Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

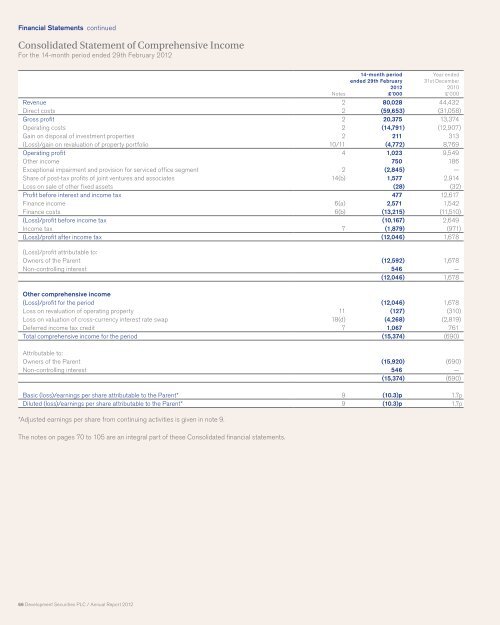

Financial Statements continued<br />

Consolidated Statement of Comprehensive Income<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

66 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

Revenue 2 80,028 44,432<br />

Direct costs 2 (59,653) (31,058)<br />

Gross profit 2 20,375 13,374<br />

Operating costs 2 (14,791) (12,907)<br />

Gain on disposal of investment properties 2 211 313<br />

(Loss)/gain on revaluation of property portfolio 10/11 (4,772) 8,769<br />

Operating profit 4 1,023 9,549<br />

Other income 750 186<br />

Exceptional impairment and provision for serviced office segment 2 (2,845) —<br />

Share of post-tax profits of joint ventures and associates 14(b) 1,577 2,914<br />

Loss on sale of other fixed assets (28) (32)<br />

Profit before interest and income tax 477 12,617<br />

Finance income 6(a) 2,571 1,542<br />

Finance costs 6(b) (13,215) (11,510)<br />

(Loss)/profit before income tax (10,167) 2,649<br />

Income tax 7 (1,879) (971)<br />

(Loss)/profit after income tax (12,046) 1,678<br />

(Loss)/profit attributable to:<br />

Owners of the Parent (12,592) 1,678<br />

Non-controlling interest 546 —<br />

(12,046) 1,678<br />

Other comprehensive income<br />

(Loss)/profit for the period (12,046) 1,678<br />

Loss on revaluation of operating property 11 (127) (310)<br />

Loss on valuation of cross-currency interest rate swap 18(d) (4,268) (2,819)<br />

Deferred income tax credit 7 1,067 761<br />

Total comprehensive income for the period (15,374) (690)<br />

Attributable to:<br />

Owners of the Parent (15,920) (690)<br />

Non-controlling interest 546 —<br />

(15,374) (690)<br />

Basic (loss)/earnings per share attributable to the Parent* 9 (10.3)p 1.7p<br />

Diluted (loss)/earnings per share attributable to the Parent* 9 (10.3)p 1.7p<br />

*Adjusted earnings per share from continuing activities is given in note 9.<br />

The notes on pages 70 to 105 are an integral part of these Consolidated financial statements.