MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

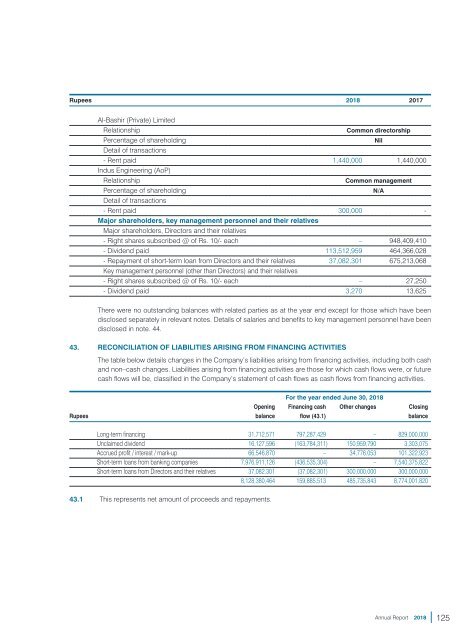

Rupees <strong>2018</strong> 2017<br />

Al-Bashir (Private) Limited<br />

Relationship<br />

Common directorship<br />

Percentage of shareholding<br />

Nil<br />

Detail of transactions<br />

- Rent paid 1,440,000 1,440,000<br />

Indus Engineering (AoP)<br />

Relationship<br />

Common management<br />

Percentage of shareholding<br />

N/A<br />

Detail of transactions<br />

- Rent paid 300,000 -<br />

Major shareholders, key management personnel and their relatives<br />

Major shareholders, Directors and their relatives<br />

- Right shares subscribed @ of Rs. 10/- each – 948,409,410<br />

- Dividend paid 113,512,959 464,366,028<br />

- Repayment of short-term loan from Directors and their relatives 37,082,301 675,213,068<br />

Key management personnel (other than Directors) and their relatives<br />

- Right shares subscribed @ of Rs. 10/- each – 27,250<br />

- Dividend paid 3,270 13,625<br />

There were no outstanding balances with related parties as at the year end except for those which have been<br />

disclosed separately in relevant notes. Details of salaries and benefits to key management personnel have been<br />

disclosed in note. 44.<br />

43. RECONCILIATION OF LIABILITIES <strong>AR</strong>ISING FROM FINANCING ACTIVITIES<br />

The table below details changes in the Company’s liabilities arising from financing activities, including both cash<br />

and non–cash changes. Liabilities arising from financing activities are those for which cash flows were, or future<br />

cash flows will be, classified in the Company’s statement of cash flows as cash flows from financing activities.<br />

For the year ended June 30, <strong>2018</strong><br />

Opening Financing cash Other changes Closing<br />

Rupees balance flow (43.1) balance<br />

Long-term financing 31,712,571 797,287,429 – 829,000,000<br />

Unclaimed dividend 16,127,596 (163,784,311) 150,959,790 3,303,075<br />

Accrued profit / interest / mark-up 66,546,870 – 34,776,053 101,322,923<br />

Short-term loans from banking companies 7,976,911,126 (436,535,304) – 7,540,375,822<br />

Short-term loans from Directors and their relatives 37,082,301 (37,082,301) 300,000,000 300,000,000<br />

8,128,380,464 159,885,513 485,735,843 8,774,001,820<br />

43.1 This represents net amount of proceeds and repayments.<br />

Annual Report <strong>2018</strong><br />

125