Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

Included in the above amounts are projects stated at net realisable value, being development and trading properties of £48,959,000 (31st December 2010:<br />

£42,947,000).<br />

Net realisable value has been estimated by the Directors, taking account of our plans for each project, the planning status and competitive position of each<br />

asset, and the anticipated market for the scheme. For material developments the Directors have consulted with third party chartered surveyors in setting<br />

their market assumptions.<br />

Weeke Local Centre, Winchester, a property previously constructed by the Group for sale, has been transferred to investment assets in the period. It is the<br />

Group’s intention to hold the asset for income and long-term capital appreciation. Capitalised interest of £521,000 has been transferred with the asset.<br />

Interest of £665,000 (31st December 2010: £nil) was capitalised on development and trading properties during the period. Capitalised interest included<br />

within the carrying value of such properties on the Balance Sheet is £759,000 (31st December 2010: £615,000).<br />

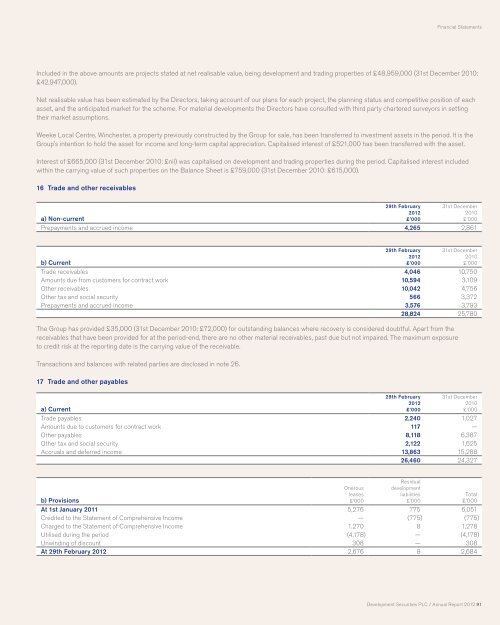

16 Trade and other receivables<br />

29th February 31st December<br />

a) Non-current<br />

<strong>2012</strong><br />

£’000<br />

2010<br />

£’000<br />

Prepayments and accrued income 4,265 2,861<br />

b) Current<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Trade receivables 4,046 10,750<br />

Amounts due from customers for contract work 10,594 3,109<br />

Other receivables 10,042 4,756<br />

Other tax and social security 566 3,372<br />

Prepayments and accrued income 3,576 3,793<br />

28,824 25,780<br />

The Group has provided £35,000 (31st December 2010: £72,000) for outstanding balances where recovery is considered doubtful. Apart from the<br />

receivables that have been provided for at the period-end, there are no other material receivables, past due but not impaired. The maximum exposure<br />

to credit risk at the reporting date is the carrying value of the receivable.<br />

Transactions and balances with related parties are disclosed in note 26.<br />

17 Trade and other payables<br />

a) Current<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Trade payables 2,240 1,027<br />

Amounts due to customers for contract work 117 —<br />

Other payables 8,118 6,387<br />

Other tax and social security 2,122 1,625<br />

Accruals and deferred income 13,863 15,288<br />

26,460 24,327<br />

b) Provisions<br />

Onerous<br />

leases<br />

£’000<br />

Residual<br />

development<br />

liabilities<br />

£’000<br />

At 1st January 2011 5,276 775 6,051<br />

Credited to the Statement of Comprehensive Income — (775) (775)<br />

Charged to the Statement of Comprehensive Income 1,270 8 1,278<br />

Utilised during the period (4,178) — (4,178)<br />

Unwinding of discount 308 — 308<br />

At 29th February <strong>2012</strong> 2,676 8 2,684<br />

Total<br />

£’000<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 91