Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 1 |<br />

SAVA GROUP<br />

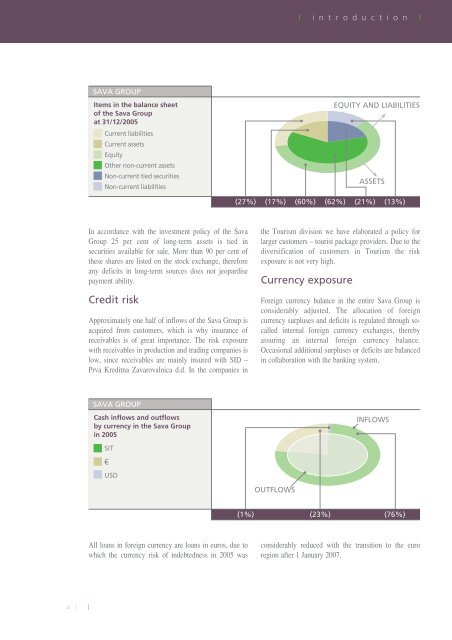

Items in the balance sheet<br />

of the <strong>Sava</strong> Group<br />

at 31/12/<strong>2005</strong><br />

Current liabilities<br />

Current assets<br />

Equity<br />

Other non-current assets<br />

Non-current tied securities<br />

Non-current liabilities<br />

In accordance with the investment policy of the <strong>Sava</strong><br />

Group 25 per cent of long-term assets is tied in<br />

securities available for sale. More than 90 per cent of<br />

these shares are listed on the stock exchange, therefore<br />

any deficits in long-term sources does not jeopardise<br />

payment ability.<br />

Credit risk<br />

(27%)<br />

Approximately one half of inflows of the <strong>Sava</strong> Group is<br />

acquired from customers, which is why insurance of<br />

receivables is of great importance. The risk exposure<br />

with receivables in production and trading companies is<br />

low, since receivables are mainly insured with SID –<br />

Prva Kreditna Zavarovalnica d.d. In the companies in<br />

SAVA GROUP<br />

Cash inflows and outflows<br />

by currency in the <strong>Sava</strong> Group<br />

in <strong>2005</strong><br />

(1%)<br />

All loans in foreign currency are loans in euros, due to<br />

which the currency risk of indebtedness in <strong>2005</strong> was<br />

| i n t r o d u c t i o n |<br />

(17%) (60%) (62%) (21%) (13%)<br />

the Tourism division we have elaborated a policy for<br />

larger customers – tourist package providers. Due to the<br />

diversification of customers in Tourism the risk<br />

exposure is not very high.<br />

Currency exposure<br />

EQUITY AND LIABILITIES<br />

ASSETS<br />

Foreign currency balance in the entire <strong>Sava</strong> Group is<br />

considerably adjusted. The allocation of foreign<br />

currency surpluses and deficits is regulated through socalled<br />

internal foreign currency exchanges, thereby<br />

assuring an internal foreign currency balance.<br />

Occasional a<strong>dd</strong>itional surpluses or deficits are balanced<br />

in collaboration with the banking system.<br />

OUTFLOWS<br />

INFLOWS<br />

(23%) (76%)<br />

considerably reduced with the transition to the euro<br />

region after 1January 2007.