Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

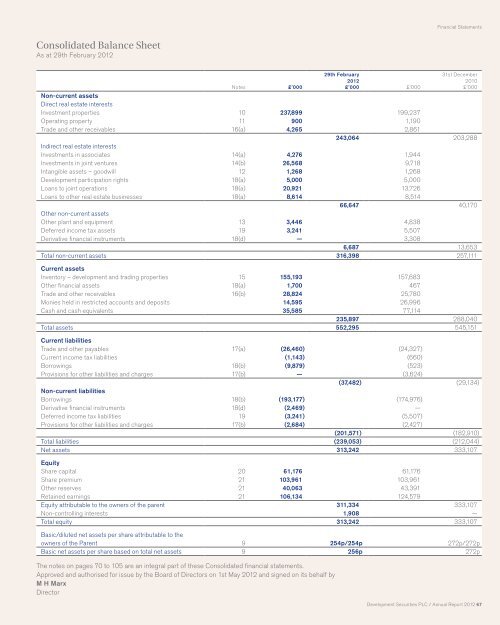

Consolidated Balance Sheet<br />

As at 29th February <strong>2012</strong><br />

29th February<br />

31st December<br />

<strong>2012</strong><br />

2010<br />

Notes £’000 £’000 £’000 £’000<br />

Non-current assets<br />

Direct real estate interests<br />

Investment properties 10 237,899 199,237<br />

Operating property 11 900 1,190<br />

Trade and other receivables 16(a) 4,265 2,861<br />

243,064 203,288<br />

Indirect real estate interests<br />

Investments in associates 14(a) 4,276 1,944<br />

Investments in joint ventures 14(b) 26,568 9,718<br />

Intangible assets – goodwill 12 1,268 1,268<br />

<strong>Development</strong> participation rights 18(a) 5,000 5,000<br />

Loans to joint operations 18(a) 20,921 13,726<br />

Loans to other real estate businesses 18(a) 8,614 8,514<br />

66,647 40,170<br />

Other non-current assets<br />

Other plant and equipment 13 3,446 4,838<br />

Deferred income tax assets 19 3,241 5,507<br />

Derivative financial instruments 18(d) — 3,308<br />

6,687 13,653<br />

Total non-current assets 316,398 257,111<br />

Current assets<br />

Inventory – development and trading properties 15 155,193 157,683<br />

Other financial assets 18(a) 1,700 467<br />

Trade and other receivables 16(b) 28,824 25,780<br />

Monies held in restricted accounts and deposits 14,595 26,996<br />

Cash and cash equivalents 35,585 77,114<br />

235,897 288,040<br />

Total assets 552,295 545,151<br />

Current liabilities<br />

Trade and other payables 17(a) (26,460) (24,327)<br />

Current income tax liabilities (1,143) (660)<br />

Borrowings 18(b) (9,879) (523)<br />

Provisions for other liabilities and charges 17(b) — (3,624)<br />

(37,482) (29,134)<br />

Non-current liabilities<br />

Borrowings 18(b) (193,177) (174,976)<br />

Derivative financial instruments 18(d) (2,469) —<br />

Deferred income tax liabilities 19 (3,241) (5,507)<br />

Provisions for other liabilities and charges 17(b) (2,684) (2,427)<br />

(201,571) (182,910)<br />

Total liabilities (239,053) (212,044)<br />

Net assets 313,242 333,107<br />

Equity<br />

Share capital 20 61,176 61,176<br />

Share premium 21 103,961 103,961<br />

Other reserves 21 40,063 43,391<br />

Retained earnings 21 106,134 124,579<br />

Equity attributable to the owners of the parent 311,334 333,107<br />

Non-controlling interests 1,908 —<br />

Total equity 313,242 333,107<br />

Basic/diluted net assets per share attributable to the<br />

owners of the Parent 9 254p/254p 272p/272p<br />

Basic net assets per share based on total net assets 9 256p 272p<br />

The notes on pages 70 to 105 are an integral part of these Consolidated financial statements.<br />

Approved and authorised for issue by the Board of Directors on 1st May <strong>2012</strong> and signed on its behalf by<br />

M H Marx<br />

Director<br />

Financial Statements<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 67