Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

£38,000,000 variable rate loan<br />

£2,700,000 loan capital amortises over the term of the loan. The remaining £35,213,000 is repayable in one instalment on 16th December 2016.<br />

The current balance outstanding on the facility is £37,913,000.<br />

£57,565,000 fixed rate loan<br />

£25,665,000 loan capital amortises over the term of the loan. The remaining £31,900,000 is repayable in one instalment on 12th March 2025.<br />

The current balance outstanding on the facility is £56,128,000.<br />

£22,470,000 fixed rate loan<br />

£9,980,000 loan capital amortises over the term of the loan. The remaining £12,490,000 is repayable in one instalment on 12th March 2025.<br />

The current balance outstanding on the facility is £22,176,000.<br />

€47,000,000 variable EURIBOR loan notes<br />

These unsecured loan notes were issued on 20th September 2007 and are denominated in Euros. They are repayable on 25th October 2027.<br />

£16,500 loan notes<br />

These unsecured loan notes were repayable in 1999. The balance of £16,500 represents the residual amount of unredeemed loan notes.<br />

A full explanation of the Group’s borrowings and any changes since the balance sheet date can be found in the Financial Review on pages 36 to 44.<br />

Financial Statements<br />

c) Financial risk management<br />

The Group’s activities expose it to a variety of financial risks: market risk (including cash flow interest rate risk, foreign currency risk, fair value interest rate<br />

risk and price risk), credit risk and liquidity risk. The Group’s overall risk management focuses on the unpredictability of financial markets and seeks to<br />

minimise potential adverse effects on the Group’s financial performance.<br />

The Group defines capital as total equity and monitors this on the basis of gearing.<br />

The nature and extent of the Group’s financial risks, and the Directors’ approach to managing those risks, are described in the Financial Review on pages 39<br />

to 40 and below. This note provides further detailed information on these risks.<br />

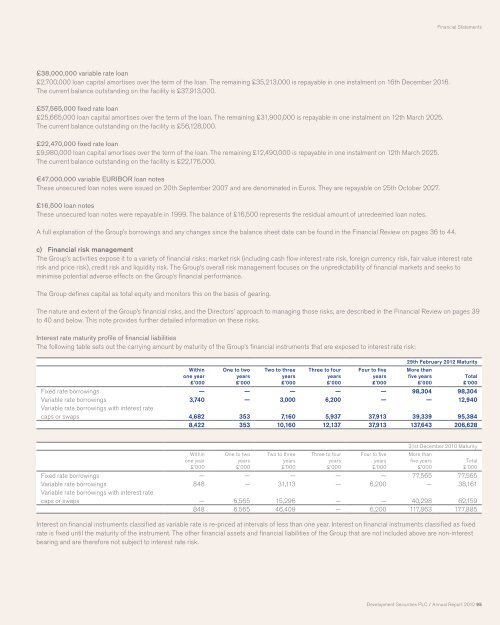

Interest rate maturity profile of financial liabilities<br />

The following table sets out the carrying amount by maturity of the Group’s financial instruments that are exposed to interest rate risk:<br />

Within<br />

one year<br />

£’000<br />

One to two<br />

years<br />

£’000<br />

Two to three<br />

years<br />

£’000<br />

Three to four<br />

years<br />

£’000<br />

Four to five<br />

years<br />

£’000<br />

29th February <strong>2012</strong> Maturity<br />

More than<br />

five years<br />

£’000<br />

Fixed rate borrowings — — — — — 98,304 98,304<br />

Variable rate borrowings 3,740 — 3,000 6,200 — — 12,940<br />

Variable rate borrowings with interest rate<br />

caps or swaps 4,682 353 7,160 5,937 37,913 39,339 95,384<br />

8,422 353 10,160 12,137 37,913 137,643 206,628<br />

Within<br />

one year<br />

£’000<br />

One to two<br />

years<br />

£’000<br />

Two to three<br />

years<br />

£’000<br />

Three to four<br />

years<br />

£’000<br />

Four to five<br />

years<br />

£’000<br />

Total<br />

£’000<br />

31st December 2010 Maturity<br />

More than<br />

five years<br />

£’000<br />

Fixed rate borrowings — — — — — 77,565 77,565<br />

Variable rate borrowings 848 — 31,113 — 6,200 — 38,161<br />

Variable rate borrowings with interest rate<br />

caps or swaps — 6,565 15,296 — — 40,298 62,159<br />

848 6,565 46,409 — 6,200 117,863 177,885<br />

Interest on financial instruments classified as variable rate is re-priced at intervals of less than one year. Interest on financial instruments classified as fixed<br />

rate is fixed until the maturity of the instrument. The other financial assets and financial liabilities of the Group that are not included above are non-interest<br />

bearing and are therefore not subject to interest rate risk.<br />

Total<br />

£’000<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 95