Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Annual Report 2012 - Development Securities PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

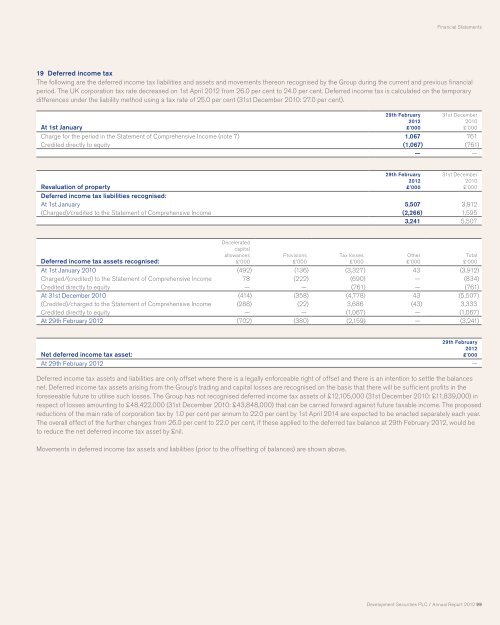

19 Deferred income tax<br />

The following are the deferred income tax liabilities and assets and movements thereon recognised by the Group during the current and previous financial<br />

period. The UK corporation tax rate decreased on 1st April <strong>2012</strong> from 26.0 per cent to 24.0 per cent. Deferred income tax is calculated on the temporary<br />

differences under the liability method using a tax rate of 25.0 per cent (31st December 2010: 27.0 per cent).<br />

At 1st January<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Charge for the period in the Statement of Comprehensive Income (note 7) 1,067 761<br />

Credited directly to equity (1,067) (761)<br />

— —<br />

Revaluation of property<br />

29th February<br />

<strong>2012</strong><br />

£’000<br />

31st December<br />

2010<br />

£’000<br />

Deferred income tax liabilities recognised:<br />

At 1st January 5,507 3,912<br />

(Charged)/credited to the Statement of Comprehensive Income (2,266) 1,595<br />

3,241 5,507<br />

Deferred income tax assets recognised:<br />

Decelerated<br />

capital<br />

allowances<br />

£’000<br />

Provisions<br />

£’000<br />

Tax losses<br />

£’000<br />

At 1st January 2010 (492) (136) (3,327) 43 (3,912)<br />

Charged/(credited) to the Statement of Comprehensive Income 78 (222) (690) — (834)<br />

Credited directly to equity — — (761) — (761)<br />

At 31st December 2010 (414) (358) (4,778) 43 (5,507)<br />

(Credited)/charged to the Statement of Comprehensive Income (288) (22) 3,686 (43) 3,333<br />

Credited directly to equity — — (1,067) — (1,067)<br />

At 29th February <strong>2012</strong> (702) (380) (2,159) — (3,241)<br />

29th February<br />

<strong>2012</strong><br />

Net deferred income tax asset:<br />

£’000<br />

At 29th February <strong>2012</strong> —<br />

Deferred income tax assets and liabilities are only offset where there is a legally enforceable right of offset and there is an intention to settle the balances<br />

net. Deferred income tax assets arising from the Group’s trading and capital losses are recognised on the basis that there will be sufficient profits in the<br />

foreseeable future to utilise such losses. The Group has not recognised deferred income tax assets of £12,105,000 (31st December 2010: £11,839,000) in<br />

respect of losses amounting to £48,422,000 (31st December 2010: £43,848,000) that can be carried forward against future taxable income. The proposed<br />

reductions of the main rate of corporation tax by 1.0 per cent per annum to 22.0 per cent by 1st April 2014 are expected to be enacted separately each year.<br />

The overall effect of the further changes from 26.0 per cent to 22.0 per cent, if these applied to the deferred tax balance at 29th February <strong>2012</strong>, would be<br />

to reduce the net deferred income tax asset by £nil.<br />

Movements in deferred income tax assets and liabilities (prior to the offsetting of balances) are shown above.<br />

Other<br />

£’000<br />

Total<br />

£’000<br />

<strong>Development</strong> <strong>Securities</strong> <strong>PLC</strong> / <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 99