Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

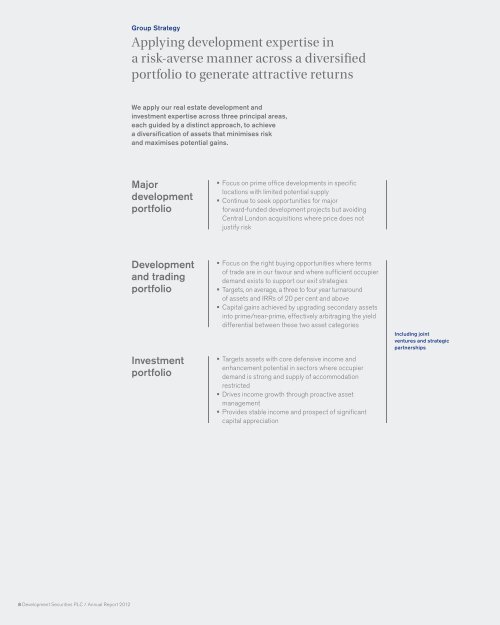

Group Strategy<br />

Applying development expertise in<br />

a risk-averse manner across a diversified<br />

portfolio to generate attractive returns<br />

We apply our real estate development and<br />

investment expertise across three principal areas,<br />

each guided by a distinct approach, to achieve<br />

a diversification of assets that minimises risk<br />

and maximises potential gains.<br />

Major<br />

development<br />

portfolio<br />

<strong>Development</strong><br />

and trading<br />

portfolio<br />

Investment<br />

portfolio<br />

Focus on prime office developments in specific<br />

locations with limited potential supply<br />

Continue to seek opportunities for major<br />

forward-funded development projects but avoiding<br />

Central London acquisitions where price does not<br />

justify risk<br />

Focus on the right buying opportunities where terms<br />

of trade are in our favour and where sufficient occupier<br />

demand exists to support our exit strategies<br />

Targets, on average, a three to four year turnaround<br />

of assets and IRRs of 20 per cent and above<br />

Capital gains achieved by upgrading secondary assets<br />

into prime/near-prime, effectively arbitraging the yield<br />

differential between these two asset categories<br />

Targets assets with core defensive income and<br />

enhancement potential in sectors where occupier<br />

demand is strong and supply of accommodation<br />

restricted<br />

Drives income growth through proactive asset<br />

management<br />

Provides stable income and prospect of significant<br />

capital appreciation<br />

Including joint<br />

ventures and strategic<br />

partnerships