Business Potential for Agricultural Biotechnology - Asian Productivity ...

Business Potential for Agricultural Biotechnology - Asian Productivity ...

Business Potential for Agricultural Biotechnology - Asian Productivity ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

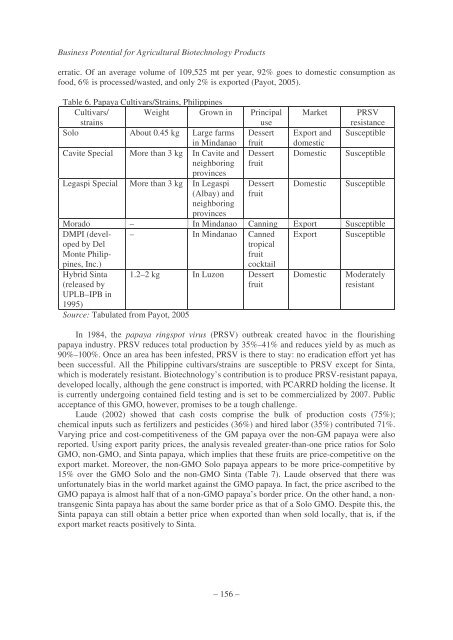

<strong>Business</strong> <strong>Potential</strong> <strong>for</strong> <strong>Agricultural</strong> <strong>Biotechnology</strong> Products<br />

erratic. Of an average volume of 109,525 mt per year, 92% goes to domestic consumption as<br />

food, 6% is processed/wasted, and only 2% is exported (Payot, 2005).<br />

Table 6. Papaya Cultivars/Strains, Philippines<br />

Cultivars/ Weight Grown in Principal Market PRSV<br />

strains<br />

use<br />

resistance<br />

Solo About 0.45 kg Large farms Dessert Export and Susceptible<br />

in Mindanao fruit domestic<br />

Cavite Special More than 3 kg In Cavite and Dessert Domestic Susceptible<br />

neighboring<br />

provinces<br />

fruit<br />

Legaspi Special More than 3 kg In Legaspi Dessert Domestic Susceptible<br />

(Albay) and<br />

neighboring<br />

provinces<br />

fruit<br />

Morado – In Mindanao Canning Export Susceptible<br />

DMPI (devel- – In Mindanao Canned Export Susceptible<br />

oped by Del<br />

tropical<br />

Monte Philip-<br />

fruit<br />

pines, Inc.)<br />

cocktail<br />

Hybrid Sinta 1.2–2 kg In Luzon Dessert Domestic Moderately<br />

(released by<br />

UPLB–IPB in<br />

1995)<br />

fruit<br />

resistant<br />

Source: Tabulated from Payot, 2005<br />

In 1984, the papaya ringspot virus (PRSV) outbreak created havoc in the flourishing<br />

papaya industry. PRSV reduces total production by 35%–41% and reduces yield by as much as<br />

90%–100%. Once an area has been infested, PRSV is there to stay: no eradication ef<strong>for</strong>t yet has<br />

been successful. All the Philippine cultivars/strains are susceptible to PRSV except <strong>for</strong> Sinta,<br />

which is moderately resistant. <strong>Biotechnology</strong>’s contribution is to produce PRSV-resistant papaya,<br />

developed locally, although the gene construct is imported, with PCARRD holding the license. It<br />

is currently undergoing contained field testing and is set to be commercialized by 2007. Public<br />

acceptance of this GMO, however, promises to be a tough challenge.<br />

Laude (2002) showed that cash costs comprise the bulk of production costs (75%);<br />

chemical inputs such as fertilizers and pesticides (36%) and hired labor (35%) contributed 71%.<br />

Varying price and cost-competitiveness of the GM papaya over the non-GM papaya were also<br />

reported. Using export parity prices, the analysis revealed greater-than-one price ratios <strong>for</strong> Solo<br />

GMO, non-GMO, and Sinta papaya, which implies that these fruits are price-competitive on the<br />

export market. Moreover, the non-GMO Solo papaya appears to be more price-competitive by<br />

15% over the GMO Solo and the non-GMO Sinta (Table 7). Laude observed that there was<br />

un<strong>for</strong>tunately bias in the world market against the GMO papaya. In fact, the price ascribed to the<br />

GMO papaya is almost half that of a non-GMO papaya’s border price. On the other hand, a nontransgenic<br />

Sinta papaya has about the same border price as that of a Solo GMO. Despite this, the<br />

Sinta papaya can still obtain a better price when exported than when sold locally, that is, if the<br />

export market reacts positively to Sinta.<br />

– 156 –