Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements continued<br />

Notes to the Consolidated Financial Statements continued<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

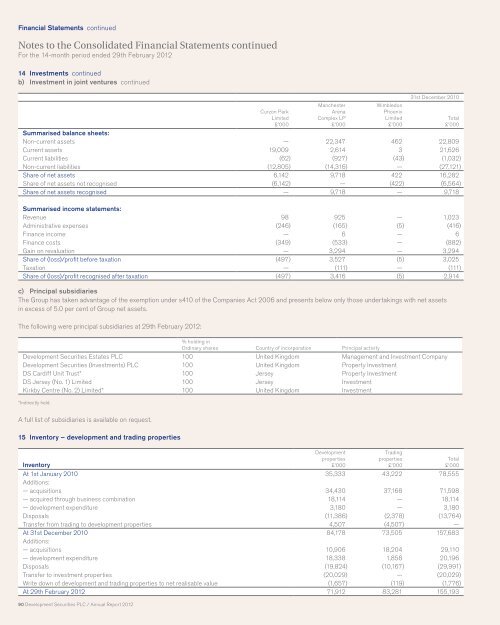

14 Investments continued<br />

b) Investment in joint ventures continued<br />

90 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Curzon Park<br />

Limited<br />

£’000<br />

Manchester<br />

Arena<br />

Complex LP<br />

£’000<br />

Wimbledon<br />

Phoenix<br />

Limited<br />

£’000<br />

31st December 2010<br />

Summarised balance sheets:<br />

Non-current assets — 22,347 462 22,809<br />

Current assets 19,009 2,614 3 21,626<br />

Current liabilities (62) (927) (43) (1,032)<br />

Non-current liabilities (12,805) (14,316) — (27,121)<br />

Share of net assets 6,142 9,718 422 16,282<br />

Share of net assets not recognised (6,142) — (422) (6,564)<br />

Share of net assets recognised — 9,718 — 9,718<br />

Summarised income statements:<br />

Revenue 98 925 — 1,023<br />

Administrative expenses (246) (165) (5) (416)<br />

Finance income — 6 — 6<br />

Finance costs (349) (533) — (882)<br />

Gain on revaluation — 3,294 — 3,294<br />

Share of (loss)/profit before taxation (497) 3,527 (5) 3,025<br />

Taxation — (111) — (111)<br />

Share of (loss)/profit recognised after taxation (497) 3,416 (5) 2,914<br />

c) Principal subsidiaries<br />

The Group has taken advantage of the exemption under s410 of the Companies Act 2006 and presents below only those undertakings with net assets<br />

in excess of 5.0 per cent of Group net assets.<br />

The following were principal subsidiaries at 29th February <strong>2012</strong>:<br />

% holding in<br />

Ordinary shares Country of incorporation Principal activity<br />

<strong>Development</strong> <strong>Securities</strong> Estates <strong>PLC</strong> 100 United Kingdom Management and Investment Company<br />

<strong>Development</strong> <strong>Securities</strong> (Investments) <strong>PLC</strong> 100 United Kingdom Property Investment<br />

DS Cardiff Unit Trust* 100 Jersey Property Investment<br />

DS Jersey (No. 1) Limited 100 Jersey Investment<br />

Kirkby Centre (No. 2) Limited* 100 United Kingdom Investment<br />

*Indirectly held.<br />

A full list of subsidiaries is available on request.<br />

15 Inventory – development and trading properties<br />

Inventory<br />

<strong>Development</strong><br />

properties<br />

£’000<br />

Trading<br />

properties<br />

£’000<br />

At 1st January 2010 35,333 43,222 78,555<br />

Additions:<br />

— acquisitions 34,430 37,168 71,598<br />

— acquired through business combination 18,114 — 18,114<br />

— development expenditure 3,180 — 3,180<br />

Disposals (11,386) (2,378) (13,764)<br />

Transfer from trading to development properties 4,507 (4,507) —<br />

At 31st December 2010 84,178 73,505 157,683<br />

Additions:<br />

— acquisitions 10,906 18,204 29,110<br />

— development expenditure 18,338 1,858 20,196<br />

Disposals (19,824) (10,167) (29,991)<br />

Transfer to investment properties (20,029) — (20,029)<br />

Write down of development and trading properties to net realisable value (1,657) (119) (1,776)<br />

At 29th February <strong>2012</strong> 71,912 83,281 155,193<br />

Total<br />

£’000<br />

Total<br />

£’000