MS AR 2018 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

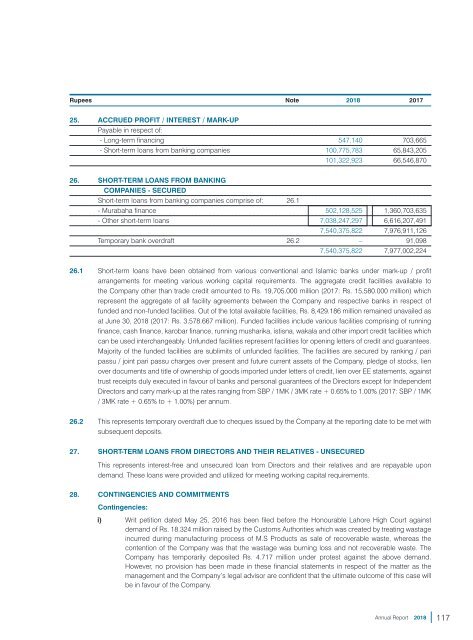

Rupees Note <strong>2018</strong> 2017<br />

25. ACCRUED PROFIT / INTEREST / M<strong>AR</strong>K-UP<br />

Payable in respect of:<br />

- Long-term financing 547,140 703,665<br />

- Short-term loans from banking companies 100,775,783 65,843,205<br />

101,322,923 66,546,870<br />

26. SHORT-TERM LOANS FROM BANKING<br />

COMPANIES - SECURED<br />

Short-term loans from banking companies comprise of: 26.1<br />

- Murabaha finance 502,128,525 1,360,703,635<br />

- Other short-term loans 7,038,247,297 6,616,207,491<br />

7,540,375,822 7,976,911,126<br />

Temporary bank overdraft 26.2 – 91,098<br />

7,540,375,822 7,977,002,224<br />

26.1 Short-term loans have been obtained from various conventional and Islamic banks under mark-up / profit<br />

arrangements for meeting various working capital requirements. The aggregate credit facilities available to<br />

the Company other than trade credit amounted to Rs. 19,705.000 million (2017: Rs. 15,580.000 million) which<br />

represent the aggregate of all facility agreements between the Company and respective banks in respect of<br />

funded and non-funded facilities. Out of the total available facilities, Rs. 8,429.186 million remained unavailed as<br />

at June 30, <strong>2018</strong> (2017: Rs. 3,578.667 million). Funded facilities include various facilities comprising of running<br />

finance, cash finance, karobar finance, running musharika, istisna, wakala and other import credit facilities which<br />

can be used interchangeably. Unfunded facilities represent facilities for opening letters of credit and guarantees.<br />

Majority of the funded facilities are sublimits of unfunded facilities. The facilities are secured by ranking / pari<br />

passu / joint pari passu charges over present and future current assets of the Company, pledge of stocks, lien<br />

over documents and title of ownership of goods imported under letters of credit, lien over EE statements, against<br />

trust receipts duly executed in favour of banks and personal guarantees of the Directors except for Independent<br />

Directors and carry mark-up at the rates ranging from SBP / 1MK / 3MK rate + 0.65% to 1.00% (2017: SBP / 1MK<br />

/ 3MK rate + 0.65% to + 1.00%) per annum.<br />

26.2 This represents temporary overdraft due to cheques issued by the Company at the reporting date to be met with<br />

subsequent deposits.<br />

27. SHORT-TERM LOANS FROM DIRECTORS AND THEIR RELATIVES - UNSECURED<br />

This represents interest-free and unsecured loan from Directors and their relatives and are repayable upon<br />

demand. These loans were provided and utilized for meeting working capital requirements.<br />

28. CONTINGENCIES AND COMMITMENTS<br />

Contingencies:<br />

i) Writ petition dated May 25, 2016 has been filed before the Honourable Lahore High Court against<br />

demand of Rs. 18.324 million raised by the Customs Authorities which was created by treating wastage<br />

incurred during manufacturing process of M.S Products as sale of recoverable waste, whereas the<br />

contention of the Company was that the wastage was burning loss and not recoverable waste. The<br />

Company has temporarily deposited Rs. 4.717 million under protest against the above demand.<br />

However, no provision has been made in these financial statements in respect of the matter as the<br />

management and the Company’s legal advisor are confident that the ultimate outcome of this case will<br />

be in favour of the Company.<br />

Annual Report <strong>2018</strong><br />

117