MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

45.1 Credit risk<br />

Credit risk represents the risk that one party to a financial instrument will cause a financial loss for the other<br />

party by failing to discharge an obligation. Company’s credit risk is primarily attributable to its long-term loan to<br />

employees, long-term deposits, trade debts, certain loans and advances, certain deposits, prepayments and<br />

receivables and its balances with banks. To manage credit risk, the Company maintains procedures covering the<br />

application for credit approvals, granting and renewal of counterparty limits and monitoring of exposures against<br />

these limits. As part of these processes the financial viability of all counterparties is regularly monitored and<br />

assessed. Customer credit risk is managed according to Company’s policy, procedures and controls relating to<br />

customer credit risk management. Credit limits are established for all customers based on internal rating criteria.<br />

Credit quality of the customer is assessed and as based on an extensive credit rating. Outstanding customer<br />

receivables are regularly monitored.<br />

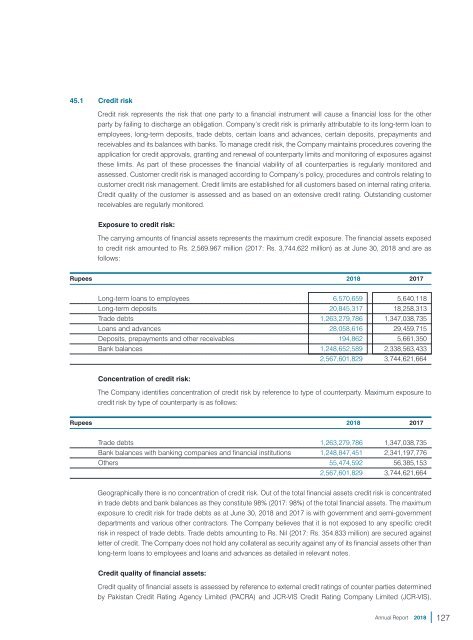

Exposure to credit risk:<br />

The carrying amounts of financial assets represents the maximum credit exposure. The financial assets exposed<br />

to credit risk amounted to Rs. 2,569.967 million (2017: Rs. 3,744.622 million) as at June 30, <strong>2018</strong> and are as<br />

follows:<br />

Rupees <strong>2018</strong> 2017<br />

Long-term loans to employees 6,570,659 5,640,118<br />

Long-term deposits 20,845,317 18,258,313<br />

Trade debts 1,263,279,786 1,347,038,735<br />

Loans and advances 28,058,616 29,459,715<br />

Deposits, prepayments and other receivables 194,862 5,661,350<br />

Bank balances 1,248,652,589 2,338,563,433<br />

2,567,601,829 3,744,621,664<br />

Concentration of credit risk:<br />

The Company identifies concentration of credit risk by reference to type of counterparty. Maximum exposure to<br />

credit risk by type of counterparty is as follows:<br />

Rupees <strong>2018</strong> 2017<br />

Trade debts 1,263,279,786 1,347,038,735<br />

Bank balances with banking companies and financial institutions 1,248,847,451 2,341,197,776<br />

Others 55,474,592 56,385,153<br />

2,567,601,829 3,744,621,664<br />

Geographically there is no concentration of credit risk. Out of the total financial assets credit risk is concentrated<br />

in trade debts and bank balances as they constitute 98% (2017: 98%) of the total financial assets. The maximum<br />

exposure to credit risk for trade debts as at June 30, <strong>2018</strong> and 2017 is with government and semi-government<br />

departments and various other contractors. The Company believes that it is not exposed to any specific credit<br />

risk in respect of trade debts. Trade debts amounting to Rs. Nil (2017: Rs. 354.833 million) are secured against<br />

letter of credit. The Company does not hold any collateral as security against any of its financial assets other than<br />

long-term loans to employees and loans and advances as detailed in relevant notes.<br />

Credit quality of financial assets:<br />

Credit quality of financial assets is assessed by reference to external credit ratings of counter parties determined<br />

by Pakistan Credit Rating Agency Limited (PACRA) and JCR-VIS Credit Rating Company Limited (JCR-VIS),<br />

Annual Report <strong>2018</strong><br />

127