Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements continued<br />

Notes to the Consolidated Financial Statements continued<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

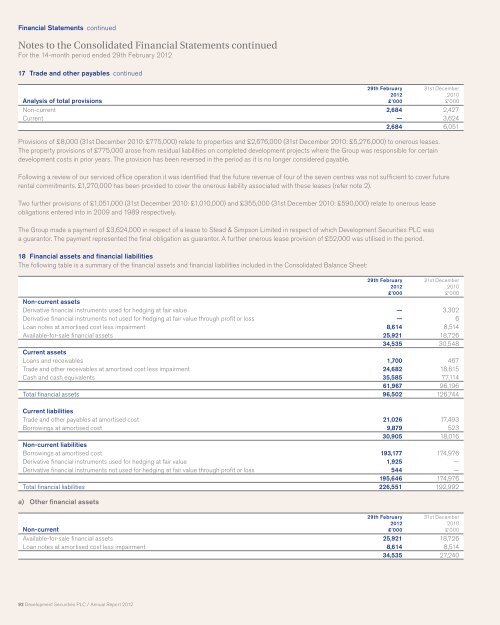

17 Trade and other payables continued<br />

Analysis of total provisions<br />

92 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Non-current 2,684 2,427<br />

Current — 3,624<br />

2,684 6,051<br />

Provisions of £8,000 (31st December 2010: £775,000) relate to properties and £2,676,000 (31st December 2010: £5,276,000) to onerous leases.<br />

The property provisions of £775,000 arose from residual liabilities on completed development projects where the Group was responsible for certain<br />

development costs in prior years. The provision has been reversed in the period as it is no longer considered payable.<br />

Following a review of our serviced office operation it was identified that the future revenue of four of the seven centres was not sufficient to cover future<br />

rental commitments. £1,270,000 has been provided to cover the onerous liability associated with these leases (refer note 2).<br />

Two further provisions of £1,051,000 (31st December 2010: £1,010,000) and £355,000 (31st December 2010: £590,000) relate to onerous lease<br />

obligations entered into in 2009 and 1989 respectively.<br />

The Group made a payment of £3,624,000 in respect of a lease to Stead & Simpson Limited in respect of which <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> was<br />

a guarantor. The payment represented the final obligation as guarantor. A further onerous lease provision of £52,000 was utilised in the period.<br />

18 Financial assets and financial liabilities<br />

The following table is a summary of the financial assets and financial liabilities included in the Consolidated Balance Sheet:<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Non-current assets<br />

Derivative financial instruments used for hedging at fair value — 3,302<br />

Derivative financial instruments not used for hedging at fair value through profit or loss — 6<br />

Loan notes at amortised cost less impairment 8,614 8,514<br />

Available-for-sale financial assets 25,921 18,726<br />

34,535 30,548<br />

Current assets<br />

Loans and receivables 1,700 467<br />

Trade and other receivables at amortised cost less impairment 24,682 18,615<br />

Cash and cash equivalents 35,585 77,114<br />

61,967 96,196<br />

Total financial assets 96,502 126,744<br />

Current liabilities<br />

Trade and other payables at amortised cost 21,026 17,493<br />

Borrowings at amortised cost 9,879 523<br />

30,905 18,016<br />

Non-current liabilities<br />

Borrowings at amortised cost 193,177 174,976<br />

Derivative financial instruments used for hedging at fair value 1,925 —<br />

Derivative financial instruments not used for hedging at fair value through profit or loss 544 —<br />

195,646 174,976<br />

Total financial liabilities 226,551 192,992<br />

a) Other financial assets<br />

Non-current<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Available-for-sale financial assets 25,921 18,726<br />

Loan notes at amortised cost less impairment 8,614 8,514<br />

34,535 27,240