Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

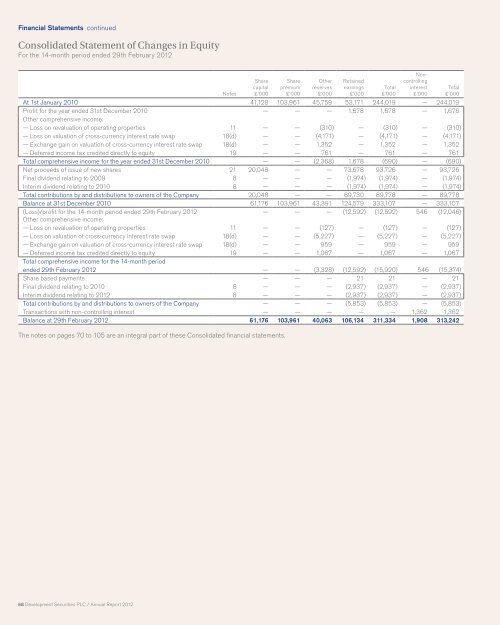

Financial Statements continued<br />

Consolidated Statement of Changes in Equity<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

68 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes<br />

Share<br />

capital<br />

£’000<br />

Share<br />

premium<br />

£’000<br />

Other<br />

reserves<br />

£’000<br />

Retained<br />

earnings<br />

£’000<br />

Total<br />

£’000<br />

Noncontrolling<br />

interest<br />

£’000<br />

At 1st January 2010 41,128 103,961 45,759 53,171 244,019 — 244,019<br />

Profit for the year ended 31st December 2010 — — — 1,678 1,678 — 1,678<br />

Other comprehensive income:<br />

— Loss on revaluation of operating properties 11 — — (310) — (310) — (310)<br />

— Loss on valuation of cross-currency interest rate swap 18(d) — — (4,171) — (4,171) — (4,171)<br />

— Exchange gain on valuation of cross-currency interest rate swap 18(d) — — 1,352 — 1,352 — 1,352<br />

— Deferred income tax credited directly to equity 19 — — 761 — 761 — 761<br />

Total comprehensive income for the year ended 31st December 2010 — — (2,368) 1,678 (690) — (690)<br />

Net proceeds of issue of new shares 21 20,048 — — 73,678 93,726 — 93,726<br />

Final dividend relating to 2009 8 — — — (1,974) (1,974) — (1,974)<br />

Interim dividend relating to 2010 8 — — — (1,974) (1,974) — (1,974)<br />

Total contributions by and distributions to owners of the Company 20,048 — — 69,730 89,778 — 89,778<br />

Balance at 31st December 2010 61,176 103,961 43,391 124,579 333,107 — 333,107<br />

(Loss)/profit for the 14-month period ended 29th February <strong>2012</strong> — — — (12,592) (12,592) 546 (12,046)<br />

Other comprehensive income:<br />

— Loss on revaluation of operating properties 11 — — (127) — (127) — (127)<br />

— Loss on valuation of cross-currency interest rate swap 18(d) — — (5,227) — (5,227) — (5,227)<br />

— Exchange gain on valuation of cross-currency interest rate swap 18(d) — — 959 — 959 — 959<br />

— Deferred income tax credited directly to equity 19 — — 1,067 — 1,067 — 1,067<br />

Total comprehensive income for the 14-month period<br />

ended 29th February <strong>2012</strong> — — (3,328) (12,592) (15,920) 546 (15,374)<br />

Share based payments — — — 21 21 — 21<br />

Final dividend relating to 2010 8 — — — (2,937) (2,937) — (2,937)<br />

Interim dividend relating to <strong>2012</strong> 8 — — — (2,937) (2,937) — (2,937)<br />

Total contributions by and distributions to owners of the Company — — — (5,853) (5,853) — (5,853)<br />

Transactions with non-controlling interest — — — — — 1,362 1,362<br />

Balance at 29th February <strong>2012</strong> 61,176 103,961 40,063 106,134 311,334 1,908 313,242<br />

The notes on pages 70 to 105 are an integral part of these Consolidated financial statements.<br />

Total<br />

£’000