Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

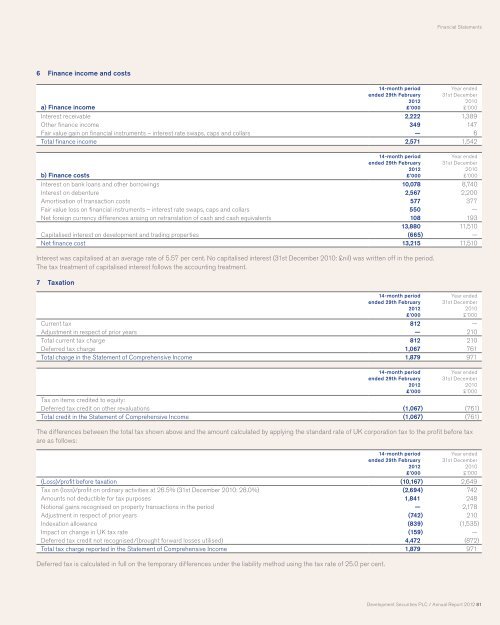

6 Finance income and costs<br />

a) Finance income<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Financial Statements<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

Interest receivable 2,222 1,389<br />

Other finance income 349 147<br />

Fair value gain on financial instruments – interest rate swaps, caps and collars — 6<br />

Total finance income 2,571 1,542<br />

b) Finance costs<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

Interest on bank loans and other borrowings 10,078 8,740<br />

Interest on debenture 2,567 2,200<br />

Amortisation of transaction costs 577 377<br />

Fair value loss on financial instruments – interest rate swaps, caps and collars 550 —<br />

Net foreign currency differences arising on retranslation of cash and cash equivalents 108 193<br />

13,880 11,510<br />

Capitalised interest on development and trading properties (665) —<br />

Net finance cost 13,215 11,510<br />

Interest was capitalised at an average rate of 5.57 per cent. No capitalised interest (31st December 2010: £nil) was written off in the period.<br />

The tax treatment of capitalised interest follows the accounting treatment.<br />

7 Taxation<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

Current tax 812 —<br />

Adjustment in respect of prior years — 210<br />

Total current tax charge 812 210<br />

Deferred tax charge 1,067 761<br />

Total charge in the Statement of Comprehensive Income 1,879 971<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

Tax on items credited to equity:<br />

Deferred tax credit on other revaluations (1,067) (761)<br />

Total credit in the Statement of Comprehensive Income (1,067) (761)<br />

The differences between the total tax shown above and the amount calculated by applying the standard rate of UK corporation tax to the profit before tax<br />

are as follows:<br />

14-month period<br />

ended 29th February<br />

<strong>2012</strong><br />

£’000<br />

Year ended<br />

31st December<br />

2010<br />

£’000<br />

(Loss)/profit before taxation (10,167) 2,649<br />

Tax on (loss)/profit on ordinary activities at 26.5% (31st December 2010: 28.0%) (2,694) 742<br />

Amounts not deductible for tax purposes 1,841 248<br />

Notional gains recognised on property transactions in the period — 2,178<br />

Adjustment in respect of prior years (742) 210<br />

Indexation allowance (839) (1,535)<br />

Impact on change in UK tax rate (159) —<br />

Deferred tax credit not recognised/(brought forward losses utilised) 4,472 (872)<br />

Total tax charge reported in the Statement of Comprehensive Income 1,879 971<br />

Deferred tax is calculated in full on the temporary differences under the liability method using the tax rate of 25.0 per cent.<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 81