Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Remuneration <strong>Report</strong> continued<br />

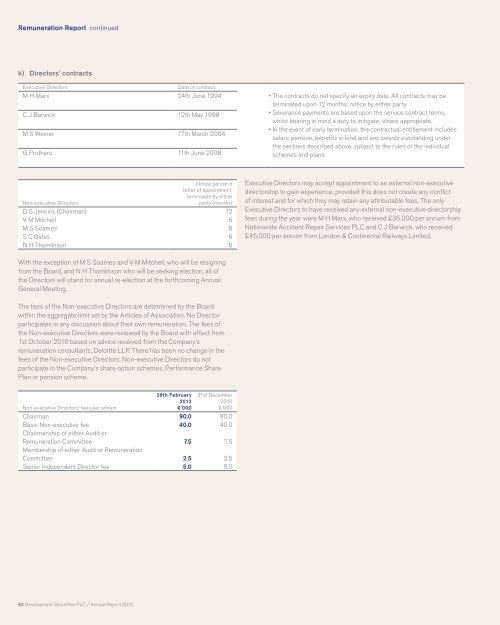

k) Directors’ contracts<br />

Executive Directors Date of contract<br />

M H Marx 24th June 1994 • The contracts do not specify an expiry date. All contracts may be<br />

terminated upon 12 months’ notice by either party.<br />

C J Barwick 12th May 1998<br />

• Severance payments are based upon the service contract terms,<br />

whilst bearing in mind a duty to mitigate, where appropriate.<br />

M S Weiner 17th March 2004<br />

• In the event of early termination, the contractual entitlement includes<br />

salary, pension, benefits in kind and any awards outstanding under<br />

the sections described above, subject to the rules of the individual<br />

G Prothero 11th June 2008<br />

schemes and plans.<br />

Non-executive Directors<br />

Notice period in<br />

letter of appointment,<br />

terminable by either<br />

party (months)<br />

D S Jenkins (Chairman) 12<br />

V M Mitchell 6<br />

M S Soames 6<br />

S C Bates 6<br />

N H Thomlinson 6<br />

With the exception of M S Soames and V M Mitchell, who will be resigning<br />

from the Board, and N H Thomlinson who will be seeking election, all of<br />

the Directors will stand for annual re-election at the forthcoming <strong>Annual</strong><br />

General Meeting.<br />

The fees of the Non-executive Directors are determined by the Board<br />

within the aggregate limit set by the Articles of Association. No Director<br />

participates in any discussion about their own remuneration. The fees of<br />

the Non-executive Directors were reviewed by the Board with effect from<br />

1st October 2010 based on advice received from the Company’s<br />

remuneration consultants, Deloitte LLP. There has been no change in the<br />

fees of the Non-executive Directors. Non-executive Directors do not<br />

participate in the Company’s share option schemes, Performance Share<br />

Plan or pension scheme.<br />

Non-executive Directors’ fees per annum<br />

62 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Chairman 90.0 90.0<br />

Basic Non-executive fee 40.0 40.0<br />

Chairmanship of either Audit or<br />

Remuneration Committee 7.5 7.5<br />

Membership of either Audit or Remuneration<br />

Committee 2.5 2.5<br />

Senior Independent Director fee 5.0 5.0<br />

Executive Directors may accept appointment to an external non-executive<br />

directorship to gain experience, provided this does not create any conflict<br />

of interest and for which they may retain any attributable fees. The only<br />

Executive Directors to have received any external non-executive directorship<br />

fees during the year were M H Marx, who received £35,000 per annum from<br />

Nationwide Accident Repair Services <strong>PLC</strong> and C J Barwick, who received<br />

£45,000 per annum from London & Continental Railways Limited.