Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In addition, the Committee must be satisfied that there has been a sustained<br />

improvement in the Company’s underlying financial performance over the<br />

performance period (typically by considering the change in net asset value).<br />

For awards from 2010, a risk underpin (as previously described) will also apply.<br />

On 22nd March 2011, awards were made under the Performance Share Plan<br />

to M H Marx of 130,862 shares in the Company, representing 75.0 per cent<br />

of salary, and to C J Barwick, M S Weiner and G Prothero of 70,883 shares,<br />

each representing 50.0 per cent of salary. In total, 624,508 shares were,<br />

at the discretion of the Committee, awarded to 33 employees and the four<br />

Executive Directors.<br />

Following feedback from shareholders the Committee determined that for<br />

the <strong>2012</strong> award a wider range of performance measures should be used.<br />

The performance condition for the <strong>2012</strong> award will be as follows:<br />

Proportion Threshold<br />

of the vesting<br />

Performance measure<br />

Relative TSR against the constituents<br />

of the FTSE Real Estate Investment<br />

Trust Index and the FTSE Real Estate<br />

award (%) (25%)<br />

Investment Services Index 50% Median<br />

RPI+3%<br />

NAV per share growth 50% per annum<br />

Maximum<br />

vesting<br />

(100%)<br />

85th<br />

Percentile<br />

RPI+10%<br />

per annum<br />

Pro-rating vesting will apply between points. The underpins described above<br />

will also apply.<br />

The performance condition under the award made on 8th May 2009 has<br />

now been assessed and the award did not vest.<br />

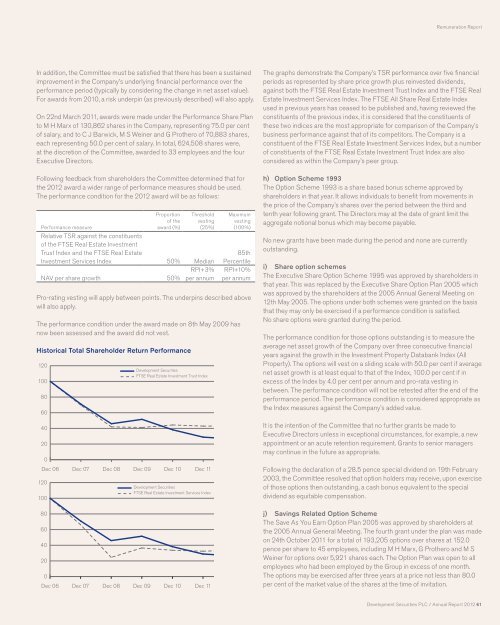

Historical Total Shareholder Return Performance<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

<strong>Development</strong> <strong>Securities</strong><br />

FTSE Real Estate Investment Trust Index<br />

<strong>Development</strong> <strong>Securities</strong><br />

FTSE Real Estate Investment Services Index<br />

0<br />

Dec 06 Dec 07 Dec 08 Dec 09 Dec 10 Dec 11 Dec 12<br />

Remuneration <strong>Report</strong><br />

The graphs demonstrate the Company’s TSR performance over five financial<br />

periods as represented by share price growth plus reinvested dividends,<br />

against both the FTSE Real Estate Investment Trust Index and the FTSE Real<br />

Estate Investment Services Index. The FTSE All Share Real Estate Index<br />

used in previous years has ceased to be published and, having reviewed the<br />

constituents of the previous index, it is considered that the constituents of<br />

these two indices are the most appropriate for comparison of the Company’s<br />

business performance against that of its competitors. The Company is a<br />

constituent of the FTSE Real Estate Investment Services Index, but a number<br />

of constituents of the FTSE Real Estate Investment Trust Index are also<br />

considered as within the Company’s peer group.<br />

h) Option Scheme 1993<br />

The Option Scheme 1993 is a share based bonus scheme approved by<br />

shareholders in that year. It allows individuals to benefit from movements in<br />

the price of the Company’s shares over the period between the third and<br />

tenth year following grant. The Directors may at the date of grant limit the<br />

aggregate notional bonus which may become payable.<br />

No new grants have been made during the period and none are currently<br />

outstanding.<br />

i) Share option schemes<br />

The Executive Share Option Scheme 1995 was approved by shareholders in<br />

that year. This was replaced by the Executive Share Option Plan 2005 which<br />

was approved by the shareholders at the 2005 <strong>Annual</strong> General Meeting on<br />

12th May 2005. The options under both schemes were granted on the basis<br />

that they may only be exercised if a performance condition is satisfied.<br />

No share options were granted during the period.<br />

The performance condition for those options outstanding is to measure the<br />

average net asset growth of the Company over three consecutive financial<br />

years against the growth in the Investment Property Databank Index (All<br />

Property). The options will vest on a sliding scale with 50.0 per cent if average<br />

net asset growth is at least equal to that of the Index, 100.0 per cent if in<br />

excess of the Index by 4.0 per cent per annum and pro-rata vesting in<br />

between. The performance condition will not be retested after the end of the<br />

performance period. The performance condition is considered appropriate as<br />

the Index measures against the Company’s added value.<br />

It is the intention of the Committee that no further grants be made to<br />

Executive Directors unless in exceptional circumstances, for example, a new<br />

appointment or an acute retention requirement. Grants to senior managers<br />

may continue in the future as appropriate.<br />

Following the declaration of a 28.5 pence special dividend on 19th February<br />

2003, the Committee resolved that option holders may receive, upon exercise<br />

of those options then outstanding, a cash bonus equivalent to the special<br />

dividend as equitable compensation.<br />

j) Savings Related Option Scheme<br />

The Save As You Earn Option Plan 2005 was approved by shareholders at<br />

the 2005 <strong>Annual</strong> General Meeting. The fourth grant under the plan was made<br />

on 24th October 2011 for a total of 193,205 options over shares at 152.0<br />

pence per share to 45 employees, including M H Marx, G Prothero and M S<br />

Weiner for options over 5,921 shares each. The Option Plan was open to all<br />

employees who had been employed by the Group in excess of one month.<br />

The options may be exercised after three years at a price not less than 80.0<br />

per cent of the market value of the shares at the time of invitation.<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 61