MS AR 2018 (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE<br />

FINANCIAL STATEMENTS<br />

FOR THE YE<strong>AR</strong> ENDED JUNE 30, <strong>2018</strong><br />

14.1 These represent interest-free loans and advances provided to employees in accordance with Company Policy.<br />

These are secured against gratuity and are repayable within twelve months. The maximum amount of loans and<br />

advances to the key management personnel outstanding at the end of any month during the year ended June 30,<br />

<strong>2018</strong> was Rs. 2.490 million (2017: Rs. 3.200 million). There were no loans and advances which were past due. No<br />

amount was provided to the Chief Executive Officer or any of the Directors during the year ended June 30, <strong>2018</strong><br />

(2017: Rs. Nil)<br />

Rupees Note <strong>2018</strong> 2017<br />

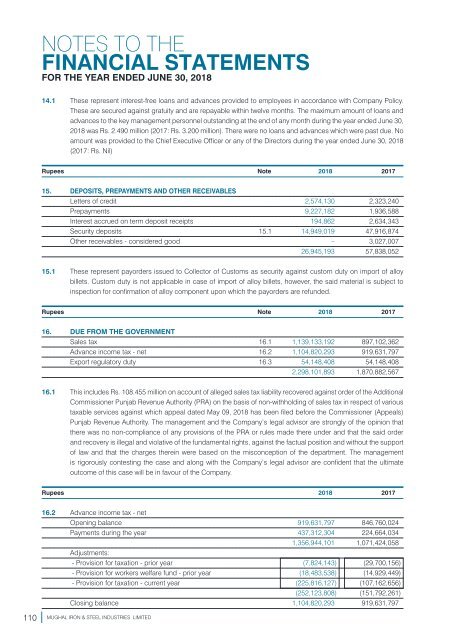

15. DEPOSITS, PREPAYMENTS AND OTHER RECEIVABLES<br />

Letters of credit 2,574,130 2,323,240<br />

Prepayments 9,227,182 1,936,588<br />

Interest accrued on term deposit receipts 194,862 2,634,343<br />

Security deposits 15.1 14,949,019 47,916,874<br />

Other receivables - considered good – 3,027,007<br />

26,945,193 57,838,052<br />

15.1 These represent payorders issued to Collector of Customs as security against custom duty on import of alloy<br />

billets. Custom duty is not applicable in case of import of alloy billets, however, the said material is subject to<br />

inspection for confirmation of alloy component upon which the payorders are refunded.<br />

Rupees Note <strong>2018</strong> 2017<br />

16. DUE FROM THE GOVERNMENT<br />

Sales tax 16.1 1,139,133,192 897,102,362<br />

Advance income tax - net 16.2 1,104,820,293 919,631,797<br />

Export regulatory duty 16.3 54,148,408 54,148,408<br />

2,298,101,893 1,870,882,567<br />

16.1 This includes Rs. 108.455 million on account of alleged sales tax liability recovered against order of the Additional<br />

Commissioner Punjab Revenue Authority (PRA) on the basis of non-withholding of sales tax in respect of various<br />

taxable services against which appeal dated May 09, <strong>2018</strong> has been filed before the Commissioner (Appeals)<br />

Punjab Revenue Authority. The management and the Company’s legal advisor are strongly of the opinion that<br />

there was no non-compliance of any provisions of the PRA or rules made there under and that the said order<br />

and recovery is illegal and violative of the fundamental rights, against the factual position and without the support<br />

of law and that the charges therein were based on the misconception of the department. The management<br />

is rigorously contesting the case and along with the Company’s legal advisor are confident that the ultimate<br />

outcome of this case will be in favour of the Company.<br />

Rupees <strong>2018</strong> 2017<br />

16.2 Advance income tax - net<br />

Opening balance 919,631,797 846,760,024<br />

Payments during the year 437,312,304 224,664,034<br />

1,356,944,101 1,071,424,058<br />

Adjustments:<br />

- Provision for taxation - prior year (7,824,143) (29,700,156)<br />

- Provision for workers welfare fund - prior year (18,483,538) (14,929,449)<br />

- Provision for taxation - current year (225,816,127) (107,162,656)<br />

(252,123,808) (151,792,261)<br />

Closing balance 1,104,820,293 919,631,797<br />

110 MUGHAL IRON & STEEL INDUSTRIES LIMITED