MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

calculating the capitalisation rate on general borrowings.<br />

The amendments are not likely to have any material impact on Company’s financial statements.<br />

New Interpretation - IFRIC 22 - Foreign Currency Transactions and Advance Consideration<br />

(Effective for annual periods beginning on or after 1 January <strong>2018</strong>)<br />

IFRIC 22 clarifies the accounting for transactions that include the receipt or payment of advance consideration in a<br />

foreign currency. The interpretation is not likely to have any material impact on Company’s financial statements.<br />

New Interpretations - IFRIC 23 — Uncertainty over Income Tax Treatments<br />

(Effective for annual periods beginning on or after 1 January <strong>2018</strong>)<br />

The interpretation is to be applied to the determination of taxable profit (tax loss), tax bases, unused tax losses,<br />

unused tax credits and tax rates, when there is uncertainty over income tax treatments under IAS 12.<br />

The interpretation is not likely to have any material impact on Company’s financial statements.<br />

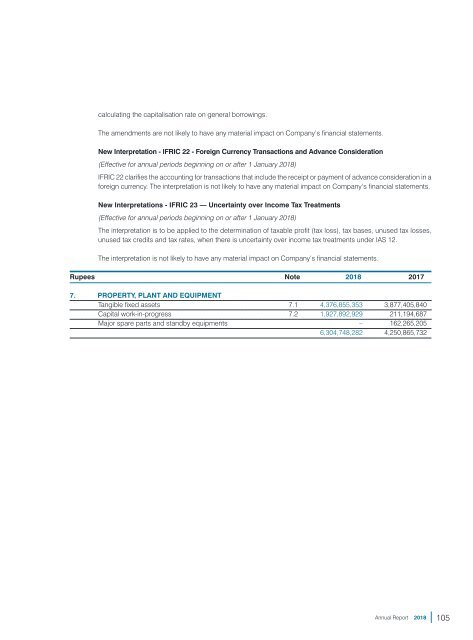

Rupees Note <strong>2018</strong> 2017<br />

7. PROPERTY, PLANT AND EQUIPMENT<br />

Tangible fixed assets 7.1 4,376,855,353 3,877,405,840<br />

Capital work-in-progress 7.2 1,927,892,929 211,194,687<br />

Major spare parts and standby equipments – 162,265,205<br />

6,304,748,282 4,250,865,732<br />

Annual Report <strong>2018</strong><br />

105