Business Potential for Agricultural Biotechnology - Asian Productivity ...

Business Potential for Agricultural Biotechnology - Asian Productivity ...

Business Potential for Agricultural Biotechnology - Asian Productivity ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Business</strong> <strong>Potential</strong> <strong>for</strong> <strong>Agricultural</strong> <strong>Biotechnology</strong> Products in the Philippines<br />

seeds, and perceived health and environmental hazards. As other corn transgenics enter the<br />

country, adoption of a particular variety may depend on the cost-competitiveness of the seeds.<br />

Gonzales (2004) recommends in<strong>for</strong>mation/education campaigns, techno demos, and workshops<br />

on integrated pest management, proactive financing to cover the cost of fertilizer and seeds, providing<br />

the needed public and private investments in infrastructure and back-up services in strategic<br />

corn-producing provinces, market-matching activities and linkages with the livestock-poultry<br />

subsectors to increase the efficiency and global competitiveness of the feedgrain-livestockpoultry<br />

industry cluster, and a sustained, ongoing system of evaluation and socio-economic<br />

impact assessment of YieldGard and other transgenic technologies to help technology generators<br />

and the public in strengthening the strategic position of Bt corn as the key result area in developing<br />

a globally competitive feed corn-livestock industry cluster.<br />

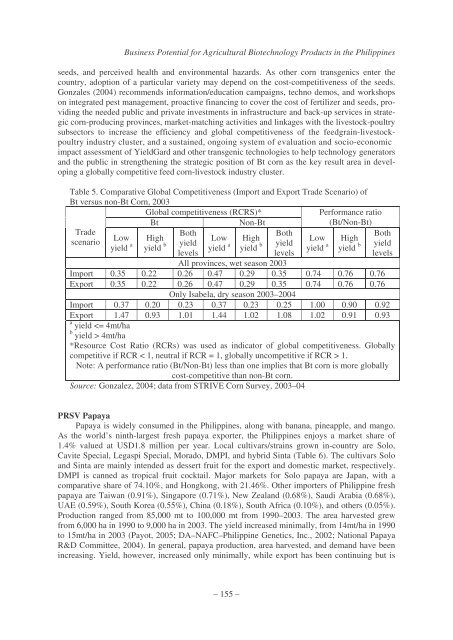

Table 5. Comparative Global Competitiveness (Import and Export Trade Scenario) of<br />

Bt versus non-Bt Corn, 2003<br />

Global competitiveness (RCRS)*<br />

Per<strong>for</strong>mance ratio<br />

Bt Non-Bt<br />

(Bt/Non-Bt)<br />

Trade<br />

scenario<br />

Low<br />

yield a<br />

High<br />

yield b<br />

Both<br />

Low<br />

yield<br />

yield<br />

levels<br />

a<br />

High<br />

yield b<br />

Both<br />

Low<br />

yield<br />

yield<br />

levels<br />

a<br />

High<br />

yield b<br />

Both<br />

yield<br />

levels<br />

All provinces, wet season 2003<br />

Import 0.35 0.22 0.26 0.47 0.29 0.35 0.74 0.76 0.76<br />

Export 0.35 0.22 0.26 0.47 0.29 0.35 0.74 0.76 0.76<br />

Only Isabela, dry season 2003–2004<br />

Import 0.37 0.20 0.23 0.37 0.23 0.25 1.00 0.90 0.92<br />

Export 1.47 0.93 1.01 1.44 1.02 1.08 1.02 0.91 0.93<br />

a<br />

yield 4mt/ha<br />

*Resource Cost Ratio (RCRs) was used as indicator of global competitiveness. Globally<br />

competitive if RCR < 1, neutral if RCR = 1, globally uncompetitive if RCR > 1.<br />

Note: A per<strong>for</strong>mance ratio (Bt/Non-Bt) less than one implies that Bt corn is more globally<br />

cost-competitive than non-Bt corn.<br />

Source: Gonzalez, 2004; data from STRIVE Corn Survey, 2003–04<br />

PRSV Papaya<br />

Papaya is widely consumed in the Philippines, along with banana, pineapple, and mango.<br />

As the world’s ninth-largest fresh papaya exporter, the Philippines enjoys a market share of<br />

1.4% valued at USD1.8 million per year. Local cultivars/strains grown in-country are Solo,<br />

Cavite Special, Legaspi Special, Morado, DMPI, and hybrid Sinta (Table 6). The cultivars Solo<br />

and Sinta are mainly intended as dessert fruit <strong>for</strong> the export and domestic market, respectively.<br />

DMPI is canned as tropical fruit cocktail. Major markets <strong>for</strong> Solo papaya are Japan, with a<br />

comparative share of 74.10%, and Hongkong, with 21.46%. Other importers of Philippine fresh<br />

papaya are Taiwan (0.91%), Singapore (0.71%), New Zealand (0.68%), Saudi Arabia (0.68%),<br />

UAE (0.59%), South Korea (0.55%), China (0.18%), South Africa (0.10%), and others (0.05%).<br />

Production ranged from 85,000 mt to 100,000 mt from 1990–2003. The area harvested grew<br />

from 6,000 ha in 1990 to 9,000 ha in 2003. The yield increased minimally, from 14mt/ha in 1990<br />

to 15mt/ha in 2003 (Payot, 2005; DA–NAFC–Philippine Genetics, Inc., 2002; National Papaya<br />

R&D Committee, 2004). In general, papaya production, area harvested, and demand have been<br />

increasing. Yield, however, increased only minimally, while export has been continuing but is<br />

– 155 –