Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements continued<br />

Notes to the Consolidated Financial Statements continued<br />

For the 14-month period ended 29th February <strong>2012</strong><br />

18 Financial assets and financial liabilities continued<br />

c) Financial risk management continued<br />

Foreign currency risk<br />

The Group does not undertake significant trade overseas, but does hold certain assets, amounting to £89,000 (31st December 2010: £642,000)<br />

denominated in foreign currencies. The currency exposure arising from these investments is not considered to materially affect the Group’s operations and<br />

is not subject to hedging arrangements.<br />

The Group is exposed to foreign currency risk from €47,000,000 (31st December 2010: €47,000,000) loan notes issued during 2007 that are denominated<br />

in Euros.<br />

The Group has entered into a currency and interest rate swap with a banking institution to minimise these potential risks. The swap is cash collateralised and<br />

qualifies to be accounted for as a cash flow hedge as detailed below. The fair value of this instrument at 29th February <strong>2012</strong> was a liability of £1,925,000<br />

(31st December 2010: £3,302,000 asset).<br />

The Group maintains a security deposit of £4,000,000 (31st December 2010: £4,000,000) throughout the loan note term. The security deposit is required<br />

to cash collateralise the risk for the swap counterparty. The Group is further required to increase this security if the Group's potential liability under the<br />

instrument increases to within £250,000 of the security deposit.<br />

During the 14-month period to 29th February <strong>2012</strong>, the movement of Sterling against the Euro was approximately 8.0 per cent. Management has therefore<br />

measured sensitivity on this basis.<br />

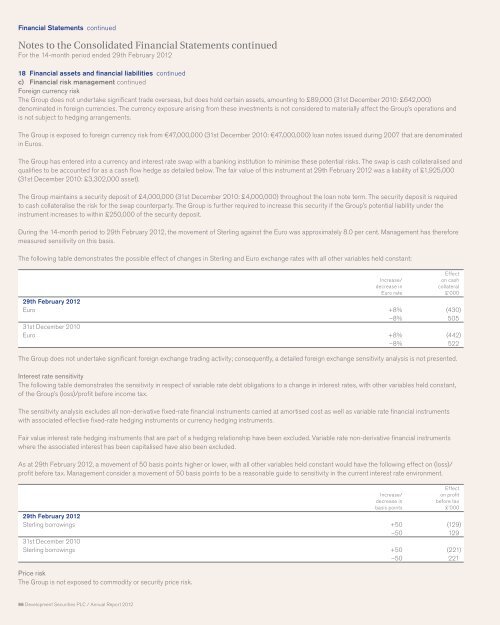

The following table demonstrates the possible effect of changes in Sterling and Euro exchange rates with all other variables held constant:<br />

96 <strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Increase/<br />

decrease in<br />

Euro rate<br />

Effect<br />

on cash<br />

collateral<br />

£’000<br />

29th February <strong>2012</strong><br />

Euro +8% (430)<br />

–8% 505<br />

31st December 2010<br />

Euro +8% (442)<br />

–8% 522<br />

The Group does not undertake significant foreign exchange trading activity; consequently, a detailed foreign exchange sensitivity analysis is not presented.<br />

Interest rate sensitivity<br />

The following table demonstrates the sensitivity in respect of variable rate debt obligations to a change in interest rates, with other variables held constant,<br />

of the Group’s (loss)/profit before income tax.<br />

The sensitivity analysis excludes all non-derivative fixed-rate financial instruments carried at amortised cost as well as variable rate financial instruments<br />

with associated effective fixed-rate hedging instruments or currency hedging instruments.<br />

Fair value interest rate hedging instruments that are part of a hedging relationship have been excluded. Variable rate non-derivative financial instruments<br />

where the associated interest has been capitalised have also been excluded.<br />

As at 29th February <strong>2012</strong>, a movement of 50 basis points higher or lower, with all other variables held constant would have the following effect on (loss)/<br />

profit before tax. Management consider a movement of 50 basis points to be a reasonable guide to sensitivity in the current interest rate environment.<br />

Increase/<br />

decrease in<br />

basis points<br />

Effect<br />

on profit<br />

before tax<br />

£’000<br />

29th February <strong>2012</strong><br />

Sterling borrowings +50 (129)<br />

–50 129<br />

31st December 2010<br />

Sterling borrowings +50 (221)<br />

–50 221<br />

Price risk<br />

The Group is not exposed to commodity or security price risk.