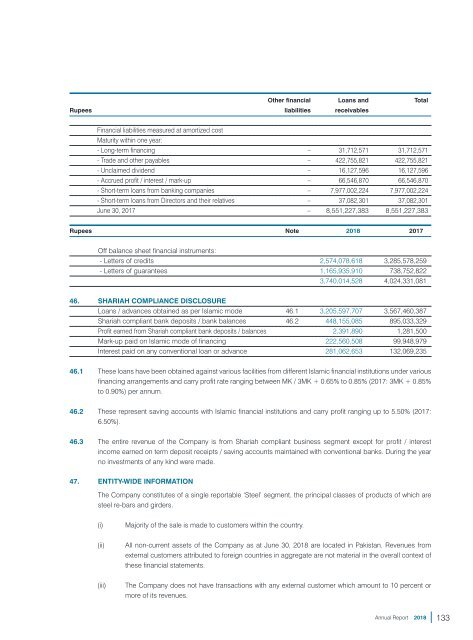

Other financial Loans and Total<br />

Rupees liabilities receivables<br />

Financial liabilities measured at amortized cost<br />

Maturity within one year:<br />

- Long-term financing – 31,712,571 31,712,571<br />

- Trade and other payables – 422,755,821 422,755,821<br />

- Unclaimed dividend – 16,127,596 16,127,596<br />

- Accrued profit / interest / mark-up – 66,546,870 66,546,870<br />

- Short-term loans from banking companies – 7,977,002,224 7,977,002,224<br />

- Short-term loans from Directors and their relatives – 37,082,301 37,082,301<br />

June 30, 2017 – 8,551,227,383 8,551,227,383<br />

Rupees Note <strong>2018</strong> 2017<br />

Off balance sheet financial instruments:<br />

- Letters of credits 2,574,078,618 3,285,578,259<br />

- Letters of guarantees 1,165,935,910 738,752,822<br />

3,740,014,528 4,024,331,081<br />

46. SH<strong>AR</strong>IAH COMPLIANCE DISCLOSURE<br />

Loans / advances obtained as per Islamic mode 46.1 3,205,597,707 3,567,460,387<br />

Shariah compliant bank deposits / bank balances 46.2 448,155,085 895,033,329<br />

Profit earned from Shariah compliant bank deposits / balances 2,391,890 1,281,500<br />

Mark-up paid on Islamic mode of financing 222,560,508 99,948,979<br />

Interest paid on any conventional loan or advance 281,062,653 132,069,235<br />

46.1 These loans have been obtained against various facilities from different Islamic financial institutions under various<br />

financing arrangements and carry profit rate ranging between MK / 3MK + 0.65% to 0.85% (2017: 3MK + 0.85%<br />

to 0.90%) per annum.<br />

46.2 These represent saving accounts with Islamic financial institutions and carry profit ranging up to 5.50% (2017:<br />

6.50%).<br />

46.3 The entire revenue of the Company is from Shariah compliant business segment except for profit / interest<br />

income earned on term deposit receipts / saving accounts maintained with conventional banks. During the year<br />

no investments of any kind were made.<br />

47. ENTITY-WIDE INFORMATION<br />

The Company constitutes of a single reportable ‘Steel’ segment, the principal classes of products of which are<br />

steel re-bars and girders.<br />

(i)<br />

(ii)<br />

(iii)<br />

Majority of the sale is made to customers within the country.<br />

All non-current assets of the Company as at June 30, <strong>2018</strong> are located in Pakistan. Revenues from<br />

external customers attributed to foreign countries in aggregate are not material in the overall context of<br />

these financial statements.<br />

The Company does not have transactions with any external customer which amount to 10 percent or<br />

more of its revenues.<br />

Annual Report <strong>2018</strong><br />

133