Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Business Model<br />

A stable and risk-averse business<br />

model that supports our progress<br />

through changing property cycles<br />

For 15 years, the management team has adopted<br />

a consistent approach to risk management and<br />

commercial focus, allowing the Company to pursue<br />

opportunities in different stages of the property and<br />

economic cycles whilst mitigating the effects of<br />

major market fluctuations.<br />

The following five principles underpin our strategy<br />

and approach. Adherence to these principles<br />

enabled the Company to survive the financial crash<br />

in 2008 without recourse to shareholder funds.<br />

01<br />

Low risk financial and funding structure<br />

The Group maintains modest levels of gearing at 50 – 60<br />

per cent.<br />

02<br />

Large-scale development projects in partnership<br />

with major institutions<br />

We consider large-scale development projects to be<br />

generally a late economic cycle activity driven by an<br />

expanding economy and strengthening demand. In our<br />

experience, large and complex developments delivered<br />

at the right part of the cycle offer greater profit potential<br />

than smaller schemes. Nonetheless, we have never<br />

believed it appropriate for a company of our size to<br />

accept sole development risk in relation to our complex<br />

and substantial development projects and, consequently,<br />

we share the majority of development project risk with<br />

financial institutions and partners who are the more<br />

appropriate long-term investors.<br />

Our funding partners on major projects have included:<br />

Standard Life Investments<br />

Scottish Widows Investment Property<br />

Partnership Trust<br />

The Prudential Assurance Company<br />

Legal & General Assurance Society<br />

Aviva Investors<br />

Corpus Sireo Immobilienfonds<br />

03<br />

Focus on commercial property<br />

Whilst the emphasis of our activities may shift between<br />

major, complex developments and smaller scale<br />

development and trading properties at the different<br />

stages of the property cycle, we maintain a predominant<br />

focus on securing planning consents and redeveloping<br />

commercial property.<br />

Our property portfolio is focused on:<br />

Single, prestige office developments<br />

Multi-phase office developments<br />

Regional urban regeneration projects<br />

Food-anchored retail development projects<br />

Mixed-use developments<br />

Selected residential schemes, hotels and student<br />

accommodation<br />

Since July 2009, we have broadened the scope of our<br />

real estate activities to take advantage of specific<br />

opportunities, partnering with specialist operators and<br />

developers as necessary.<br />

04<br />

Actively managed investment portfolio for<br />

steady income<br />

We maintain an investment portfolio that is proactively<br />

managed to drive capital growth and enhance rental<br />

income. Thus, the investment portfolio provides a steady<br />

and predictable flow of funds, contributing significantly<br />

towards central overheads and mitigating the more<br />

uneven profits and cash flow arising from the major<br />

development and trading portfolio. The investment<br />

portfolio accounts for a significant element of invested<br />

equity and represents a diverse portfolio of assets across<br />

the UK, comprising carefully selected retail and office<br />

properties. The scale and profile of our portfolio does not<br />

suit the concentration of risk from any significant<br />

investment in Central London commercial property.<br />

05<br />

Geographic focus<br />

All of our development and investment activity is<br />

conducted within the United Kingdom.<br />

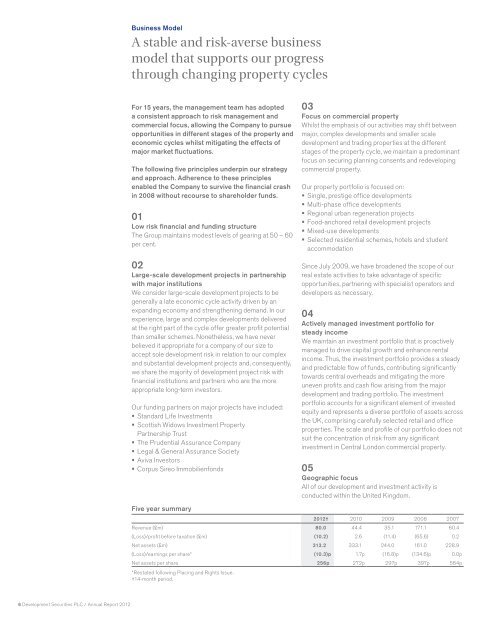

Five year summary<br />

<strong>2012</strong>† 2010 2009 2008 2007<br />

Revenue (£m) 80.0 44.4 35.1 171.1 60.4<br />

(Loss)/profit before taxation (£m) (10.2) 2.6 (11.4) (65.6) 0.2<br />

Net assets (£m) 313.2 333.1 244.0 161.0 228.9<br />

(Loss)/earnings per share* (10.3)p 1.7p (16.8)p (134.6)p 0.0p<br />

Net assets per share<br />

*Restated following Placing and Rights Issue.<br />

†14-month period.<br />

256p 272p 297p 397p 564p