Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements continued<br />

Notes to the Consolidated Financial Statements continued<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

18 Financial assets and financial liabilities continued<br />

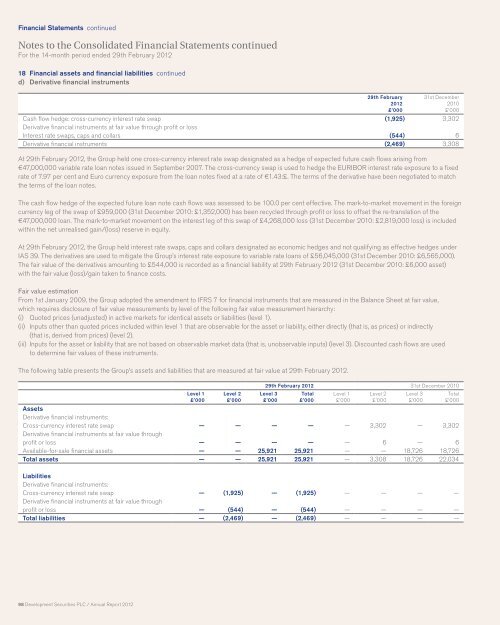

d) Derivative financial instruments<br />

98 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Cash flow hedge: cross-currency interest rate swap (1,925) 3,302<br />

Derivative financial instruments at fair value through profit or loss<br />

Interest rate swaps, caps and collars (544) 6<br />

Derivative financial instruments (2,469) 3,308<br />

At 29th February <strong>2012</strong>, the Group held one cross-currency interest rate swap designated as a hedge of expected future cash flows arising from<br />

€47,000,000 variable rate loan notes issued in September 2007. The cross-currency swap is used to hedge the EURIBOR interest rate exposure to a fixed<br />

rate of 7.97 per cent and Euro currency exposure from the loan notes fixed at a rate of €1.43:£. The terms of the derivative have been negotiated to match<br />

the terms of the loan notes.<br />

The cash flow hedge of the expected future loan note cash flows was assessed to be 100.0 per cent effective. The mark-to-market movement in the foreign<br />

currency leg of the swap of £959,000 (31st December 2010: £1,352,000) has been recycled through profit or loss to offset the re-translation of the<br />

€47,000,000 loan. The mark-to-market movement on the interest leg of this swap of £4,268,000 loss (31st December 2010: £2,819,000 loss) is included<br />

within the net unrealised gain/(loss) reserve in equity.<br />

At 29th February <strong>2012</strong>, the Group held interest rate swaps, caps and collars designated as economic hedges and not qualifying as effective hedges under<br />

IAS 39. The derivatives are used to mitigate the Group’s interest rate exposure to variable rate loans of £56,045,000 (31st December 2010: £6,565,000).<br />

The fair value of the derivatives amounting to £544,000 is recorded as a financial liability at 29th February <strong>2012</strong> (31st December 2010: £6,000 asset)<br />

with the fair value (loss)/gain taken to finance costs.<br />

Fair value estimation<br />

From 1st January 2009, the Group adopted the amendment to IFRS 7 for financial instruments that are measured in the Balance Sheet at fair value,<br />

which requires disclosure of fair value measurements by level of the following fair value measurement hierarchy:<br />

(i) Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).<br />

(ii) Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly<br />

(that is, derived from prices) (level 2).<br />

(iii) Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (level 3). Discounted cash flows are used<br />

to determine fair values of these instruments.<br />

The following table presents the Group’s assets and liabilities that are measured at fair value at 29th February <strong>2012</strong>.<br />

Level 1<br />

£’000<br />

Level 2<br />

£’000<br />

29th February <strong>2012</strong> 31st December 2010<br />

Assets<br />

Derivative financial instruments:<br />

Cross-currency interest rate swap — — — — — 3,302 — 3,302<br />

Derivative financial instruments at fair value through<br />

profit or loss — — — — — 6 — 6<br />

Available-for-sale financial assets — — 25,921 25,921 — — 18,726 18,726<br />

Total assets — — 25,921 25,921 — 3,308 18,726 22,034<br />

Liabilities<br />

Derivative financial instruments:<br />

Cross-currency interest rate swap — (1,925) — (1,925) — — — —<br />

Derivative financial instruments at fair value through<br />

profit or loss — (544) — (544) — — — —<br />

Total liabilities — (2,469) — (2,469) — — — —<br />

Level 3<br />

£’000<br />

Total<br />

£’000<br />

Level 1<br />

£’000<br />

Level 2<br />

£’000<br />

Level 3<br />

£’000<br />

Total<br />

£’000