Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

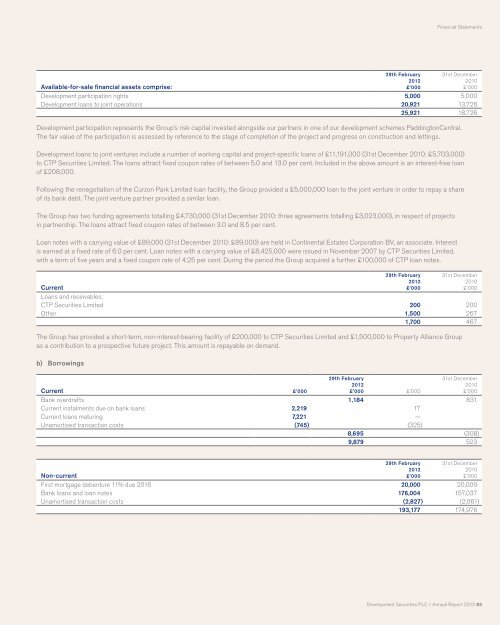

Available-for-sale financial assets comprise:<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

Financial Statements<br />

31st December<br />

2010<br />

£’000<br />

<strong>Development</strong> participation rights 5,000 5,000<br />

<strong>Development</strong> loans to joint operations 20,921 13,726<br />

25,921 18,726<br />

<strong>Development</strong> participation represents the Group’s risk capital invested alongside our partners in one of our development schemes PaddingtonCentral.<br />

The fair value of the participation is assessed by reference to the stage of completion of the project and progress on construction and lettings.<br />

<strong>Development</strong> loans to joint ventures include a number of working capital and project-specific loans of £11,191,000 (31st December 2010: £5,703,000)<br />

to CTP <strong>Securities</strong> Limited. The loans attract fixed coupon rates of between 5.0 and 13.0 per cent. Included in the above amount is an interest-free loan<br />

of £208,000.<br />

Following the renegotiation of the Curzon Park Limited loan facility, the Group provided a £5,000,000 loan to the joint venture in order to repay a share<br />

of its bank debt. The joint venture partner provided a similar loan.<br />

The Group has two funding agreements totalling £4,730,000 (31st December 2010: three agreements totalling £3,023,000), in respect of projects<br />

in partnership. The loans attract fixed coupon rates of between 3.0 and 8.5 per cent.<br />

Loan notes with a carrying value of £89,000 (31st December 2010: £89,000) are held in Continental Estates Corporation BV, an associate. Interest<br />

is earned at a fixed rate of 6.0 per cent. Loan notes with a carrying value of £8,425,000 were issued in November 2007 by CTP <strong>Securities</strong> Limited,<br />

with a term of five years and a fixed coupon rate of 4.25 per cent. During the period the Group acquired a further £100,000 of CTP loan notes.<br />

Current<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Loans and receivables:<br />

CTP <strong>Securities</strong> Limited 200 200<br />

Other 1,500 267<br />

1,700 467<br />

The Group has provided a short-term, non-interest-bearing facility of £200,000 to CTP <strong>Securities</strong> Limited and £1,500,000 to Property Alliance Group<br />

as a contribution to a prospective future project. This amount is repayable on demand.<br />

b) Borrowings<br />

Current £’000<br />

29th February<br />

<strong>2012</strong><br />

£’000 £’000<br />

31st December<br />

2010<br />

£’000<br />

Bank overdrafts 1,184 831<br />

Current instalments due on bank loans 2,219 17<br />

Current loans maturing 7,221 —<br />

Unamortised transaction costs (745) (325)<br />

8,695 (308)<br />

9,879 523<br />

Non-current<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

First mortgage debenture 11% due 2016 20,000 20,000<br />

Bank loans and loan notes 176,004 157,037<br />

Unamortised transaction costs (2,827) (2,061)<br />

193,177 174,976<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 93