Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements continued<br />

Notes to the Consolidated Financial Statements continued<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

10 Investment properties continued<br />

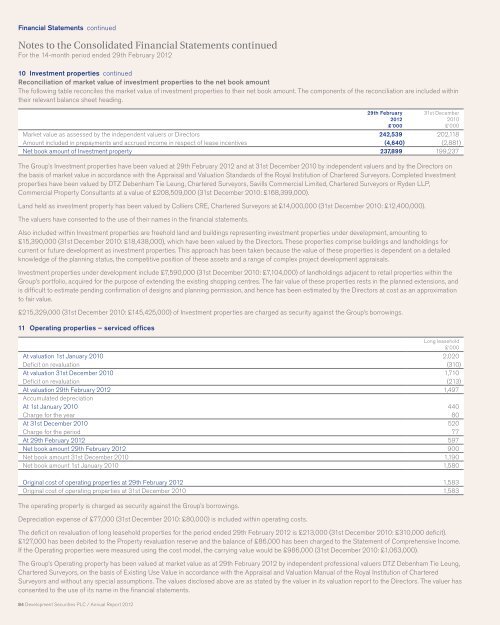

Reconciliation of market value of investment properties to the net book amount<br />

The following table reconciles the market value of investment properties to their net book amount. The components of the reconciliation are included within<br />

their relevant balance sheet heading.<br />

84 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Market value as assessed by the independent valuers or Directors 242,539 202,118<br />

Amount included in prepayments and accrued income in respect of lease incentives (4,640) (2,881)<br />

Net book amount of Investment property 237,899 199,237<br />

The Group’s Investment properties have been valued at 29th February <strong>2012</strong> and at 31st December 2010 by independent valuers and by the Directors on<br />

the basis of market value in accordance with the Appraisal and Valuation Standards of the Royal Institution of Chartered Surveyors. Completed Investment<br />

properties have been valued by DTZ Debenham Tie Leung, Chartered Surveyors, Savills Commercial Limited, Chartered Surveyors or Ryden LLP,<br />

Commercial Property Consultants at a value of £208,509,000 (31st December 2010: £168,399,000).<br />

Land held as investment property has been valued by Colliers CRE, Chartered Surveyors at £14,000,000 (31st December 2010: £12,400,000).<br />

The valuers have consented to the use of their names in the financial statements.<br />

Also included within Investment properties are freehold land and buildings representing investment properties under development, amounting to<br />

£15,390,000 (31st December 2010: £18,438,000), which have been valued by the Directors. These properties comprise buildings and landholdings for<br />

current or future development as investment properties. This approach has been taken because the value of these properties is dependent on a detailed<br />

knowledge of the planning status, the competitive position of these assets and a range of complex project development appraisals.<br />

Investment properties under development include £7,590,000 (31st December 2010: £7,104,000) of landholdings adjacent to retail properties within the<br />

Group’s portfolio, acquired for the purpose of extending the existing shopping centres. The fair value of these properties rests in the planned extensions, and<br />

is difficult to estimate pending confirmation of designs and planning permission, and hence has been estimated by the Directors at cost as an approximation<br />

to fair value.<br />

£215,329,000 (31st December 2010: £145,425,000) of Investment properties are charged as security against the Group’s borrowings.<br />

11 Operating properties – serviced offices<br />

Long leasehold<br />

£’000<br />

At valuation 1st January 2010 2,020<br />

Deficit on revaluation (310)<br />

At valuation 31st December 2010 1,710<br />

Deficit on revaluation (213)<br />

At valuation 29th February <strong>2012</strong> 1,497<br />

Accumulated depreciation<br />

At 1st January 2010 440<br />

Charge for the year 80<br />

At 31st December 2010 520<br />

Charge for the period 77<br />

At 29th February <strong>2012</strong> 597<br />

Net book amount 29th February <strong>2012</strong> 900<br />

Net book amount 31st December 2010 1,190<br />

Net book amount 1st January 2010 1,580<br />

Original cost of operating properties at 29th February <strong>2012</strong> 1,583<br />

Original cost of operating properties at 31st December 2010 1,583<br />

The operating property is charged as security against the Group’s borrowings.<br />

Depreciation expense of £77,000 (31st December 2010: £80,000) is included within operating costs.<br />

The deficit on revaluation of long leasehold properties for the period ended 29th February <strong>2012</strong> is £213,000 (31st December 2010: £310,000 deficit).<br />

£127,000 has been debited to the Property revaluation reserve and the balance of £86,000 has been charged to the Statement of Comprehensive Income.<br />

If the Operating properties were measured using the cost model, the carrying value would be £986,000 (31st December 2010: £1,063,000).<br />

The Group’s Operating property has been valued at market value as at 29th February <strong>2012</strong> by independent professional valuers DTZ Debenham Tie Leung,<br />

Chartered Surveyors, on the basis of Existing Use Value in accordance with the Appraisal and Valuation Manual of the Royal Institution of Chartered<br />

Surveyors and without any special assumptions. The values disclosed above are as stated by the valuer in its valuation report to the Directors. The valuer has<br />

consented to the use of its name in the financial statements.